U.S. containerized imports closed 2025 slightly below prior-year levels, while early 2026 reflects uneven demand across regions. China-origin volumes continued to erode into December as Southeast Asia gained share, leaving capacity available but misaligned with demand. Carriers deployed additional tonnage ahead of Lunar New Year, boosting utilization without tightening capacity. For importers, the focus is timing and service reliability as factory closures extend into February.

U.S. IMPORT VOLUME AND SOURCING TRENDS

December 2025 year-over-year data reinforces the continued shift in U.S. sourcing patterns. China-origin volumes declined significantly, while Vietnam, Thailand, and Indonesia recorded strong growth, further redistributing export activity across Asia. Despite these gains, volumes across the top countries of origin remained lower overall, indicating that diversification has not fully offset softer demand conditions. This imbalance continues to shape carrier deployment decisions and limits the market’s ability to absorb elevated capacity.

TRANSPACIFIC OCEAN CAPACITY CONDITIONS

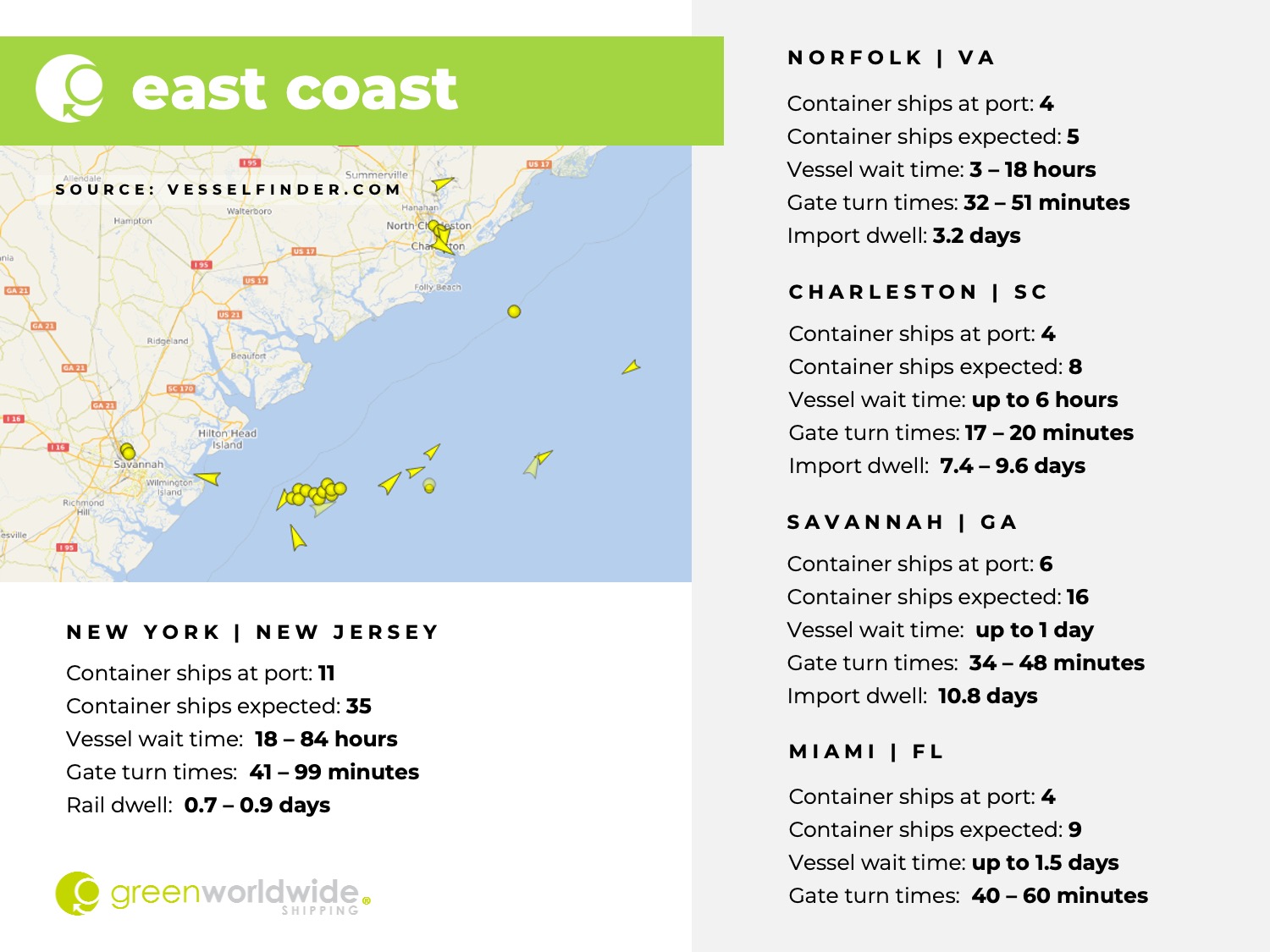

Pre-Lunar New Year cargo activity has been met with substantial vessel deployment across Transpacific lanes. Vessel utilization has improved into early January, reaching approximately 90 percent on U.S. West Coast services and 80 to 85 percent on U.S. East Coast services. However, volumes remain insufficient to support sustained rolling programs. With blank sailing activity expected to remain stable until after Week 08, capacity continues to outpace demand in the near term.

LUNAR NEW YEAR PRODUCTION OUTLOOK

Factory shutdowns are expected to spike through early February, with a majority of China’s factories entering holiday closure by mid-month. Production restarts will be staggered, beginning with major manufacturing hubs such as Shenzhen, Shanghai, and Ningbo before extending to northern and secondary ports later in February. This phased shutdown and restart will limit the potential for rapid demand rebound, leading to uneven booking patterns through early March.

