Week 29 finds U.S. importers navigating July peak volumes, looming tariff deadlines, and tightening Transpacific capacity as blank sailings reduce vessel space.

JULY IMPORT VOLUMES & DEMAND OUTLOOK

U.S. imports arriving in July are expected to reach their highest level in 18 months as retailers accelerate stocking ahead of impending U.S. tariff actions. Analysts warn this rush will be short‑lived, with reciprocal tariffs effective August 1, 2025, likely to trigger a demand decline. Analysts project month‑to‑month retail import volume decreases from August through November under higher duty expectations.

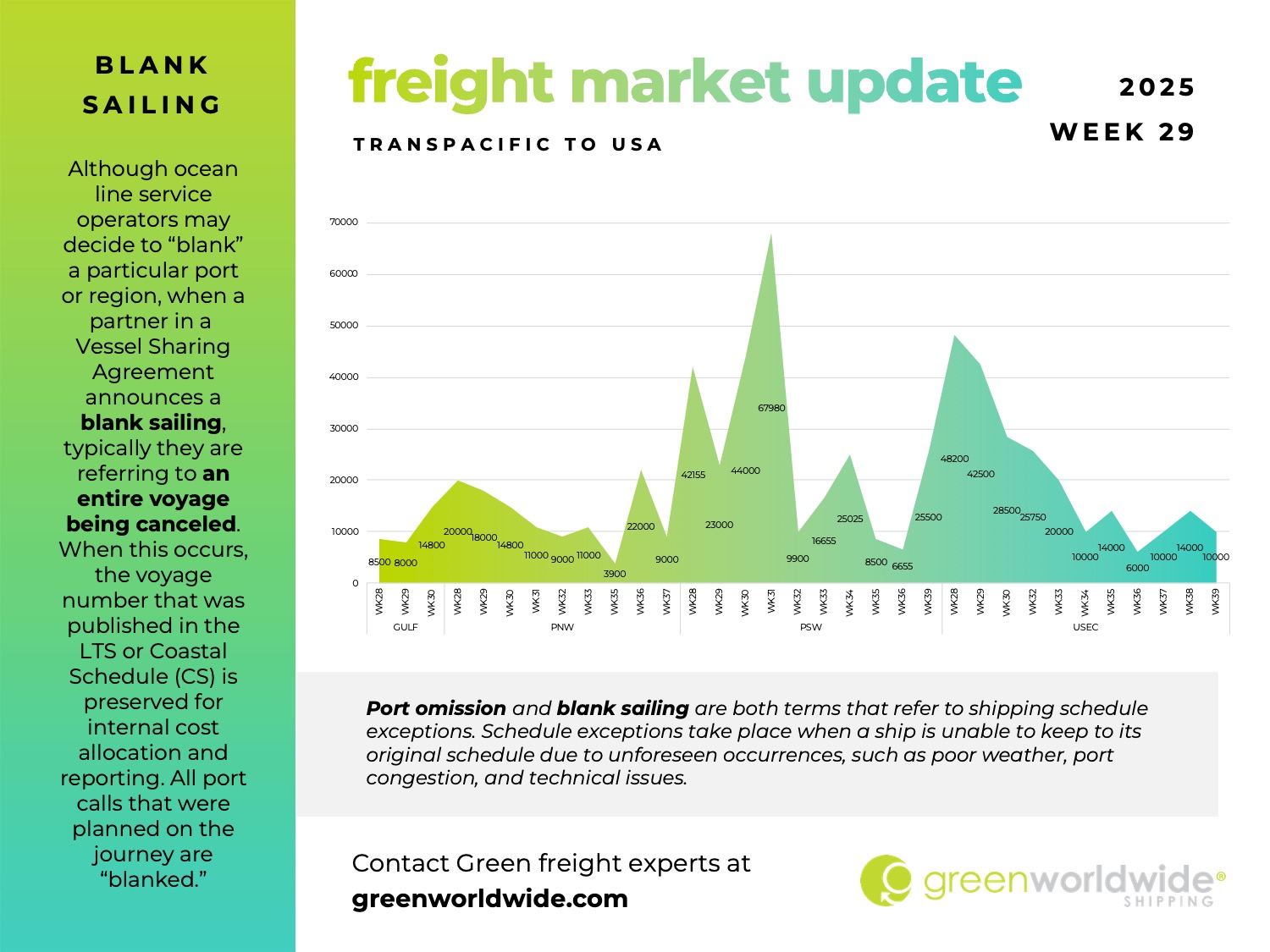

TRANSPACIFIC CAPACITY CUTBACKS & SERVICE SUSPENSIONS

In response to uneven demand, shipping lines are retracting tonnage deployment to the U.S. West Coast. Seventeen blank sailings are planned over the next three weeks – thirteen to PSW and four to PNW – and MSC will suspend its PEARL service from Vietnam and southern Chinese gateways beginning week 30. A June 30 analysis of data indicates carriers will cut capacity from Asia to the U.S. West Coast by 6.2 percent in August compared to July, while volumes to the East Coast and Gulf will see a modest 1.7 percent reduction.

U.S. TARIFF ACTIONS ON METALS AND KEY TRADE PARTNERS

Recently, the White House signaled a broad expansion of U.S. import tariffs set to take effect August 1. A social media post on July 9 announced Section 232 duties on refined copper, citing national security concerns related to strategic applications. That same communication threatens identical levies on all Brazilian exports tied to diplomatic disputes. A July 10 letter to Canada warns of a 35 percent general duty on most Canadian goods, preserving carve‑outs for energy, fertilizer, and USMCA‑origin shipments under negotiation. Official guidance remains pending on the implementation of these changing U.S. trade policies.

SECONDARY & ADDITIONAL GLOBAL TARIFF MEASURES

Letters dated July 11 to Mexico and the European Union advise a 30 percent surcharge on all imports beginning August 1, with pathways for duty reductions tied to cartel enforcement in Mexico and market‑access improvements in Europe. On July 14, the Administration initiated a 50‑day countdown – expiring September 2 – for imposing 100 percent secondary tariffs on third‑country purchasers of Russian commodities if hostilities persist. Importers should align compliance protocols with these evolving requirements to mitigate exposure.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.