Week 23 finds the global freight market navigating sustained trans-Pacific demand, persistent port congestion, and policy shifts with trade compliance implications.

SECTION 232 TARIFF EXPANSION TAKES EFFECT JUNE 4, 2025

Section 232 tariffs on most imported steel and aluminum will rise from 25% to 50% beginning June 4. The new proclamation also expands reciprocal tariffs to include non-metal content in covered goods, a departure from previous policy. Importers must ensure accurate HTS classification and content breakdowns as U.S. Customs and Border Protection prepares enforcement measures. The change is prompting adjustments in sourcing, landed cost planning, and duty-deferral strategies.

U.S.-CHINA TRADE TALKS SCHEDULED

In response to alleged non-compliance, the United States has increased export controls and signaled further restrictions on student visa issuance. The Chinese Ministry of Commerce issued a statement pledging to defend its economic interests if additional retaliatory measures are enacted. Meanwhile, talks are expected to continue ahead of the early July decision window. U.S. importers are advised to monitor any policy developments that could disrupt cross-Pacific trade lanes or alter current demand patterns.

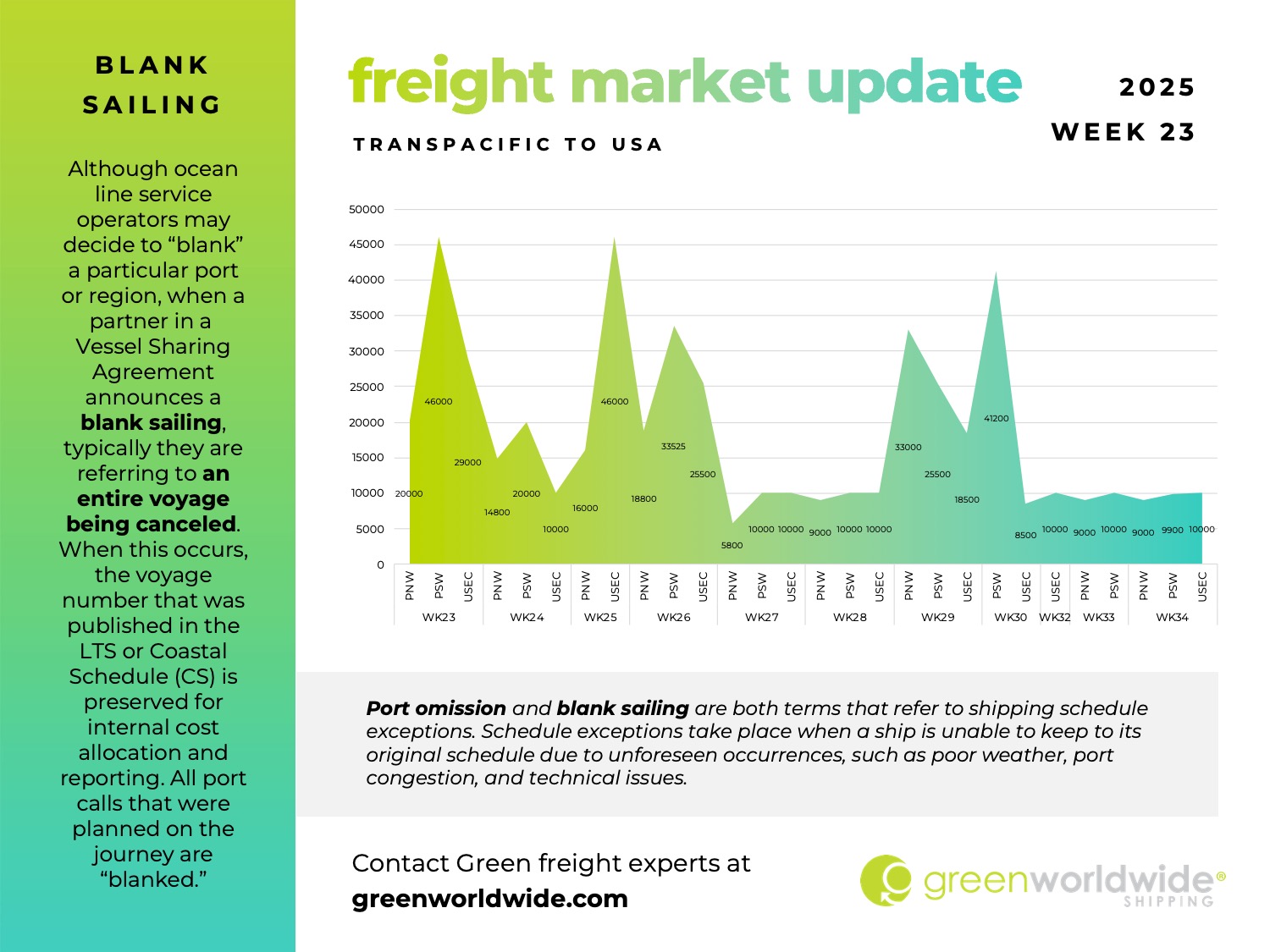

TRANS-PACIFIC SERVICE RESHUFFLE DRIVEN BY TARIFF-RELATED EXPORT SURGE

Ocean carriers have begun reactivating suspended Far East to U.S. West Coast services as trans-Pacific demand remains strong during the ongoing 90-day tariff relief. The rebound in Chinese export volumes, initially triggered by tariff adjustments in May, continues to drive bookings upward. This led to the reinstatement of select weekly loops that were withdrawn in April and early May. Slot availability remains limited, however, due to ongoing berth congestion at major Asian load ports and the residual backlog from prior rollings.

CONGESTION ONGOING IN MEXICO’S MANZANILLO CORRIDOR

Manzanillo, Mexico’s largest container port continues to face delays nearly three weeks after a four-day customs strike disrupted operations. While vessel arrivals are only delayed by about one day at berth, end-to-end cargo processing times remain prolonged, with inland dwell and rail delays compounding the issue. Both major terminals continue to confront operational congestion, and exporters are reporting rail transit delays of up to 72 hours. While some operators anticipate near-term normalization, data continues to classify the port as heavily disrupted, and vessel calls have declined since mid-May. Shippers moving goods into the U.S. via Mexico may see elevated landed costs for finished goods due to delays.

ASIA TO EUROPE CONGESTION RIPPLING THROUGH GLOBAL NETWORKS

Port congestion is intensifying on the Asia to Europe lane, creating additional pressure across global carrier networks. Heavy berth delays at Shanghai and Singapore, fueled by increased U.S.-bound exports, have been compounded by European labor shortages and Rhine River disruptions. Waiting times at key North European ports have spiked significantly, and carriers are now reallocating capacity from Asia to Europe in order to support booming trans-Pacific volumes. These shifts are expected to tighten space further on certain European loops and reduce available slack across the broader east-west network.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.