On November 19, 2019, Congress introduced an extension of the Growing Renewable Energy and Efficiency (GREEN) Act with support of the current Wind Power Production Tax Credit (PTC) and the Investment Tax Credit (ITC) for an additional 5 years, through 2026.

Growing Renewable Energy and Efficiency (GREEN) Act

WHO WOULD BENEFIT FROM THIS LEGISLATION?

Those in the wind and solar power industry; such as, energy providers, Original Equipment Manufacturers (OEMs), and transportation companies all benefit from this legislation’s promotion of renewable energy usage and reduction of greenhouse gas emissions through financial tax incentives.

HOW DOES THIS IMPACT SUPPLY CHAIN OPERATIONS?

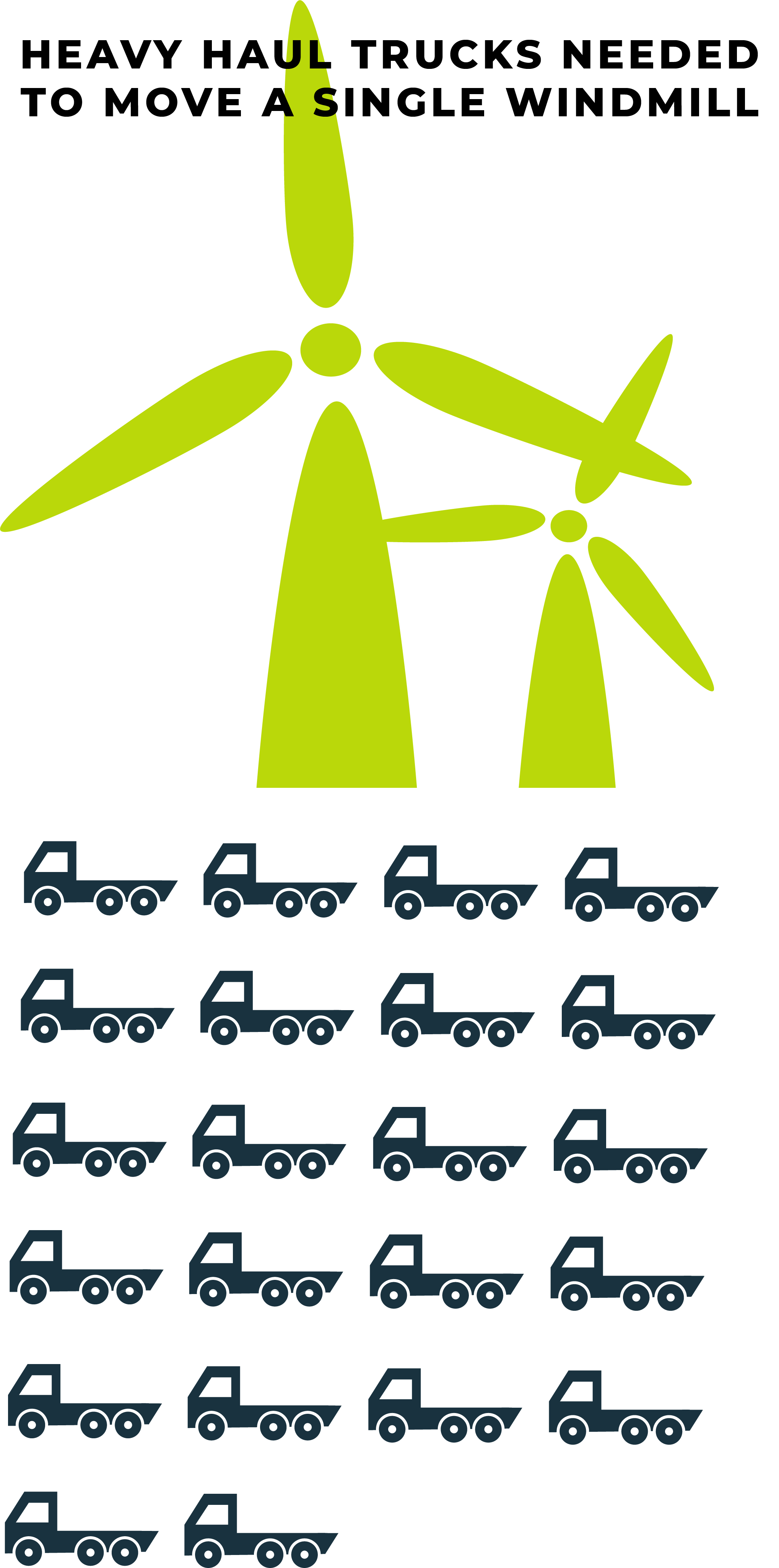

When an industry’s freight is consistently long haul, heavy haul or over-sized, such as with wind power machinery, specialty equipment, trucks, licensing, and simply put, just space, must be injected or allocated, to support supply chain operations.

Ports, such as Corpus Christi in Texas and Vancouver in Washington, have begun expanding the laydown space dedicated to breakbulk cargo to support the strong growth projections the industry expects well through 2020.

Construction of windmills, for example, can take an estimated 18 to 22 heavy haul trucks, depending on the number of towers composing the greater structure. On long haul moves inland from one or more ports where sending the equipment by rail is not possible, some windmill equipment can require 5 to 7 sets of trucks with 9 to 11 trailers per set – that’s 60 to 70 total trailers for one project.

Transportation companies are also struggling to find specialized carrier drivers with the expertise to pilot heavy-haul rigs, some of which can stretch the length of a football field. But talent isn’t the only thing that doesn’t come cheap…

Currently trucking companies are in a holding pattern on ordering more trailers for moving turbines, nacelles, and the housing that covers a wind turbine – a single multi-lane, multi-axel trailer can cost as much as $1 million.

The new legislation for extending the PCT and ITC credits on renewable energy production for an additional 5 more years was proposed back in July and is currently being reviewed.

Growing Renewable Energy and Efficiency (GREEN) Act information and updates are available on the govtrack.us website.

If the GREEN Act does pass, it would continue tax credits for the wind and solar power industries. Extending current renewable energy tax incentives and creating new models to increase the use of green energy while reducing greenhouse gas emissions.

THE GREEN ACT:

- Promotes the use of green energy technologies and incentivize the reduction of greenhouse gas emissions through new and existing tax benefits;

- Increases energy efficiency and green energy use in both residential and commercial buildings;

- Supports the use of zero-emission transportation and supporting infrastructure;

- Invests in a green workforce through energy credits for manufacturers;

- Advances environmental justice through tax credits for research and academic programs; and

- Requires the Treasury Department to analyze the feasibility of a price on greenhouse gas emissions, using the EPA’s Greenhouse Gas Reporting Program.

In turn, a re-dedication to renewable energies may spur further investment by the ports, maritime operators, and trucking companies for new space and expensive handling equipment.

If the legislation does not pass the PTC and ITC tax credits will come to an end in 2023. While that might mean less over-sized or heavy haul loads from the wind and solar industries, it does not mean less work for those transportation companies.

As Green continues to monitor the situation, stay up-to-date on freight news by following us on Facebook, Twitter, and LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.