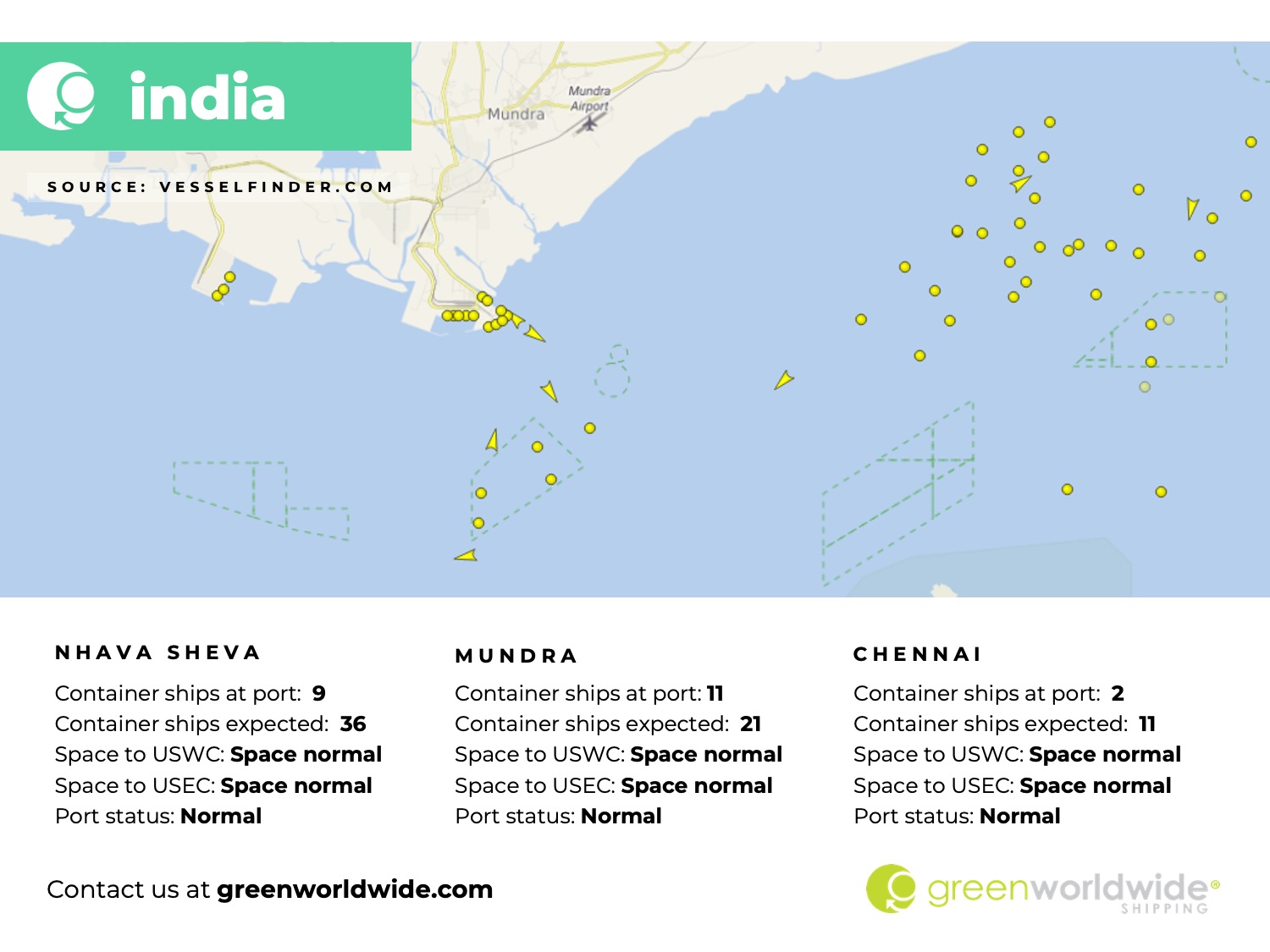

INDIA-USA OCEAN MARKET UPDATE

India-origin services continue to show generally open space to both U.S. coasts. Selective blank sailings are emerging on certain U.S. East Coast services as carriers manage utilization, while congestion at Kolkata remains a factor affecting vessel schedules and empty equipment positioning. Overall capacity remains sufficient, with carriers relying on tactical sailing adjustments rather than broad withdrawals.

CARRIER NETWORK DEVELOPMENTS

Emirates Shipping Line recently announced plans to upgrade its Vietnam-South China-U.S. West Coast Sun Chief Express service to a weekly frequency beginning June 2026. The service will continue to call at Haiphong, Ho Chi Minh, Shekou, and Seattle, reflecting sustained export growth from Vietnam and Southeast Asia. The expansion signals continued carrier investment in services aligned with evolving sourcing strategies and regional demand shifts.

AIR CARGO MARKET CONDITIONS

China-U.S. air cargo volumes peaked in early January and have since leveled off as the Lunar New Year production window narrows. Cross-border e-commerce volumes remain significantly lower year over year, while policy uncertainty continues to influence shipper behavior. Hong Kong is experiencing a short-term pre-holiday uplift driven primarily by e-commerce, while Southeast Asia air markets remain broadly stable, supported by garments, electronics, and diversified manufacturing output.

U.S. TRADE POLICY UPDATE

On January 12, 2026, the White House announced an immediate 25 percent tariff applicable to countries conducting business with Iran when goods are imported into the United States. The announcement did not include product-level detail or implementation guidance. As of this week, no additional clarification has been issued by USTR, BIS, or CBP, and importers continue to monitor for formal compliance instructions.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.