It’s difficult for shippers to ignore the tight capacity and backlog of deliveries plaguing domestic transportation across the United States. Fleets nationwide are desperate for drivers and equipment as freight rates, diesel prices, and container volumes continue to soar heading into the August peak season. Intermodal providers may have locked in contracts through the end of the year, but service reliability is spotty from scheduling delays leading to exponential bottlenecks. While some attribute the crunch to the cyclical nature of economics, others point to costly implications for trucking and intermodal cargoes moving across the United States.

DRIVERS

Back in April, the implementation of the electronic logging device mandate (ELD)took a big chunk of capacity out of U.S. trucking. Modifying and extending hours-of-service was common practice, leaving wiggle room for drivers during congestion or waiting periods. Now, the ELD mandate has automated driver compliance to strict hours-of-service removing a large chunk of capacity. Deliveries that used to take one day now stretch into two, limiting the number of runs a driver can complete, and receive compensation for. Adding drivers seems like the obvious solution, but trucking jobs compete with other blue collar industries, such as construction, that offer premium benefits and make recruiting new talent difficult. While driver employment has increased by 7 percent in recent months, it’s just not enough to ease capacity issues and a shortage of equipment is now aggravating deliveries even further.

EQUIPMENT

From chassis to heavy-truck orders, it seems that equipment is almost as hard to come by as driver talent. Demand for heavy trucks saw a 141% increase year-over-year this June, mostly in recovery from last year’s trucking recession. Unfortunately, carriers are still not able to service their equipment because of insufficient components and parts from original equipment manufacturers.

“There is an enormous demand for trucks due to burgeoning freight growth and extremely tight industry capacity,” advised Freight Transportation Research Associates (FTR). “However, supply is severely constrained because OEM suppliers cannot provide the needed parts and components required to build more trucks fast enough. This bottleneck is causing fleets to get more orders in the backlog in hopes of getting more trucks as soon as they are available.”

“Fleets are desperate for more equipment, but trucks are in short supply due to the supplier constraints. This is creating a surge in orders as fleets react to this unusual situation. If OEMs were producing at capacity, the truck build this year could have been as high as 360,000 units. Orders for the last twelve months have now reached 411,000, so there are some excess orders in the backlog.”

Manufacturers, however, point to the strain of economic growth from capacity, lead time, and transportation costs in playing a heavy role in production decisions. International trade relations have been tense as the United States issued tariffs on steel and aluminumin addition to $34 billion USD in Section 301 taxes for Chinese imports. The ongoing tit-for-tat exchange of tariff escalation has many industries worried about a second, much more comprehensive list of targeted Chinese imports valued at $505.5 billion USD.

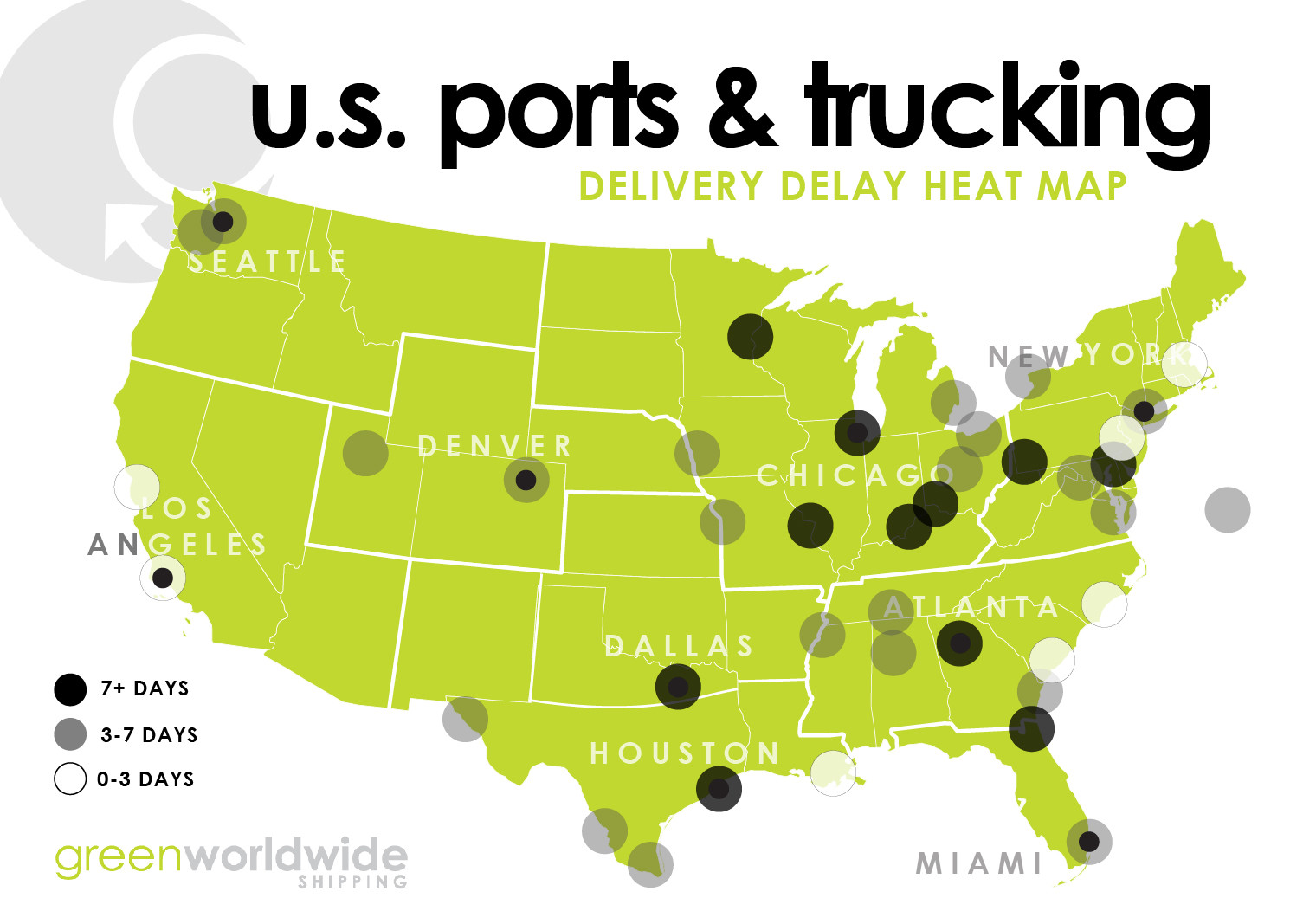

TRUCK POWER HEAT MAP

WHAT SHOULD A SHIPPER DO?

Heading into peak season, shippers need to understand a new delivery relationship dynamic with their service providers. As market volatility lends to local delivery hostility, consider the following steps that will turn carriers into long-term partnerships:

- Dispatch early– Advanced scheduling is a great way to proactively plan deliveries and secure trucking. Consider dispatching 10-14 days in advance for congested ports/ramps such as Baltimore, Atlanta, and rail/Memphis, and 5 to 7 days for Charleston and Savannah.

- Understand the process– Before a shipment can secure trucking for delivery, it must have both a Customs and freight payment release. Delays in either without proper coordination may result in additional costs and delays.

- Be flexible– As in all partnerships, compromise is key. By keeping flexible receiving hours, accommodating driver needs, and communicating, shippers can develop deep bonds that can endure cyclical trends.

As Green continues to monitor the situation, stay up-to-date on freight news by following us on Facebook, Twitter, and LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.