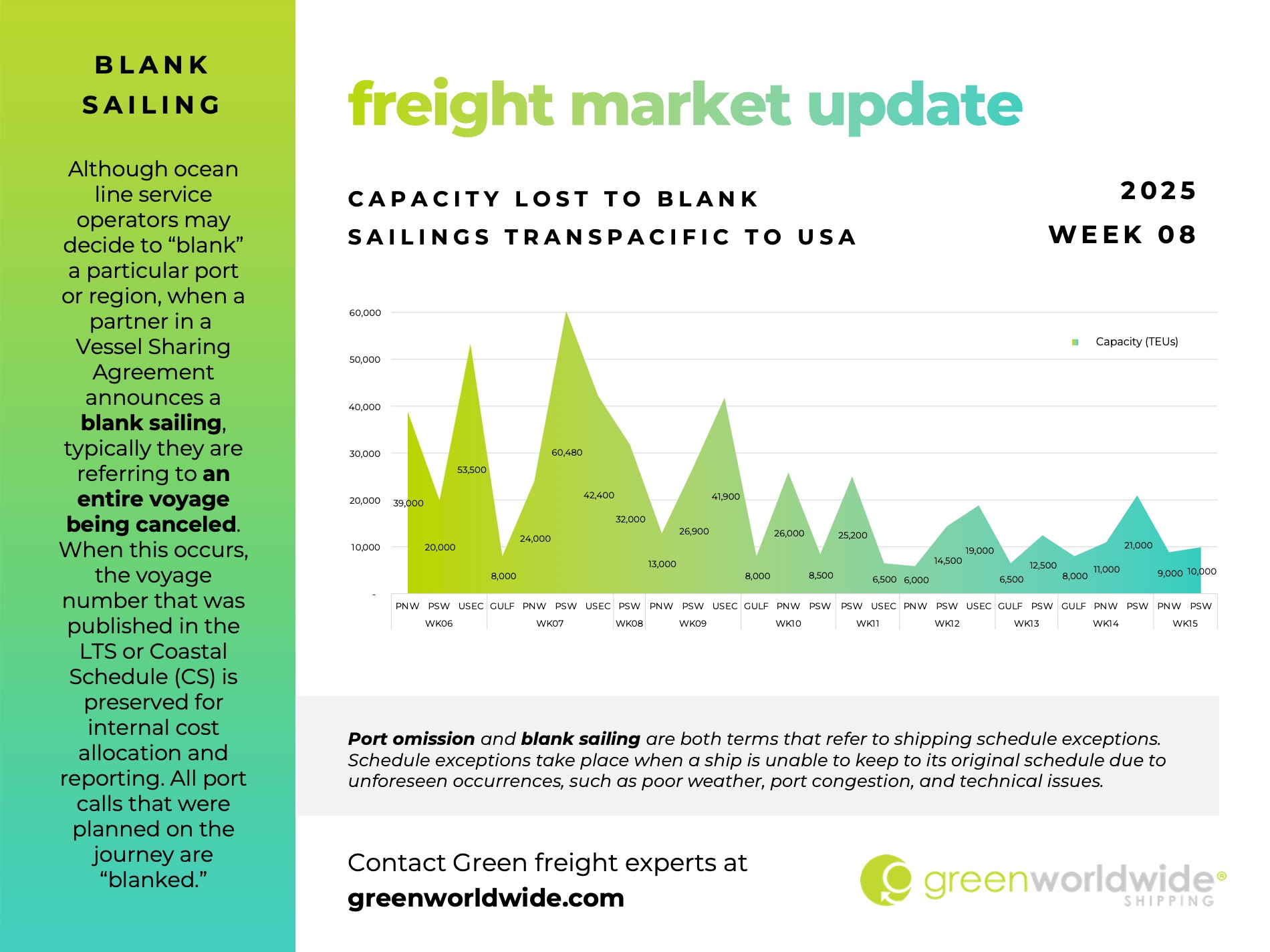

SLOW FREIGHT RECOVERY CONTINUES

With Week 08 underway, global freight volumes remain sluggish, as demand struggles to recover following Lunar New Year closures and new tariff policies. Market activity is currently at 30-40% of pre-holiday levels, with a gradual rebound expected after mid-March as manufacturing operations ramp up.

GEMINI ALLIANCE: HUB-AND-SPOKE MODEL ACTIVE

The Gemini Cooperation officially launched its first sailings in mid-February, rolling out its Hub-and-Spoke model across key transshipment hubs. Feeder vessel connectivity has been timely so far, though vessel connections and schedule reliability remain under close review as the alliance integrates its operations. The fleet will consist of ~340 vessels with a combined 3.7 million TEU capacity, with many vessels designed for cleaner fuel adoption.

