Trade & tariffs

If you’re a business owner, then chances are you’ve been following as the United States trade agenda sent waves of change across international waters. After implementing tariffs on imported steel and aluminum, the Administration also announced the first round of additional 25 percent Section 301 tariffs on China, starting July 6, 2018. United States allies seemed blind sighted that exemptions were not extended for long-time friends and responded with retaliatory tariffs of their own.

The European Union has placed tariffs of $3.2 billion on U.S. products such as jeans, bourbon, motorcycles, and agriculture products. This week, Harley Davidson announced intentions to move production off-shore to combat the increase. Canada will implement $12.4 billion in tariffs against U.S. imports starting July 1, 2018, while Mexico has already imposed a $3 billion penalty again American exports. China, the main target of the trade restrictions has also promised reciprocating penalties on $50 billion of U.S. products.

But international governments aren’t the only ones taking action. The American Institute for International Steel (AIIS), and two steel importers, Sim-Tex and Kurt Orban Partners, have filed suit over the constitutionality of Section 232 of the 1962 Trade Expansion Actin providing such broad authority to the president with no judicial review.

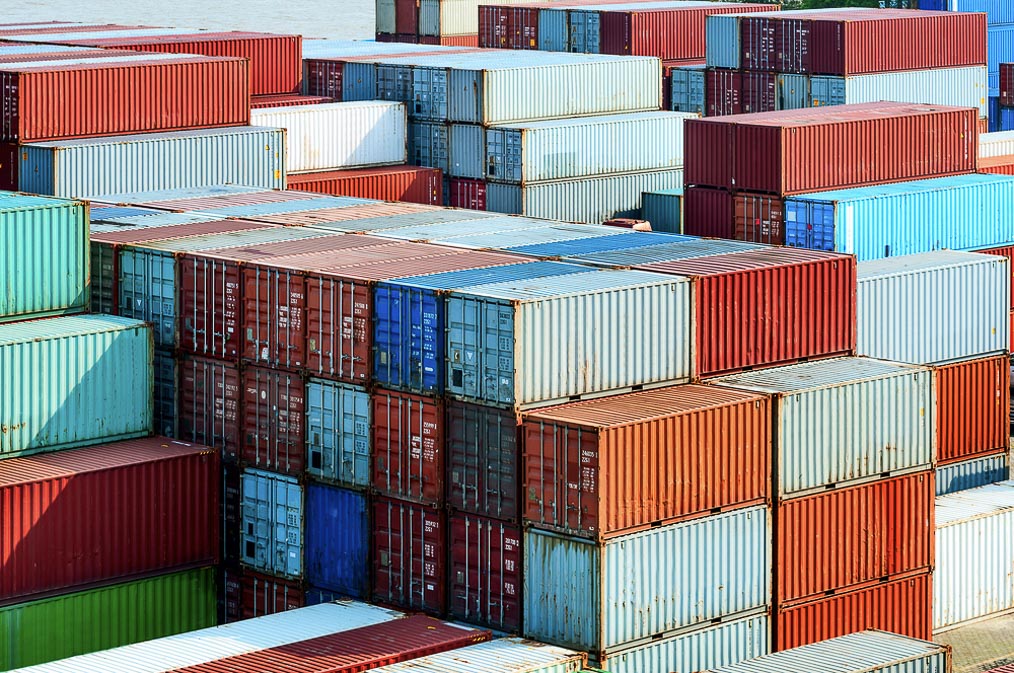

Ocean freight market

While space and rates are holding steady, most ocean carriers will be pushing for general rate increases (GRIs) as they gear up for peak season. While demand remains strong, trade policy could impact the volume for most upcoming markets. Lean margins for carriers led to a slew of consolidations over the past few years and shippers are looking forward to more efficient services at low contracted rates. But on the heels of a new International Maritime Organization (IMO) to implement a .5% sulphur cap on marine fuel by January 1, 2020 could add $50 billion to ocean carrier bottom lines.

TRANSPACIFIC EASTBOUND

Asia to both U.S. coasts – Open space, GRI announced for July 1.

TRANSATLANTIC WESBOUND

Europe to both U.S. coasts – Space is tight with bookings recommended 2 weeks in advance. GRI announced for July 1.

EXPORTS

U.S. Exports to Asia and Europe – Emergency bunker surcharges announced for July 1. Space is tight, book at least 10 days in advance.

Airfreight update

Japanese Airline Nippon Cargo Airlines (NCA) suspended operations after government inspection grounded eleven freighters for incomplete maintenance records. The suspension is expected to impact capacity out of Asia, although at present, the market is stable with plenty of space available. Shippers still suffering from flashback of last year’s tight air market are shopping for options to the upcoming holiday peak season.

Domestic

The U.S. trucking market is tense as providers have started to settle into the ‘new normal’ under electronic logging device (ELD) implementation. Known to “fudge” service time records, truckers are now required to keep electronic logs or be forced off the road to combat crash-related fatalities due to driver distraction or fatigue.

The ELD has impacted most cargo operators that aren’t used to advanced scheduling, airfreight shipments with notoriously shorter free time, and long hauls over 100 air miles from pick-up. Some ocean carriers have stopped offering door deliveries while rail providers have also shifted operations. Under pressure from shippers, domestic carriers are seeking updates to the hours-of-service through the Honest Operators Undertaking Road Safety Act, presented in Congress this month, to extend an ELD exemption from 100 air miles to 150 air miles.

Stay up-to-date on freight and logistics by following Green Worldwide Shipping on Facebook, Twitter, and LinkedIn.