U.S.–CHINA TARIFF SUSPENSION OFFERS SHORT-TERM TARIFF RELIEF FOR U.S. IMPORTERS

On May 11, 2025, the United States and China jointly announced a 90-day suspension of select tariffs imposed over the previous six weeks. A new Executive Order, effective May 14, removes 24 percentage points of additional duties on Chinese-origin goods while retaining a 10% baseline rate. It also eliminates certain tariffs under earlier executive orders and reduces the duty rate on low-value imports from 120% to 54%.

For U.S. importers sourcing from China, Hong Kong, and Macau, this offers a short-term opportunity to reduce landed costs and adjust entry procedures. The suspension is not retroactive and does not impact duties under Section 232 or Section 301. Importers should review affected HTS codes, confirm applicability with brokers, and prioritize qualifying shipments within the suspension window.

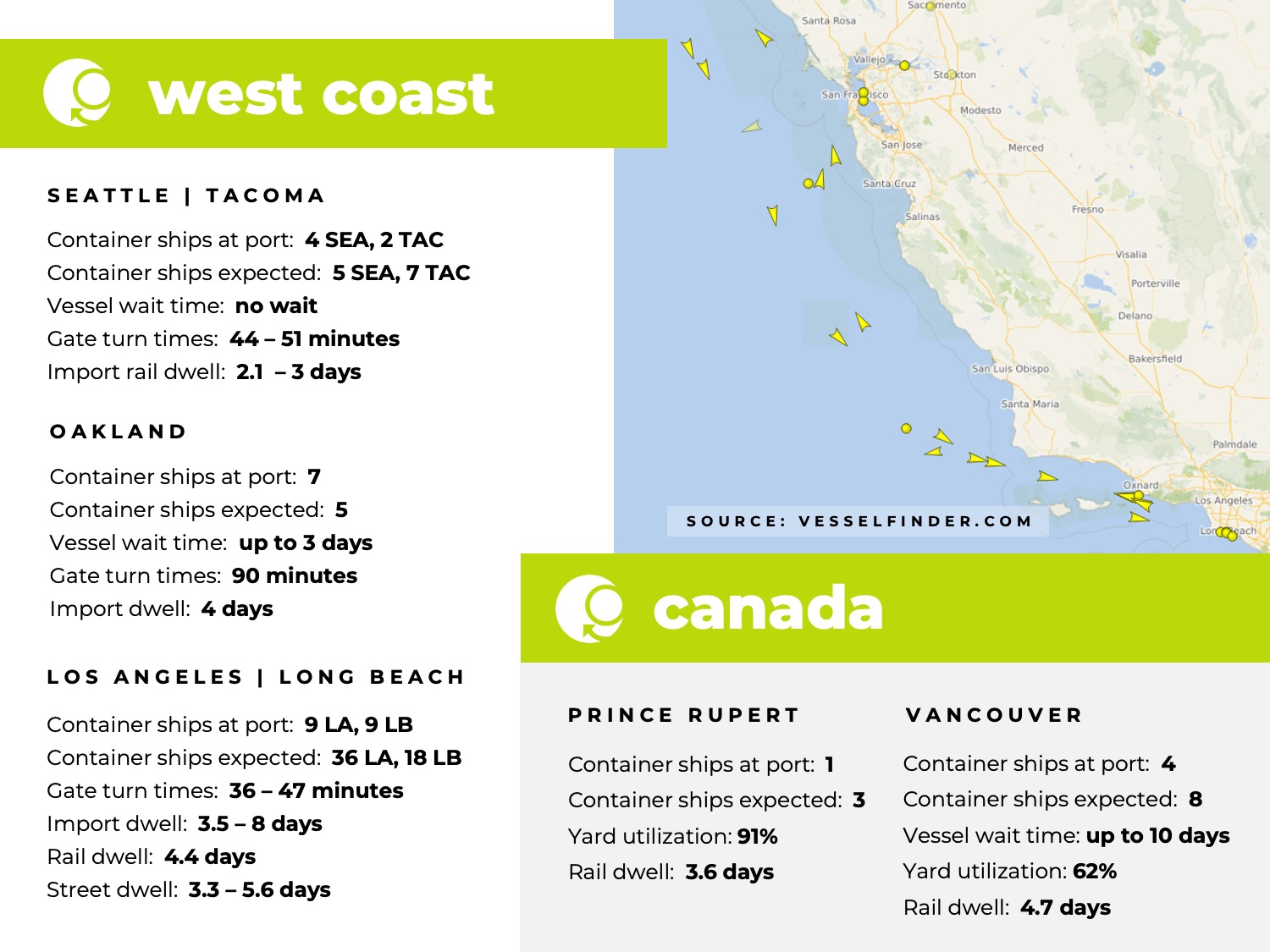

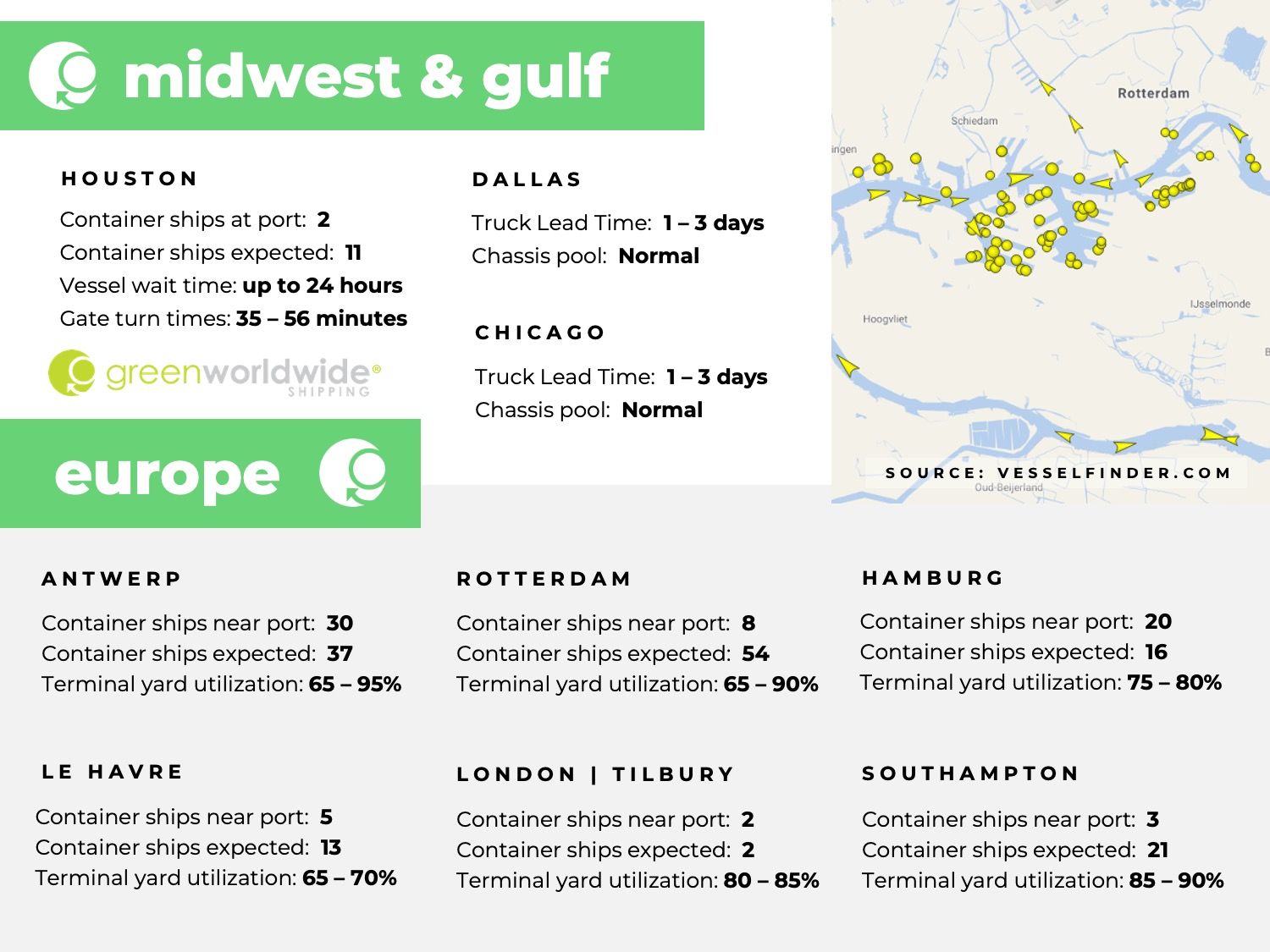

REBOUND IN CHINA–U.S. VOLUMES STRAINS CAPACITY AS IMPORTERS RUSH TO SHIP UNDER TARIFF RELIEF WINDOW

The U.S.–China tariff suspension has triggered a sharp rise in eastbound Transpacific bookings as importers move quickly to ship under the 90-day window. Origin ports in China report week-over-week booking increases exceeding 50%, as exporters release cargo previously held due to tariff uncertainty. This surge is rapidly consuming available vessel space and container equipment.

Importers are front-loading shipments to reduce risk and replenish inventories, intensifying pressure on a network still recovering from widespread service suspensions and blank sailings. Carriers are now working to reinstate capacity and reposition equipment to meet renewed demand.

With peak season activity starting earlier than usual, space availability and equipment access will remain the primary challenges facing U.S.-bound shippers in the near term.

INDIA–PAKISTAN TRADE RESTRICTIONS CONTINUE TO IMPACT U.S.-BOUND VESSELS

Ongoing trade restrictions between India and Pakistan continue to disrupt both direct and third-country containerized shipments in South Asia. Earlier this month, India banned all Pakistan-origin containers, including transshipment, in-transit (ROB), and import cargo from entering its ports. Pakistan enacted reciprocal measures, restricting Indian-origin goods from transiting its territory across all modes.

Indian ports will refuse entry to any vessel carrying Pakistan-origin containers, including empties. This restriction includes U.S.-bound vessels that typically make port calls at Karachi en route to India. Impacted vessels are being redirected to discharge Pakistan-origin cargo before entering Indian waters.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.