February finds the freight marketing navigating uneven demand across Asia-U.S. trade lanes in the lead up to Lunar New Year with ongoing capacity management by ocean carriers, and evolving U.S. trade policies. Transpacific lanes continue to see blank sailings and rollover, while India-origin cargo remains relatively stable. Air cargo markets continue to adjust to softer volumes.

TRANS-PACIFIC OCEAN CAPACITY MANAGEMENT

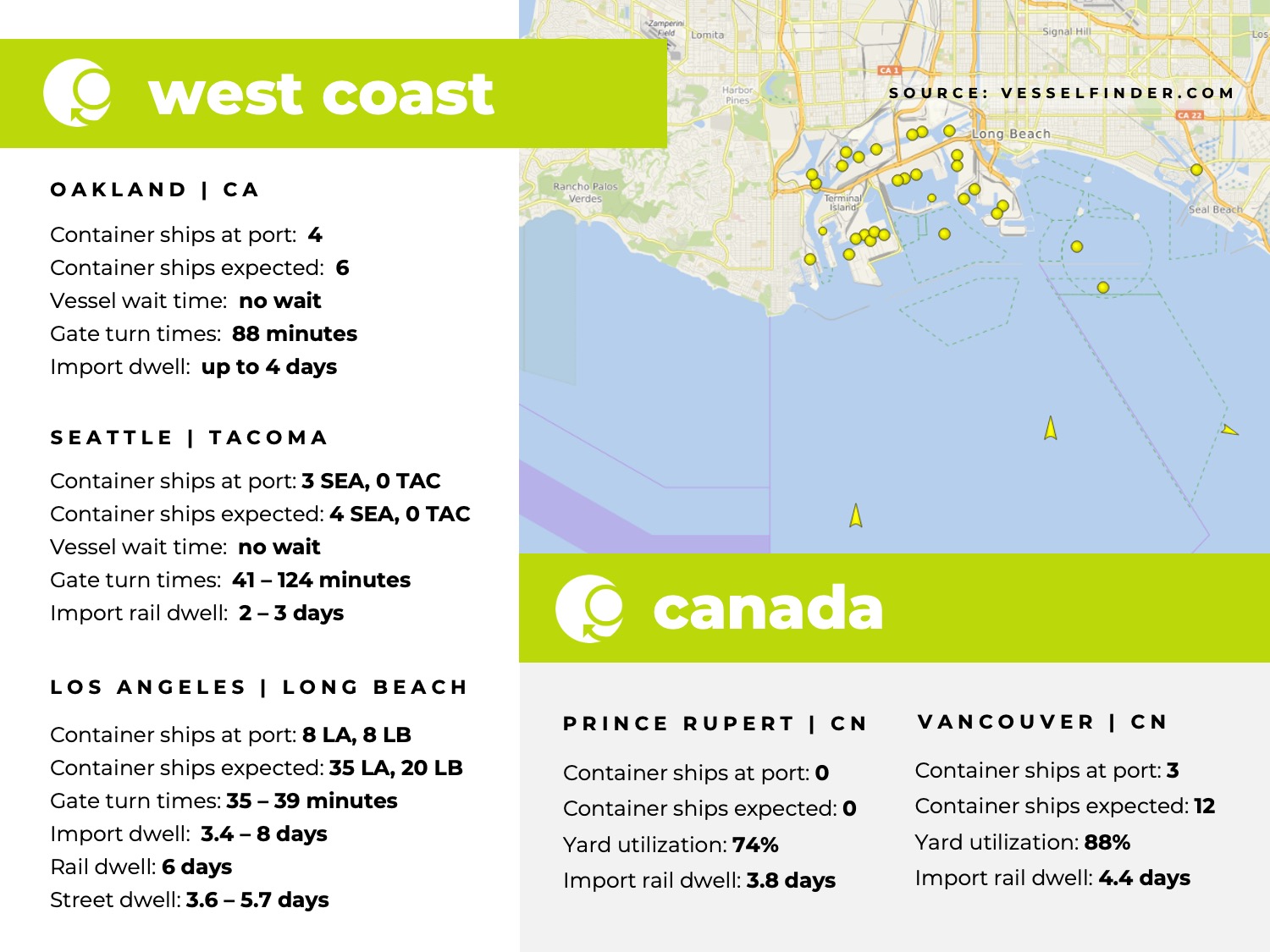

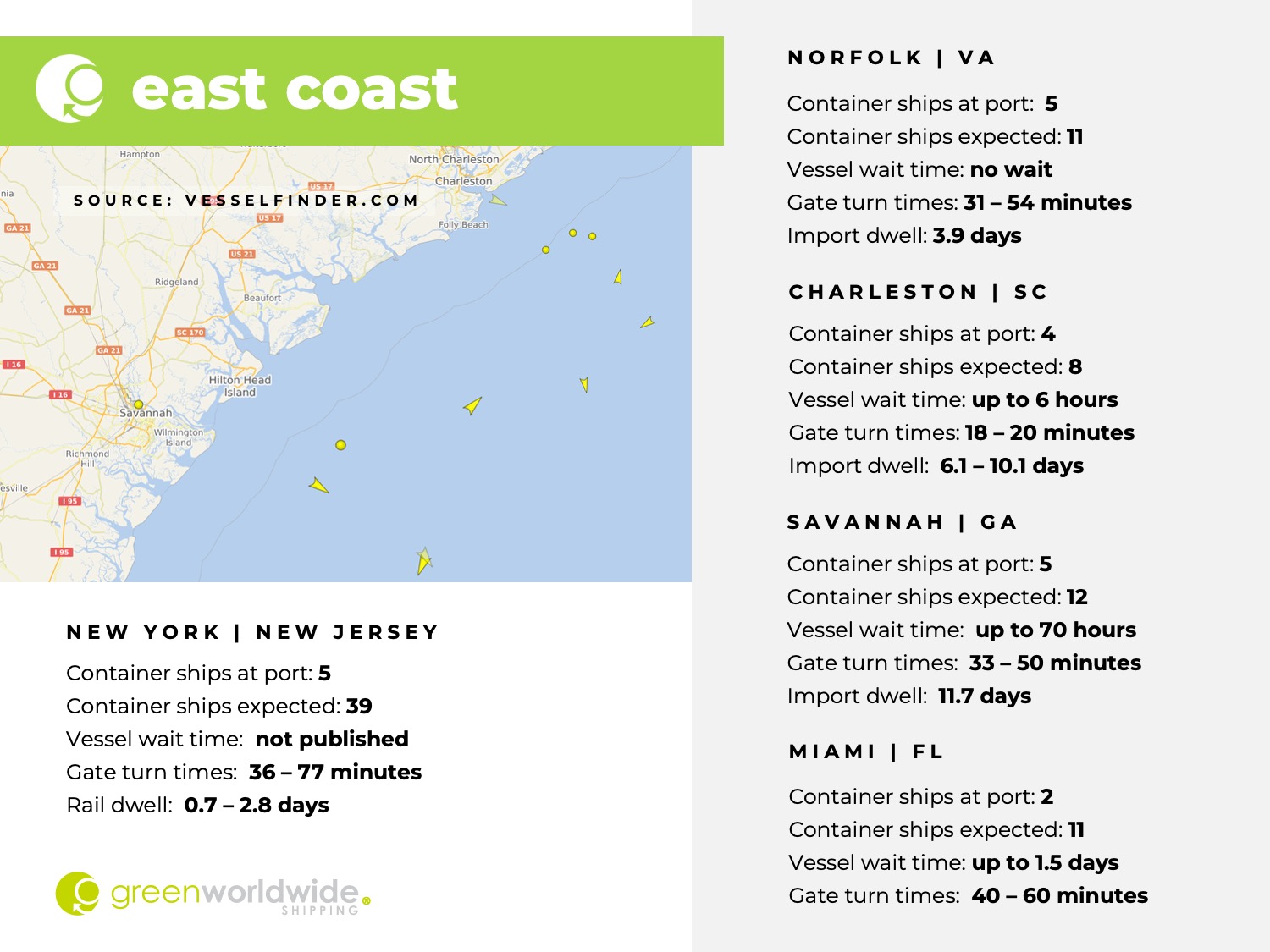

Ocean carriers are actively managing transpacific capacity as the Lunar New Year holiday approaches, with blank sailings reducing effective vessel supply into the US West Coast. Rollover exposure remains elevated on select Pacific lanes as weekly allocations fill earlier in the booking cycle. Capacity into the US East Coast remains comparatively balanced, though space is narrowing on certain services. These adjustments reflect continued carrier caution as networks move through the holiday window.

SPACE AVAILABILITY AND ASIA-ORIGIN PORT OPERATIONS

South China origins are showing the greatest variability, with Hong Kong and Shenzhen reflecting tight to tightening space into the US West Coast. East China gateways including Shanghai, Ningbo, and Qingdao remain constrained to the West Coast, while Qingdao is also tightening into the US East Coast. Vietnam-origin cargo remains comparatively stable, supported by consistent feeder connectivity, though early signs of tightening are emerging on select West Coast lanes. Overall execution remains uneven across Asia origins, with conditions varying by port and destination.

AIR CARGO MARKETS REMAIN SUBDUED

China-U.S. air cargo volumes remained soft entering February as the Lunar New Year period approached. Hong Kong demand continued to track below typical seasonal levels, while Southeast Asia markets showed modest resilience supported by technology, electronics, and garment flows. Airlines continued managing lift through targeted freighter cancellations to align capacity with near-term demand.

