WHAT NEW TARIFFS DID THE WHITE HOUSE ANNOUNCE?

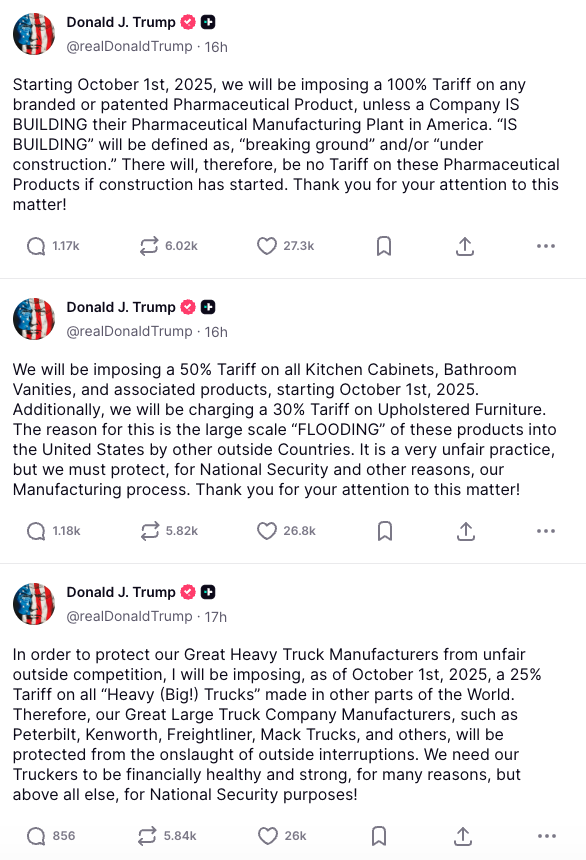

The White House recently issued a series of public statements via social media outlining new import tariffs effective October 1, 2025. The measures focus on heavy trucks, household furnishings, and branded pharmaceuticals.

According to the statements, the following new tariffs will apply:

- A 25 percent tariff will apply to all heavy trucks manufactured outside the United States.

- A 50 percent tariff will apply to imported kitchen cabinets, bathroom vanities, and related products.

- A 30 percent tariff will apply to upholstered furniture.

- A 100 percent tariff will apply to branded or patented pharmaceutical products, unless the manufacturer is currently building a U.S. production facility. The term “building” is defined as a project that has broken ground or is under construction.

WHY WERE THESE TARIFFS INTRODUCED?

The administration described the tariffs as a means to strengthen domestic production capacity and reduce dependence on foreign suppliers in sectors it considers vital to economic and national security. The pharmaceutical provision, in particular, is framed as an incentive for companies to invest in U.S. manufacturing infrastructure.

HOW COULD THESE MEASURES IMPACT U.S. INDUSTRIES?

The measures are expected to influence multiple industries and supply networks.

- Heavy-truck sector: U.S. distributors and fleet operators may encounter higher purchase costs on imported vehicles and components.

- Home furnishings: Importers of cabinetry, vanities, and furniture could see increased landed costs, with potential downstream effects on builders and retailers.

- Pharmaceuticals: Importers of branded medications may be affected by the 100 percent duty unless their suppliers meet the construction exemption criteria.

At this stage, no formal guidance has been issued regarding how the tariffs will interact with existing agreements such as the United States-Mexico-Canada Agreement (USMCA).

WHAT LEGAL AND TRADE CONSIDERATIONS APPLY?

The tariffs are expected to rely on existing executive trade authorities under Sections 232 or 301 of the Trade Act. Implementation procedures, compliance mechanisms, and potential exclusion pathways will become clearer once official notices are released through the Federal Register.

The recent Federal Circuit Court ruling in V.O.S. Selections, Inc. v. Trump (August 29, 2025) clarified that the International Emergency Economic Powers Act (IEEPA) does not authorize the imposition of tariffs. The court held that IEEPA’s authority to “regulate importation” does not extend to creating duties or taxes, reinforcing that tariff-setting authority must derive from statutes such as the Trade Expansion Act or the Trade Act of 1974. This decision may influence future judicial or administrative review of executive tariff measures. The U.S. Supreme Court has agreed to hear this case on appeal in November 2025.

Trading partners may also seek review through the World Trade Organization or bilateral consultations.

WHAT SHOULD IMPORTERS DO NOW TO PREPARE FOR THESE TARIFFS?

Importers and compliance professionals can begin preparing for these tariff by:

- Confirming correct HTSUS classifications for covered goods.

- Partnering with Green Worldwide Shipping to model potential duty exposure at the announced rates.

- Monitoring forthcoming Federal Register notices for confirmation of scope and enforcement.

- Assessing sourcing alternatives or domestic production partnerships where feasible.

Further clarification from U.S. Customs and Border Protection (CBP) and the Office of the U.S. Trade Representative (USTR) is expected to define timelines, documentation requirements, and any exclusion procedures before the effective date.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.