3 REASONS U.S. CHASSIS MANUFACTURING ISN’T MEETING DEMAND

As chassis shortages continue to create inland ramp delays resulting in bottlenecks for North American supply chains, chassis manufacturers are racing to meet growing U.S. demand. Access to new equipment has been limited after the United States began levying anti-dumping penalties on the world’s largest chassis manufacturer, limiting the supply available to the market. U.S. chassis providers are working to ramp up manufacturing capabilities but shortages – raw materials, chassis components, and qualified manufacturing laborers – are causing a chassis manufacturing lag that will be felt well into 2024.

1. RAW MATERIALS

Aluminum, copper, nickel, and related raw material production is not scaling with demand triggering price increases and failing to meet manufacturing needs. While mining production in Russia remains unaffected by the war in Ukraine, the humanitarian crisis caused by the invasion has prevented manufacturers from acquiring Russian-made raw materials.

2. QUALIFIED LABOR

Chassis manufacturers historically hired laborers during periods of demand and furloughed or laid-off workers when demand waned. Highly qualified laborers have been resistant to accepting chassis manufacturing jobs due to this employment instability. Some chassis manufacturers began implementing 3-year employment guarantees in recruitment efforts to retain workers, however, the hiring rates fail to meet current manufacturing demands.

3. CHASSIS COMPONENTS

Each chassis requires subcomponents (tires, suspensions, harnesses, axels, etc.) from roughly 20-30 suppliers. Global raw material and labor shortages impact the manufacture of these components. Port congestion and supply chain delays further exacerbate the production schedule, waiting for the necessary components to arrive before they can move to the next phase of the chassis manufacturing process.

CHASSIS MANUFACTURING LEAD TO INLAND DELAYS

Claus Henning, Dallas Branch Manager for Green Worldwide Shipping, explains that a “lack of warehouse space can aggravate equipment limitations and create a cyclical supply chain problem – as containers sit on chassis longer, whether at the rail yards, container depots, or warehouses, they absorb usable capacity from the market and make it difficult to maintain cargo fluidity. The key is to not to let containers idle and find suitable warehousing space for the overflow of excess inventory.”

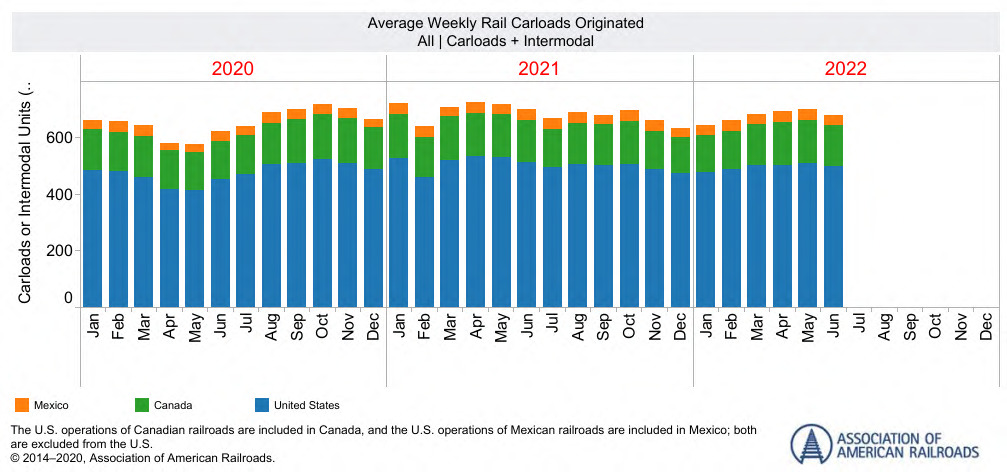

INTERMODAL CONTAINER SHIPMENTS LAG

U.S. ports continue to wrestle with the marine chassis shortage leading to berth and offloading delays of several days to several weeks depending on location. The American Association of Railroads (AAR) noted that U.S. intermodal rail units moved in July 2022 totaled 263,825 containers, down by -5.7% from 265,953 in July 2021.

PORT AND INLAND INTERMODAL WAREHOUSE CONSTRAINTS

Port warehouses are at or near capacity further taxing an already stressed network. In response to similar constraints last year, some Class 1 railroads imposed freight suspensions from Los Angeles and Long Beach ports to inland intermodal facilities attempting to lessen the congestion at some of their warehouses. The current lag in intermodal container movement by rail and growing warehouse capacity constraints raise concerns that railroads may consider implementing freight suspensions again.

NEED DALLAS WAREHOUSING?

Centrally located, Dallas (and surrounding Dallas-Fort Worth metropolitan area) offers shippers a unique advantage for distribution throughout the United States. Green Worldwide Shipping has 72,000 square feet of warehousing serving this major trade gateway.

Contact [email protected] for more information.

Stay up-to-date on freight news with Green’s Weekly Freight Market report by following us on Facebook, Twitter, and LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.