Week 2 finds the freight market transitioning from year end recovery into early pre Lunar New Year positioning, defined by elevated ocean capacity, uneven port conditions across Asia and Europe, and a gradual normalization of transpacific air cargo operations. Carrier deployment decisions ahead of the late 2026 Lunar New Year are shaping near term supply dynamics across both ocean and air modes, while recent regulatory developments are providing additional planning clarity for U.S. importers.

TRANSPACIFIC OCEAN CAPACITY DEVELOPMENTS

Market analysts indicate a pronounced capacity build across transpacific lanes ahead of Chinese Lunar New Year. Asia to U.S. West Coast capacity is projected to peak in early February, representing a significant increase compared to levels observed ten weeks prior to the holiday. While some capacity withdrawal is expected immediately ahead of Lunar New Year, overall vessel supply remains elevated relative to baseline conditions. A similar pattern is unfolding on Asia to U.S. East Coast lanes, where capacity is expected to remain materially above average through the holiday period. Sustained vessel deployment is tempering short term market momentum, with carriers retaining flexibility to adjust schedules through blank sailings or service modifications if demand conditions shift.

ASIA PORT CONDITIONS AND REGIONAL DISRUPTIONS

Operational conditions across several Asian gateways remain constrained. Persistent vessel bunching and elevated berth demand continue to drive delays at Shanghai’s Yangshan terminal, with multi day waiting times extending into January. In Southeast Asia, congestion remains acute at key Malaysian ports, where high yard density and berth limitations linked to infrastructure projects are impacting terminal productivity. New Year holiday closures across parts of the Philippines, Thailand, and Japan are also creating short duration but widespread schedule disruptions that may carry residual effects into mid January sailing windows.