Weather-related disruption in North America contributed to minor transit delays on select routings, though no widespread network interruption was reported. Air cargo execution remains focused on maintaining schedule stability through the holiday period.

U.S. TRADE POLICY UPDATES

A new Executive Order recently established a framework that could allow additional tariffs on countries determined to supply oil to Cuba. The order does not impose immediate duties and does not identify specific products or sectors. Any future action would depend on subsequent determinations by the Department of Commerce and review by the Department of State, with further guidance expected through formal announcements.

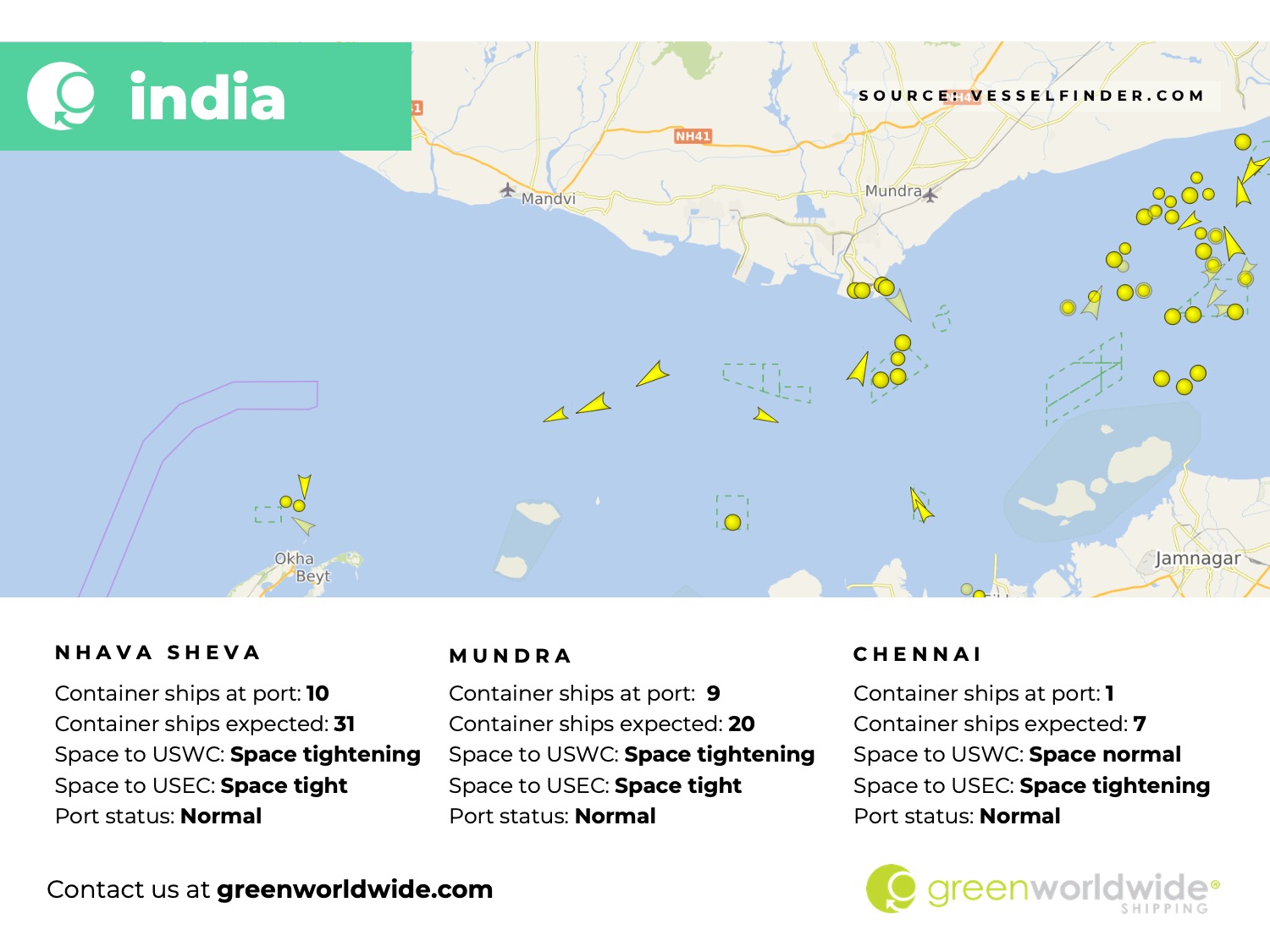

Separately, the Administration announced a trade understanding with India heralding adjustments to reciprocal tariffs and signaling broader trade cooperation. The announcement does not change current compliance requirements. Importers should continue filing entries under existing tariff classifications and duty treatment until formal instructions are issued by U.S. Customs and Border Protection.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.