Many shippers are looking for ways to get more out of their supply chain and improve the bottom line. One, often underrated, program that can assist with significant savings is duty drawback.

WHAT IS DUTY DRAWBACK?

Established by the U.S. Continental Congress over two centuries ago, drawback is the refund of certain Customs duties, Internal Revenue taxes and fees collected upon the importation of goods that is eligible to be refunded when that same merchandise is exported or destroyed.

It was established to create jobs, increase manufacturing in the United States and encourage the export of U.S. goods abroad.

A drawback claimant may receive back up to 99% of duties paid on imported merchandise, that:

- is used in manufacturing and subsequently exported out of U.S., or

- has not been used in U.S. commerce and is ultimately exported or destroyed, or

- has been rejected for several reasons and then exported or destroyed.

Identifying the correct type of drawback claim for your business will determine your drawback roadmap.

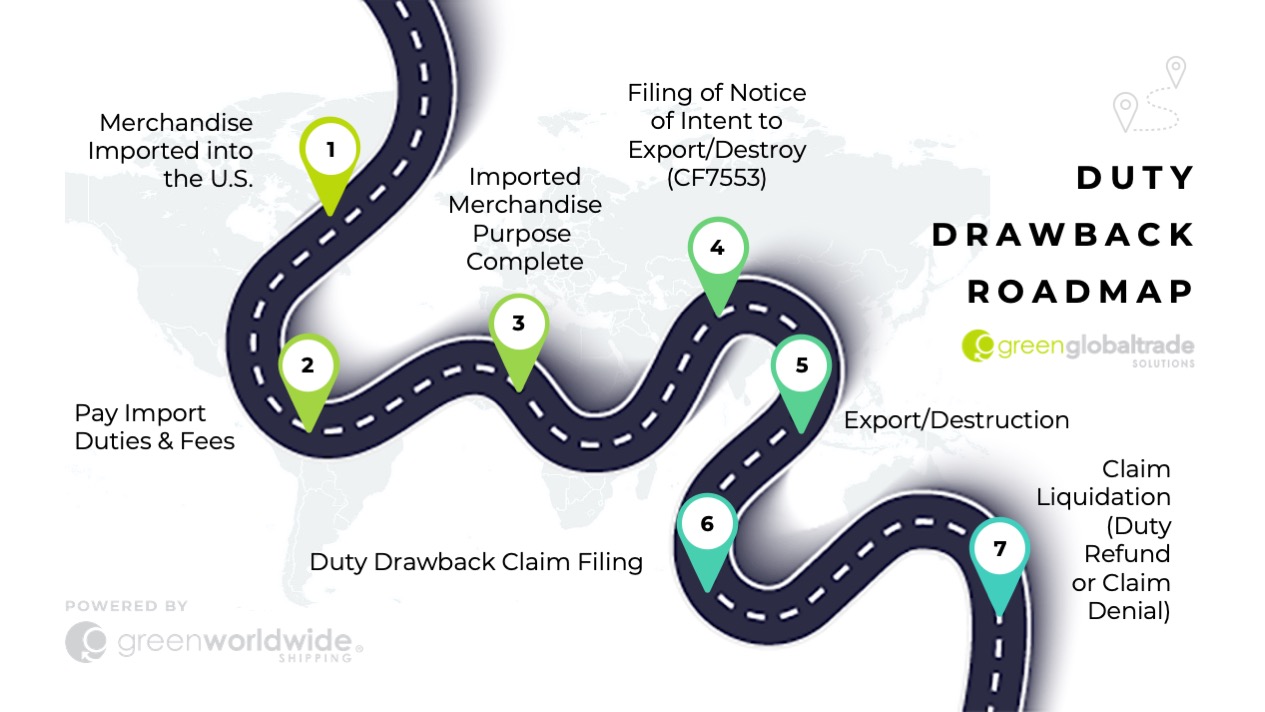

DUTY DRAWBACK ROADMAP

In general, the drawback process looks like this:

- Import Merchandise into the U.S.

- Pay Import Duties & Fees

- Imported Merchandise Purpose Complete

- Filing of Notice of Intent to Export/Destroy (CF7553)

- Export/Destruction

- Duty Drawback Claim Filing

- Claim Liquidation (Duty Refund or Claim Denial)

WHO IS ALLOWED TO CLAIM DUTY DRAWBACK?

According to CBP regulations, the exporter or destroyer of the goods is the party entitled to claim drawback. However, a waiver of drawback rights can be completed by the exporter or destroyer to assign the rights to claim drawback to importer, or manufacturer, or another intermediate party.

WHAT DOCUMENTS ARE NEEDED?

There are several documents that Customs will want to review along with drawback entry in order to substantiate the claim. These documents include:

- Purchase order & proof of payment

- Commercial invoices

- Packing Lists

- Bills of lading

- Entry summary (CF7501)

- Notice of Intent to Export (CF7553), as required

- Business & inventory records prepared in the ordinary course of business

- Evidence to tie together U.S. imports to U.S. export, as needed

- Proof of export

- Any additional documentation requested by CBP upon review

HOW LONG DOES IT TAKE TO GET A DRAWBACK REFUND?

Once the drawback claim is approved, it may take CBP up to a year to liquidate the drawback entry and issue of a refund. However, claimants have the option to file for the following privileges to expedite the process:

- Waiver of prior notice of intent to export

- Accelerated payment

Depending on your duty drawback type, the process from filing a claim to receiving a duty refund might seem daunting, but it is achievable and can have an enormous impact on your bottom line.

Did you know: Drawback is actually a business privilege, not a right. Hence, there are strict compliance and drawback regulations that must be followed.

Green Worldwide Shipping’s Global Trade Solutions team are Duty Drawback Experts and can help you navigate the road to your refund. Contact us, today!

IMPORTERS & EXPORTERS NEED A RELIABLE COMPLIANCE PARTNER TO GUIDE THEM THROUGH THIS REGULATORY MAZE

meet kate rayer

Global Trade Manager, LCHB

Green Worldwide Shipping, LLC