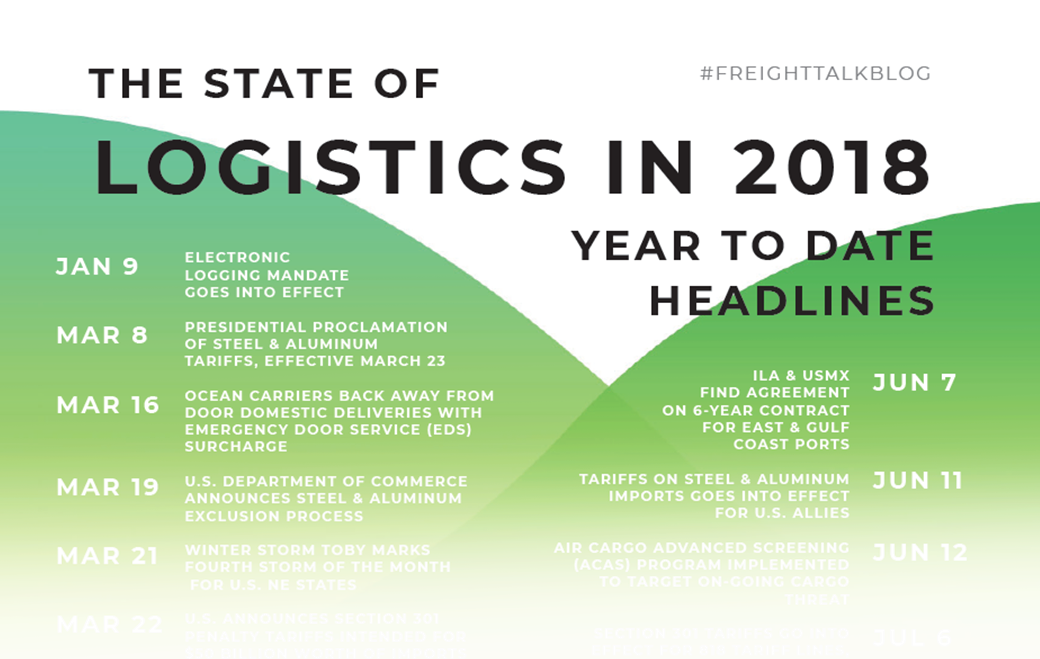

CLICK HERE FOR YEAR-TO-DATE FREIGHT NEWS THAT MADE HEADLINES

International shippers expecting calm, profitable peak season markets, after toiling consolidation of the steamship line industry last year, are finding the path to consumers is political, congested and, once again, expensive.

POLITICS OF TRADE

While most hesitate in labeling it a trade war, the United States international trade policy has seen its share of recent upheaval. After investigations and meetings with trade, tariff penalties are still being introduced against the U.S.’s dearest friends and foes, alike, with no real end in sight. This has left shippers searching for additional sourcing, but in most cases, stocking up before the implementation of more tariffs and the upcoming blank Golden Week sailings the week of October 1st.

FUELED & FAILED EXPECTATIONS

Earlier this year, ocean carriers removed three weekly services to the WC, and one to the EC in anticipation of the modest increase to 2018 imports projected earlier in the year; however, due to weather and operational adjustments, drastic reduction to on-time vessel deliveries pulled capacity deeply below demand and placed shippers in the current environment of high rates and even higher chances for rolled bookings. Utilization, “fill factors,” are over 100% for both U.S. coasts and carriers are milking the opportunity, but not for the nefarious reasons we want to believe. Simply put, increased fuel costs have eaten away steamship line profits and impending further investments towards mandatory programs, such as the International Maritime Organization’s cap on sulphur fuel emissions in 2020, means shippers should get used to paying premium price for space.

Week-to-week, beneficial cargo owners (BCO) that signed cheap carrier contracts are seeing their “dedicated” space go to the highest bidder. Non-vessel Operating Common Carriers (NVOCC), such as freight forwarders, are also battling for space and being forced to ride ocean spot rates – but luckily, within a larger, more global pool of options.

DOMESTIC DELIVERIES

Demand for surface transportation across the United States has remained strong all year, predominantly from removed capacity in the form of electronic logging mandate (ELD) restrictions and delivery delays of rail-bound cargo. As rail providers announce technological investments to improve the root causes of service delays, truckers could see some flexibility in rigid electronic logging as four proposed changes are presented to the U.S. Federal Motor Carrier Safety Administration (FMSCA).

- Increase on-duty hours for local (up to 150 miles) CDL drivers from 12 to 14 hours;

- Adverse driving conditions extension of 2 hours (up to 14 hours);

- Reconsideration of the sleep or split provision would once again allow drivers the option of splitting their off-duty hours; and

- Responsible & Effective Standards for Truckers (REST) Act proposes one rest/break of up to 3 consecutive hours;

These additional flexibilities could ease some of the operational frictions the electronic mandate has enforced on the industry and release much needed capacity back into domestic moves.

CLICK HERE FOR YEAR-TO-DATE FREIGHT NEWS THAT MADE HEADLINES

As Green continues to monitor the situation, stay up-to-date on freight news by following us on Facebook, Twitter, and LinkedIn or, subscribe to Green’s Freight Talk blog to received updates directly to your email.