Week 30 finds U.S. importers and port operators transitioning from July’s peak arrival volumes into a more cautious 3rd Quarter outlook as Transpacific volumes continue to decline ahead of U.S. August tariff deadlines.

CHINA DEMAND DECLINES AS IMPORTERS DIVERSIFY SOURCING

U.S. import volumes from China began declining sharply following a frontloading wave that peaked in recent weeks as importers raced to beat the August 14, 2025, expiration of the 90-day tariff pause on China-origin imports. Analysts report a 28.3% decrease in containerized imports from China, noting furniture, plastics, and machinery imports declined year-over-year.

Meanwhile, importers continue to accelerate sourcing diversification, boosting import growth from Southeast Asian countries. Volumes increased by 15.6% for Thailand, 27.6% for Vietnam, and 57.5% for Indonesia. China’s share of U.S. July container imports fell to 28.8%, a drop from 2024’s 40% share during peak demand. Analysts project lower retail import volumes from August through November due to higher duty expectations.

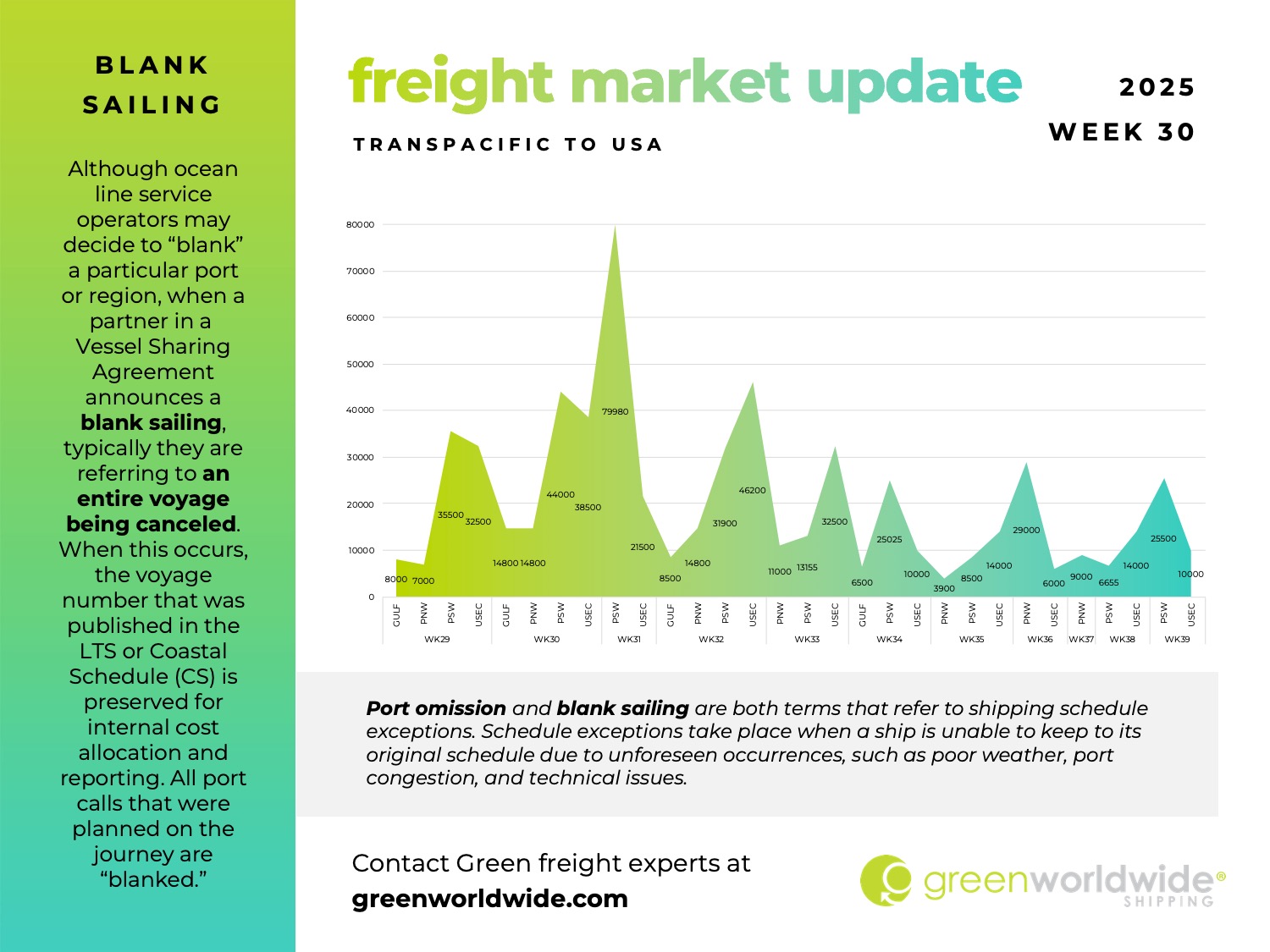

CARRIES CONTINUE TO CUT TRANSPACIFIC CAPACITY DUE TO LOWER DEMAND

Ocean carriers continue their July trend of sailing cancellations between Asia and the U.S. West Coast. Analysts forecast 175,000 TEUs of capacity will be blanked in July, which accounts for roughly 11% of scheduled shipments, an increase from 9% in June. The majority of blanked sailings coincide with the August 1 tariff deadline for non-China trade partners and with the August 12 China, Hong Kong, and Macau-specific tariff deadline. Industry experts note that shipments from Southeast Asia departing now will not arrive at U.S. ports in time to avoid potential increased tariff exposure.

