USTR SECTION 301 PORT-FEE IMPLEMENTATION PROMPTS FLEET REALIGNMENT

The October 14, 2025, implementation of USTR’s Section 301 vessel-fee measure is prompting major carriers to adjust network deployment and reduce exposure to Chinese-built tonnage calling at U.S. ports. The policy introduces phased service fees on Chinese-owned and Chinese-built vessels over a three-year period, with the first six months carrying a zero-fee rate before escalating through 2028.

Maersk, Hapag-Lloyd, ONE, and HMM have confirmed that no surcharges or service disruptions are planned at this time, while CMA CGM and MSC are redeploying vessels to minimize exposure. CBP guidance designates the vessel operator as responsible for pre-payment at least three days before port arrival. Analysts anticipate continued capacity balancing and network optimization as carriers align operations ahead of enforcement.

CBP AUTOMATED REJECTION OF MANIFEST FILINGS WITH INSUFFICIENT CARGO INFORMATION

U.S. Customs and Border Protection (CBP) began automatically rejecting manifest filings that lacked complete cargo, consignee, or shipper details on September 27, 2025. This procedural change applies to all modes of transport with a goal to strengthen compliance with manifest data requirements. Shipments that arrive with incomplete information may be held until corrected.

Importers and shippers are urged to verify that cargo descriptions are detailed and accurate, confirm that consignee and shipper information is complete, and ensure that all documentation is submitted promptly to prevent CBP release delays and associated storage costs.

CHINA GOLDEN WEEK NATIONAL HOLIDAY

China’s Golden Week holiday, observed from October 1 to October 8, 2025, has temporarily slowed export activity and supply network movement in China and some surrounding regions. Most factories, ports, and logistics providers across China either closed or operated at limited capacity, producing a temporary production halt and shipment backlog. The resulting slowdowns have delayed cargo readiness and created temporary inventory gaps across multiple industries. Given China’s central role in global manufacturing, the post-holiday recovery period is expected to extend through mid-October as factories resume normal operations and carriers clear accumulated backlogs at major export hubs.

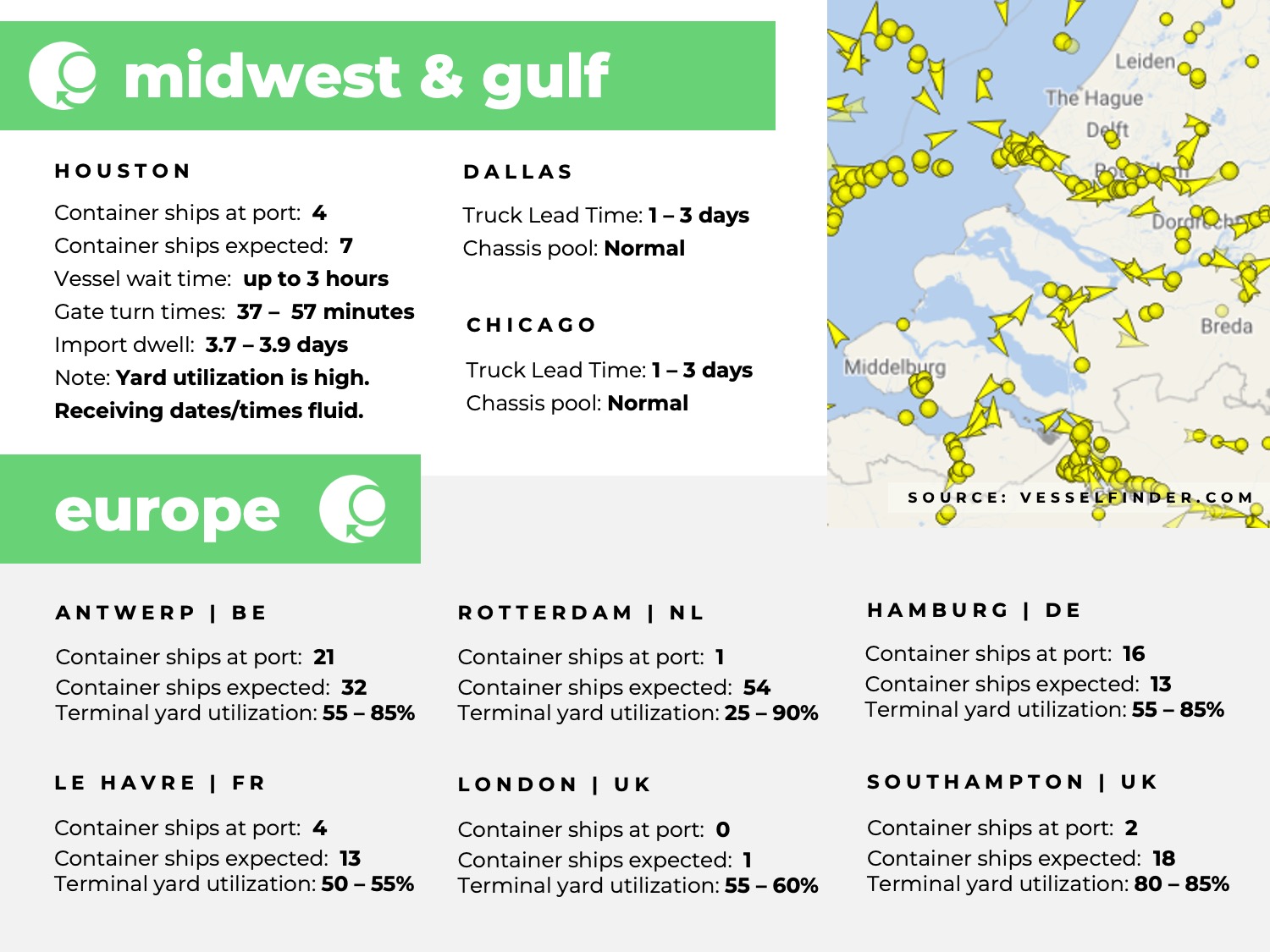

EUROPEAN PORT STRIKES AMPLIFY CONGESTION AT ROTTERDAM AND ANTWERP

Strike activity in Europe’s two largest ports has intensified congestion across North Europe gateways. In Belgium, limited operating hours for Flemish pilotage services have disrupted vessel arrivals and departures at Antwerp and Zeebrugge since early October. In Rotterdam, two-day strikes by container lashing companies have halted operations across all major terminals, including Maasvlakte II, Delta II, ECT Delta, and Rotterdam World Gateway.

Inland transport and feeder connections have also been affected, compounding storm-related backlogs from the previous week. The disruption has worsened schedule reliability on the Asia–Europe corridor, which remains the lowest among global ocean trades. Analysts report that September’s on-time performance averaged 23 percent, reflecting ongoing congestion and longer transit times associated with larger vessel deployments.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.