MAY 29 UPATE | CAFC STAYS CIT ORDER

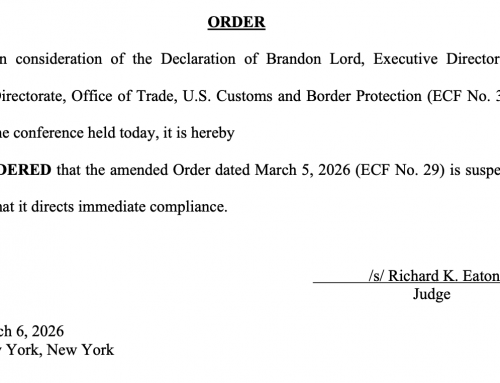

The U.S. Court of Appeals for the Federal Circuit moved swiftly on May 29, 2025, issuing an administrative stay that keeps the controversial “reciprocal,” “fentanyl,” and other International Emergency Economic Powers Act (IEEPA)–based tariffs in force while it reviews the government’s appeal of two lower-court rulings that struck them down.

- Appeals consolidated. The court granted the government’s motions to combine appeal Nos. 2025-1812 and 2025-1813—both challenging separate Court of International Trade (CIT) judgments that struck down and enjoined various tariff-imposing Executive Orders—into a single proceeding.

- Immediate administrative stay. To preserve the status quo while it considers the stay motions, the Federal Circuit temporarily stayed the CIT’s judgments and permanent injunctions. The tariffs therefore remain collectable nationwide (not just against the two CIT plaintiffs) unless and until the Federal Circuit rules otherwise.

- Parallel stay request at the CIT. The United States has also asked the CIT itself for a stay; that request is still pending. The Federal Circuit directed the parties to “immediately inform” it of any action the CIT takes on that request.

ACCELERATED BRIEFING SCHEDULE

- Appellees (the importers and the group of states) must file their responses to the government’s stay motions by June 5, 2025.

- The government may file a single consolidated reply by June 9, 2025.

CAFC STAY RULING: https://storage.courtlistener.com/recap/gov.uscourts.cafc.23106/gov.uscourts.cafc.23106.10.0.pdf

On 28 May, a three-judge panel of the U.S. Court of International Trade (CIT) vacated every tariff the Trump Administration imposed under the International Emergency Economic Powers Act (IEEPA), including:

- the baseline 10 percent “reciprocal” tariff that has applied to virtually all countries since 5 April;

- higher country-specific reciprocal rates that were due to resume in July; and

- the February/March duties on products of China, Canada and Mexico.

The court held that IEEPA does not delegate tariff-setting authority to the President and that the orders “exceed any authority granted … to regulate importation by means of tariffs.”

Full CIT Judgement: https://storage.courtlistener.com/recap/gov.uscourts.cit.17080/gov.uscourts.cit.17080.56.0.pdf

Government Appeal: https://storage.courtlistener.com/recap/gov.uscourts.cit.17080/gov.uscourts.cit.17080.57.0.pdf

TEN-DAY COMPLIANCE CLOCK FOR CBP

The judgment accompanying the opinion directs the government to “issue orders implementing the permanent injunction” within 10 calendar days of the decision—i.e., no later than Saturday, 7 June 2025—instructing U.S. Customs and Border Protection (CBP) to stop collecting the duties and to treat the tariffs as void “ab initio”.

Ab initio is a Latin term that means “from the beginning” or “from inception”. It’s often used in law to indicate that something existed from the start of a relevant time period.

IMMEDIATE GOVERNMENT APPEAL

Hours after the opinion posted, the Justice Department filed a notice of appeal to the U.S. Court of Appeals for the Federal Circuit (CAFC). The government can also ask the CIT or CAFC for a stay; none had been granted as of yet.

MAY 29 | MORNING UPDATE — D.C. DISTRICT COURT ISSUES IEEPA TARIFF INJUNCTION

Just one day after the Court of International Trade wiped out all IEEPA-based tariffs nationwide, the U.S. District Court for the District of Columbia echoed—and deepened—that judgment, ruling that IEEPA provides no tariff authority at all. Judge Rudolph Contreras’ order, however, protects only the two plaintiff importers and is stayed for 14 days, creating a split over both jurisdiction and presidential tariff power as the government races to appeal in two separate circuits.

- Judge Rudolph Contreras ruled on 29 May that the statute“does not” authorize the President to impose tariffs of any kind.

- The courtdenied the government’s bid to transfer the case to the CIT, finding that district courts retain jurisdiction over non-Customs challenges.

- Collection of the tariffs is enjoinedonly for the two small importers who sued, not nationwide. The order is stayed for 14 days (until 12 June 2025) so the government can ask the D.C. Circuit for relief.

- Unlike the CIT, Judge Contrerasdid not vacate the executive orders in full. Instead, he stopped CBP from collecting duties from the plaintiffs while the case proceeds.

DC Court Ruling: https://storage.courtlistener.com/recap/gov.uscourts.dcd.279804/gov.uscourts.dcd.279804.37.0_3.pdf

PRACTICAL IMPLICATIONS FOR IMPORTERS

- Near-term entries: If no stay issues, merchandise entered or released on or after 7 June should be free of IEEPA duties. Importers should flag affected shipments now so that entries can be transmitted without the extra lines as soon as CBP guidance appears.

- Refund strategy: For entries that already paid IEEPA duties, prepare Post-Summary Corrections or protests promptly after CBP opens a refund pathway. Accurate data (entry numbers, HTS lines, duty amounts) will speed recovery and protect rights if the tariffs are later reinstated.

- Contingency planning: Because the appeal could restore the duties, companies should model landed costs with and without the IEEPA add-on for contracts shipping later this summer and autumn. Duty-deferral tools such as bonded warehousing or FTZ admission can hedge against back-and-forth litigation risk.

- Other regimes unaffected: The ruling does not disturb Section 301, Section 232 or normal MFN duty schedules; those rates continue to apply.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.