Pursuant to the Federal Register General Notice 84 FR 37902, U.S. Customs and Border Protection (CBP) is adjusting certain customs user fees and corresponding limitations established by the Consolidated Omnibus Budget Reconciliation Act (COBRA) for Fiscal Year 2020 in accordance with the Fixing America’s Surface Transportation Act (FAST Act) as implemented by CBP regulations.

The adjusted amounts of Customs COBRA user fees will be effective October 1, 2019.

HOW IS INFLATION CALCULATED?

For fiscal year 2020, CBP is making this determination by comparing the average of the Consumer Price Index—All Urban Consumers (CPI-U) of all items (CPI-U) for the current year (June 2018-May 2019) with the average of the CPI-U for the comparison year (June 2017-May 2018) to determine the change in inflation, if any.

CBP has determined that the increase in the CPI between the most recent June to May 12-month period (June 2018-May 2019) and the comparison year (June 2017-May 2018) is 2.02 percent.

If there is an increase in the CPI of greater than one (1) percent, CBP must adjust the customs COBRA user fees and corresponding limitations using the methodology set forth in 19 CFR 24.22(k).

CBP has determined that the factor by which the base fees and limitations will be adjusted is 7.167 % and are effective October 1, 2019.

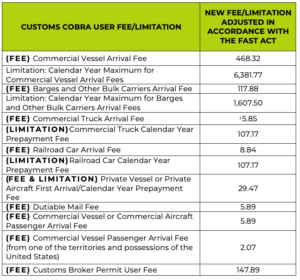

CUSTOMS COBRA USER FEES AND LIMITATIONS

FOUND IN 19 CFR 24.22 AS ADJUSTED FOR FISCAL YEAR 2020

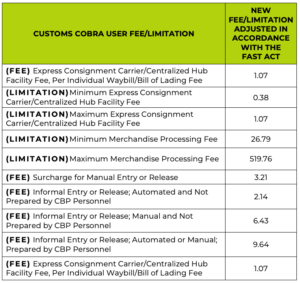

CUSTOMS COBRA USER FEES AND LIMITATIONS

FOUND IN 19 CFR 24.23 AS ADJUSTED FOR FISCAL YEAR 2020

Stay up-to-date on everything freight by following Green Worldwide Shipping on Facebook, Twitter, and LinkedIn or, subscribe to Green’s Freight Talk blog to received updates directly to your email.