Several carriers announced mainline service and express suspensions. Fleet reductions are well underway for carriers with rotations that link Asia, the U.S. West coast, and the Indian Subcontinent. Seven vessels remain to provide coverage for this loop. Additional service withdrawals are impacting capacity on Asia to U.S. East Coast trade lanes.

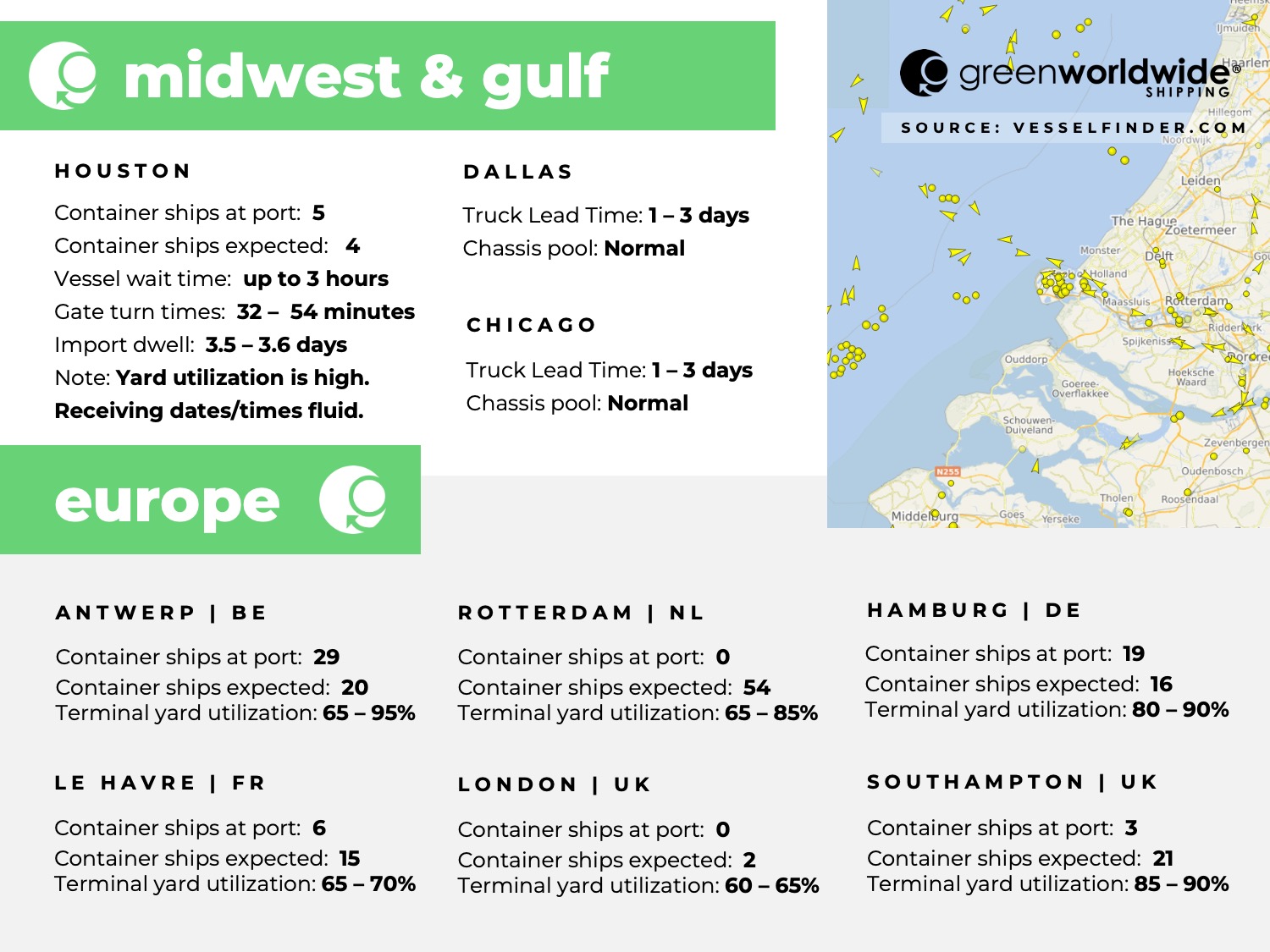

ONGOING PORT CONGESTION A CHALLENGE FOR KEY EUROPEAN AND LATIN AMERICAN PORTS

Northern European Ports, as well as the Port of Manzanilla and neighboring ports in Mexico, remain heavily congested, with longer-than-usual truck turn and container transfer times.

Port activity in Rotterdam remains under pressure, reporting congestion is tied to rising volumes and vessel call sizes. Over 100 containerships with call sizes exceeding 12,000 TEUs called the port in the first half of the year, contributing to extended inland terminal wait times. Although seaborne congestion remains limited, land-side operations continue to absorb peak volumes. Efforts are underway to shift cargo to off-peak hours, optimize inland barge corridors, and strengthen digital coordination to enhance system efficiency.

Shippers may experience freight delays and should anticipate blank sailings and port omissions while ports work through container backlogs.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.