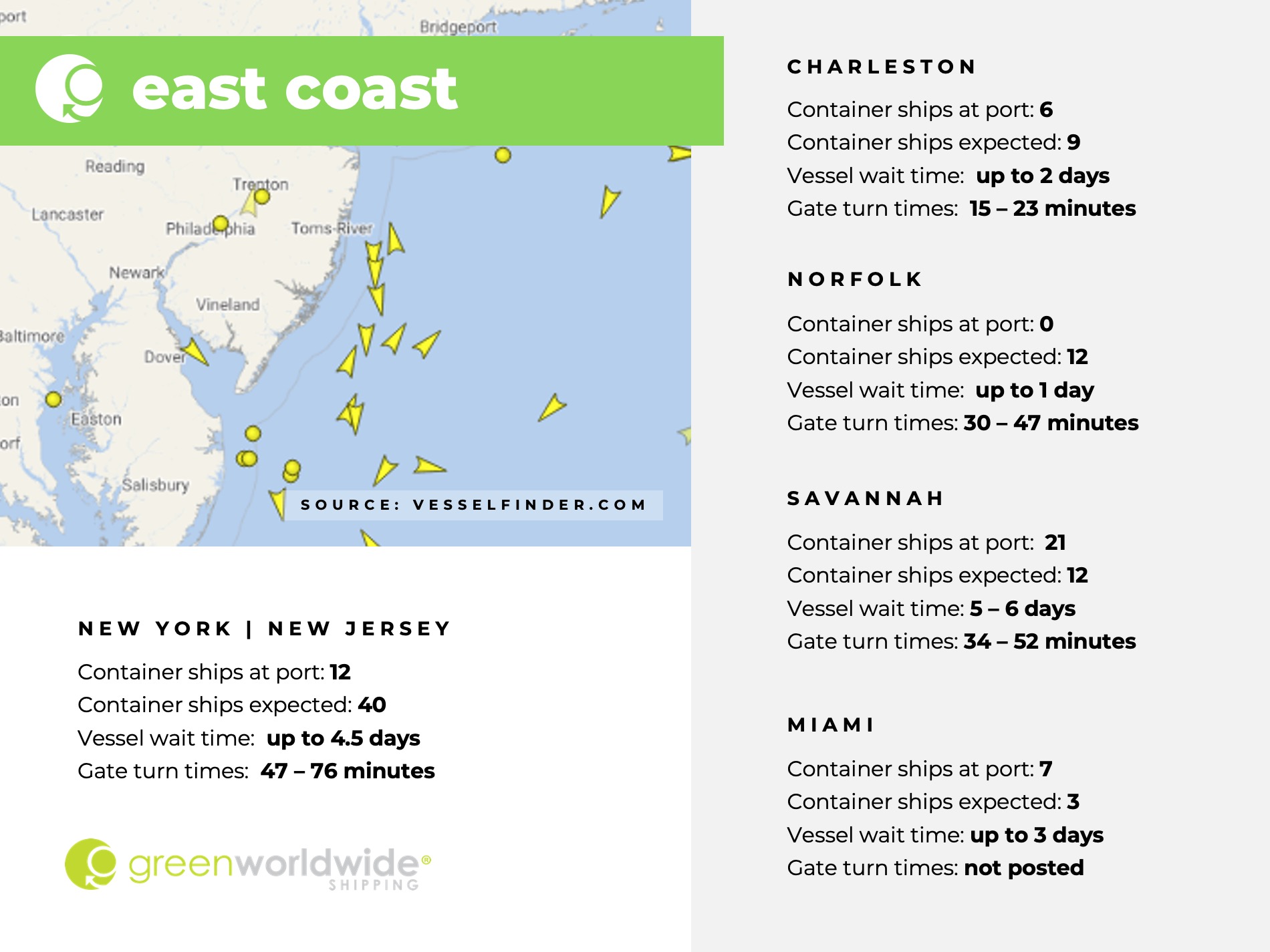

EQUIPMENT CONGESTION PERSISTS AT NY/NJ TERMINALS

New York/New Jersey terminals continue to experience equipment congestion, with elevated empty container volumes limiting available capacity. To mitigate pressure, additional vessel deployments are scheduled to evacuate empty equipment:

- Weeks 7-9: Approx. 17,000 TEUs of empty containers will be repositioned.

- Post-Week 9: Ongoing evacuations of ~2,500 TEUs per week will continue.

