In Week 35, importers are seeing mixed signals. Space on key transpacific lanes is tightening just as Golden Week preparations ramp up, while congestion at several Asian ports is slowing vessel operations. A new 25% duty on Indian products is now in force adds another layer of compliance to manage.

TRANSPACIFIC CAPACITY PRESSURE AHEAD OF GOLDEN WEEK

Despite the extended U.S.–China tariff pause, carriers are not relaxing capacity controls. The usual late-summer surge has been muted. Much of the seasonal volume was pulled forward earlier this year, and many U.S. warehouses are still carrying heavier stock than normal.

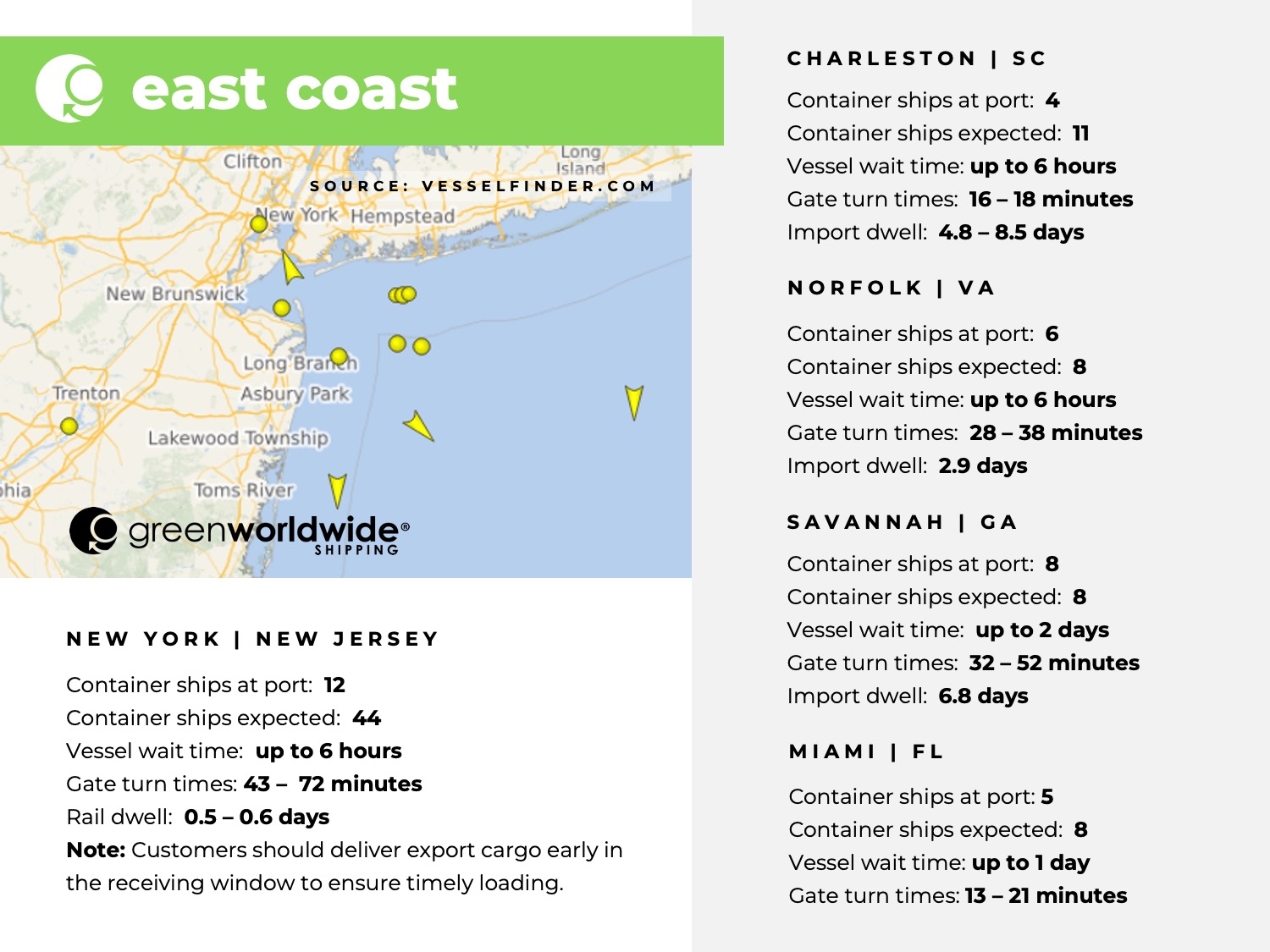

Carriers are responding with frequent schedule adjustments. Extra-loaders have been redeployed to other regions, and blank sailings are being added across several strings. East Coast services are especially affected, with some shifted to bi-weekly rotations or moved into Latin American trades. MSC and ZIM announced up to seven blank sailings on East Coast lanes in Weeks 35 and 36, nearly half of the available space for that period. These moves follow capacity changes from Cosco, CMA CGM, and Evergreen, pointing to a more restricted September.

OPERATIONAL IMPACTS FOR IMPORTERS

Even with demand easing, reliability is still fragile. More blanks and last-minute changes are expected into early September. Importers with fixed delivery windows should be prepared for possible vessel delays and rolling. Capacity on East Coast and Gulf lanes will likely remain tight, while West Coast services could vary week-to-week as carriers adjust to uneven bookings.

ASIA PORT CONGESTION FROM EXTREME WEATHER

Lingering weather issues continue to slow operations at major hubs:

-

Shanghai (Yangshan): Recovery from earlier typhoon closures is slow, with delays of three days or more and 16 ships waiting as of August 20.

-

Shanghai (Waigaoqiao): WGQ4 is most affected, with delays up to five days and 25 ships queued.

-

Singapore: Yard density remains high, close to 90%, causing two-day delays on average. PSA is prioritizing outbound loads and limiting some moves until space frees up.

-

Manila: Two- to three-day delays continue at MICT, with eight vessels in line.

TRADE COMPLIANCE UPDATES

CBP has begun collecting a new 25% duty on Indian-origin products under Executive Order 14329. The action addresses indirect imports of Russian oil and revises the Harmonized Tariff Schedule to cover additional goods. The duty applies to entries starting August 27, 2025. Shipments loaded before that date can still qualify for relief if entered by September 17. Articles admitted to foreign trade zones after August 27 must be placed in privileged foreign status. Importers should confirm product classifications, monitor shipping timelines, and review possible exemptions to avoid costly errors.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.