TRADE SHIFTS, CAPACITY PRESSURES, AND POLICY IMPACTS

Week 12 finds trade policy shifts, capacity constraints, and supply network adjustments continuing to shape the global freight market. New U.S. tariffs on European automotive imports take effect April 2, 2025 while expanded Section 232 tariffs on steel and aluminum are now in full enforcement. Shippers are responding with strategic volume shifts, particularly in trans-Atlantic and transpacific lanes.

TRANSPACIFIC TRADE: VOLUME RECOVERY REMAINS UNEVEN

February saw a 12.5% drop in U.S. imports from China, primarily due to the Lunar New Year slowdown. While volumes typically recover by mid-March, new U.S. tariffs on Chinese goods have slowed the rebound, with shippers delaying bookings amid policy uncertainty.

Despite some recovery, China-origin shipments are expected to reach only 70% of December levels this month, with South China performing slightly better at 80%. Southeast Asia and South Korea have seen stronger rebounds, reaching 90% of pre-holiday levels, while Vietnam lags at 80%.

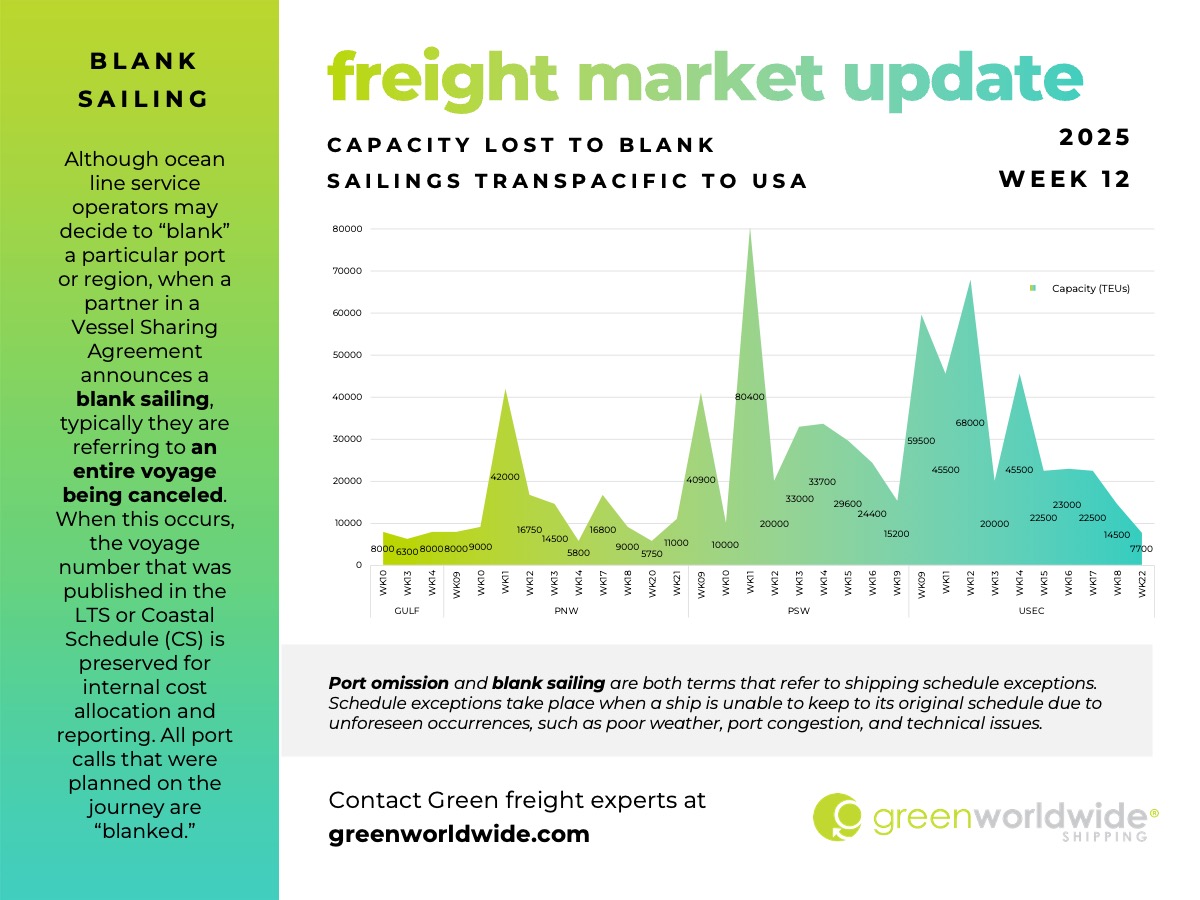

The recent global shipping alliance restructuring has added to market uncertainty. Increased blank sailings are restricting available space, and capacity is expected to remain tight through late March as carriers adjust to demand fluctuations.

SHIFTING SUPPLY NETWORKS: SOUTHEAST ASIA SEES GROWTH IN U.S. IMPORTS

With rising tariffs and trade disruptions, U.S. importers are shifting sourcing strategies, moving key commodity flows from China to Southeast Asia.

Among the most affected goods, electrical machinery, furniture, industrial equipment, and textiles have seen a noticeable shift in sourcing. Imports from China in these categories have declined, while Southeast Asian exports to the U.S. have grown by as much as 11.5%. This trend is expected to continue through 2025 as companies adjust supply networks to minimize cost and policy risks.

U.S. STEEL & ALUMINUM TARIFFS IN FULL EFFECT

The expanded Section 232 tariffs on steel and aluminum took effect on March 12, 2025, imposing a 25% duty on all steel and aluminum imports, including derivatives. The Commerce Department has eliminated country-specific exclusions, affecting shipments from Canada, Mexico, and the EU.

CBP now requires additional reporting for aluminum and steel imports, including details on the primary country of smelt, country of cast, and country where steel was melted and poured. Importers must ensure proper documentation and tariff classification, particularly for goods admitted under Foreign Trade Zone (FTZ) regulations, as privileged foreign status does not exempt shipments from the tariff.

EU RETALIATORY TARIFFS SET TO TAKE EFFECT APRIL 1

In response to U.S. steel and aluminum tariffs, the European Union announced countermeasures targeting €26 billion ($28.4 billion) worth of U.S. goods.

The rollout will occur in two phases:

- April 1, 2025 – Reinstatement of previously suspended tariffs on €4.5 billion ($4.9 billion) in U.S. exports.

- Mid-April 2025 – Additional tariffs on €18 billion ($19.6 billion) in U.S. exports, with final product selection based on EU industry consultations.

The EU tariffs apply across industrial, agricultural, and consumer goods, including machinery, motorcycles, bourbon whiskey, peanut butter, home appliances, and textiles. With growing trade compliance complexity, shippers should review the potential impacts with local Customs teams to ensure accurate tariff classification and proper supply chain adjustments.

TRANSATLANTIC AIR FREIGHT SURGE AMID ONGOING TRADE POLICY SHIFTS

Shippers are accelerating Transatlantic air freight movements as U.S.-EU trade policy shifts continue. With Section 232 tariffs on steel, aluminum, and their derivatives now in full effect, businesses are closely monitoring potential additional trade measures and their impact on cross-border commerce.

Industry data shows an 11% year-over-year increase in Transatlantic air cargo volume for early March, with load factors reaching 76%, particularly for main deck cargo. Freighter capacity remains tight, as 2,000 tons per week have been redirected to Asia-Pacific trade lanes to support e-commerce demand.

As airlines roll out summer flight schedules on April 1, additional widebody passenger flights will increase belly cargo capacity. Historically, this shift has lowered load factors by 10–20%, which could help ease pressure on freight availability.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.