Industry stakeholders are also exploring off-site depots for empty returns, though no formal implementation has been confirmed. These measures, along with broader industry efforts, are expected to gradually alleviate congestion challenges in the coming weeks.

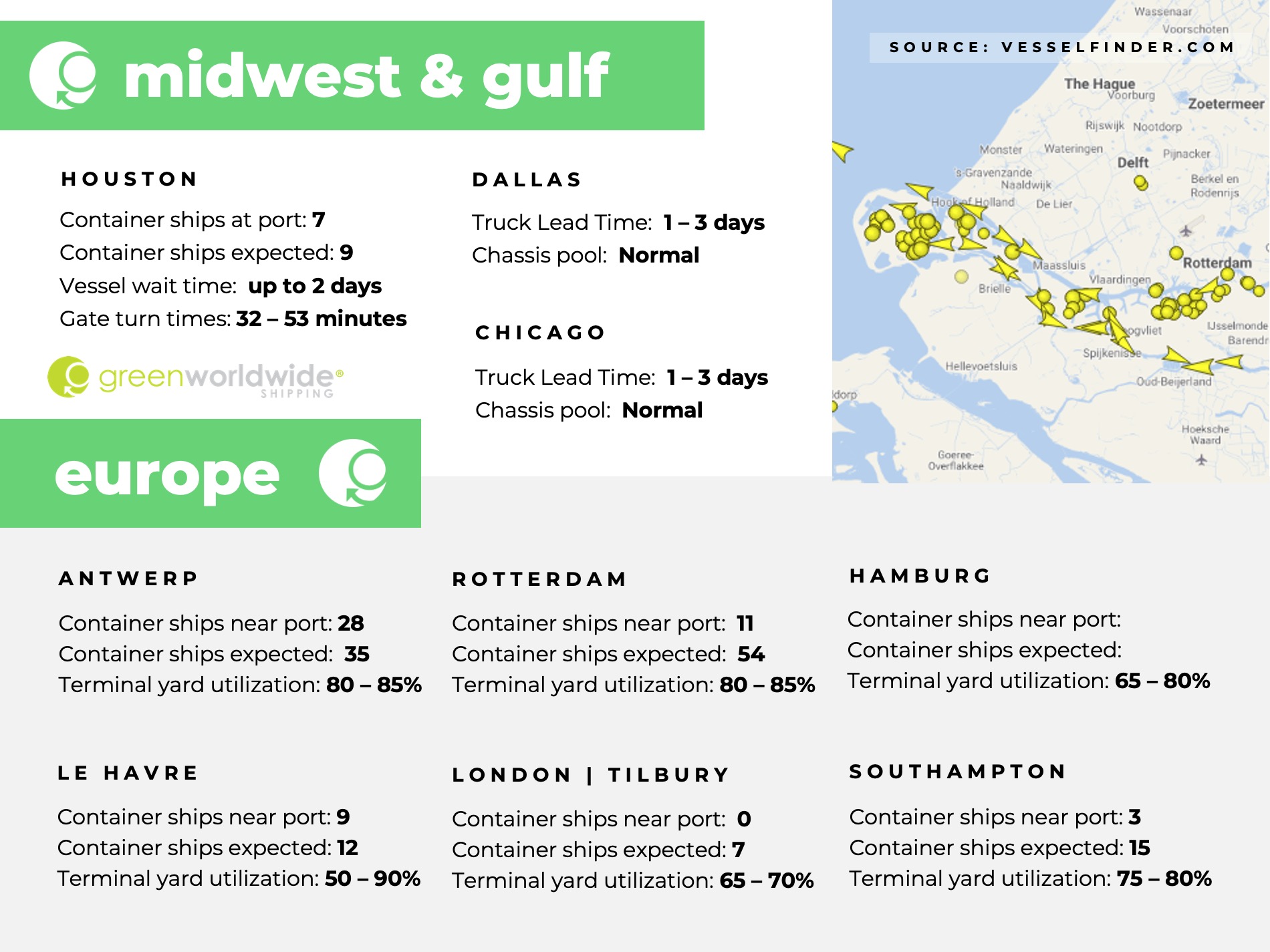

FRENCH PORT STRIKES DISRUPT OPERATIONS

Industrial action at French ports, including Le Havre, continues, with 4-hour stoppages occurring multiple times per week. Additional strike actions have been confirmed for:

- February 18, 2025

- February 20, 2025

These labor disruptions are impacting vessel schedules, cargo handling, and inland freight movements, contributing to delays in European trade flows. Further updates will follow as developments unfold.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.