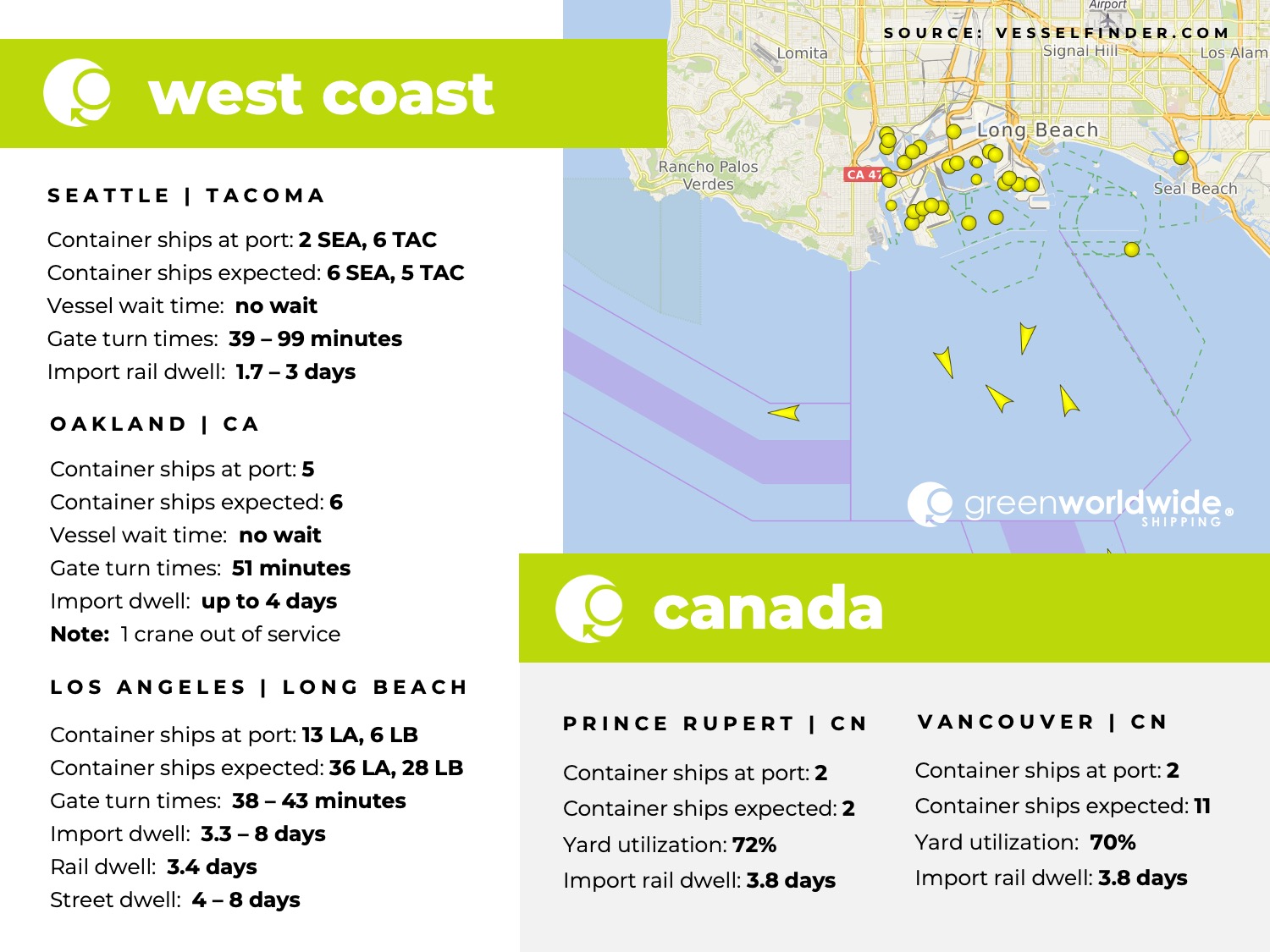

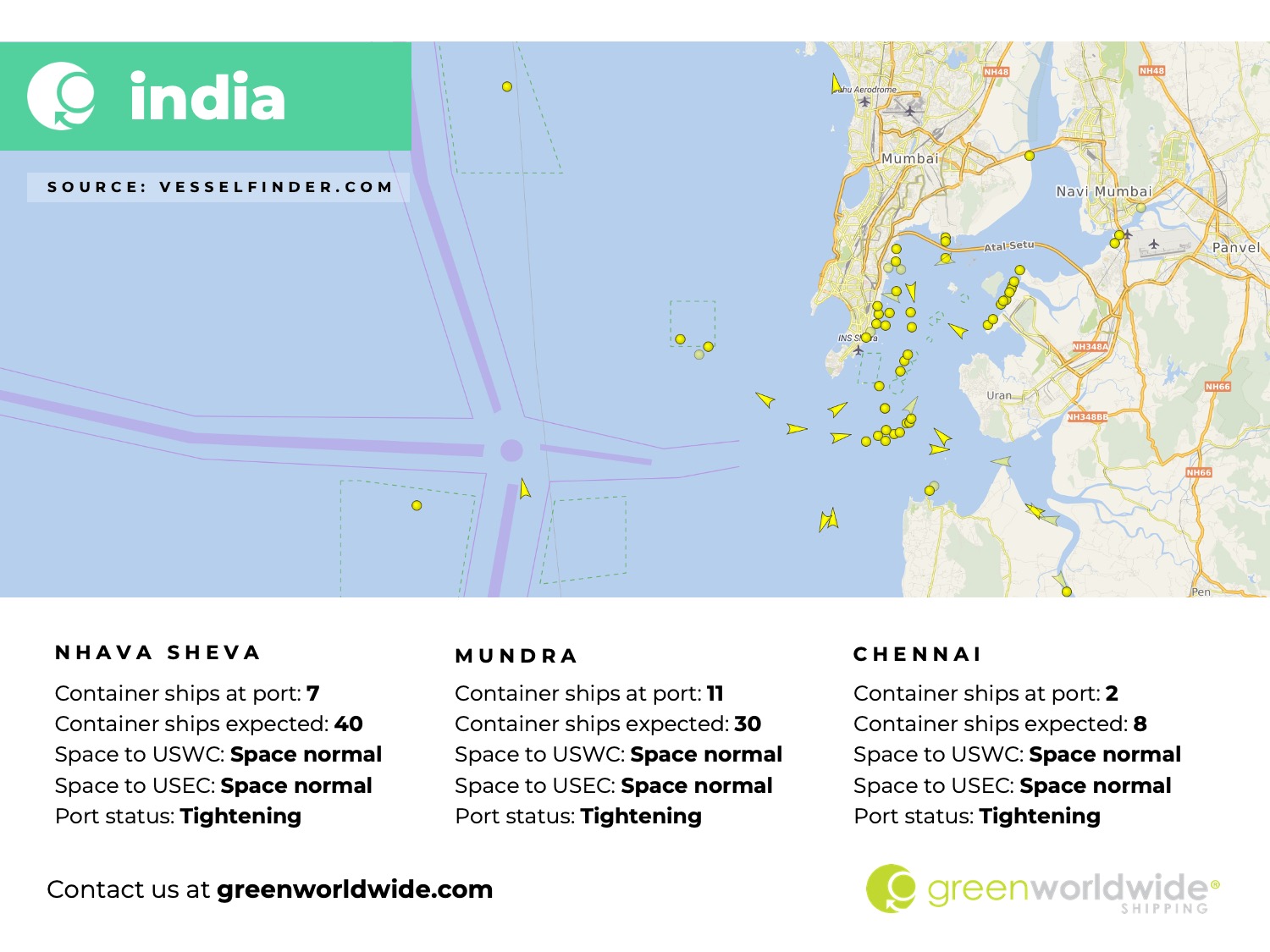

INDIA TO U.S. OCEAN MARKET CONDITIONS

Space availability on India to U.S. West Coast and East Coast routings remains generally stable, though selective East Coast blank sailings are creating localized tightness. Inland congestion at Kolkata continues to affect vessel schedules and empty container flows, contributing to intermittent equipment imbalances, particularly for 40 foot high cube units. Several inland container depots are experiencing inventory constraints, adding complexity to export planning and inland sequencing as January progresses.

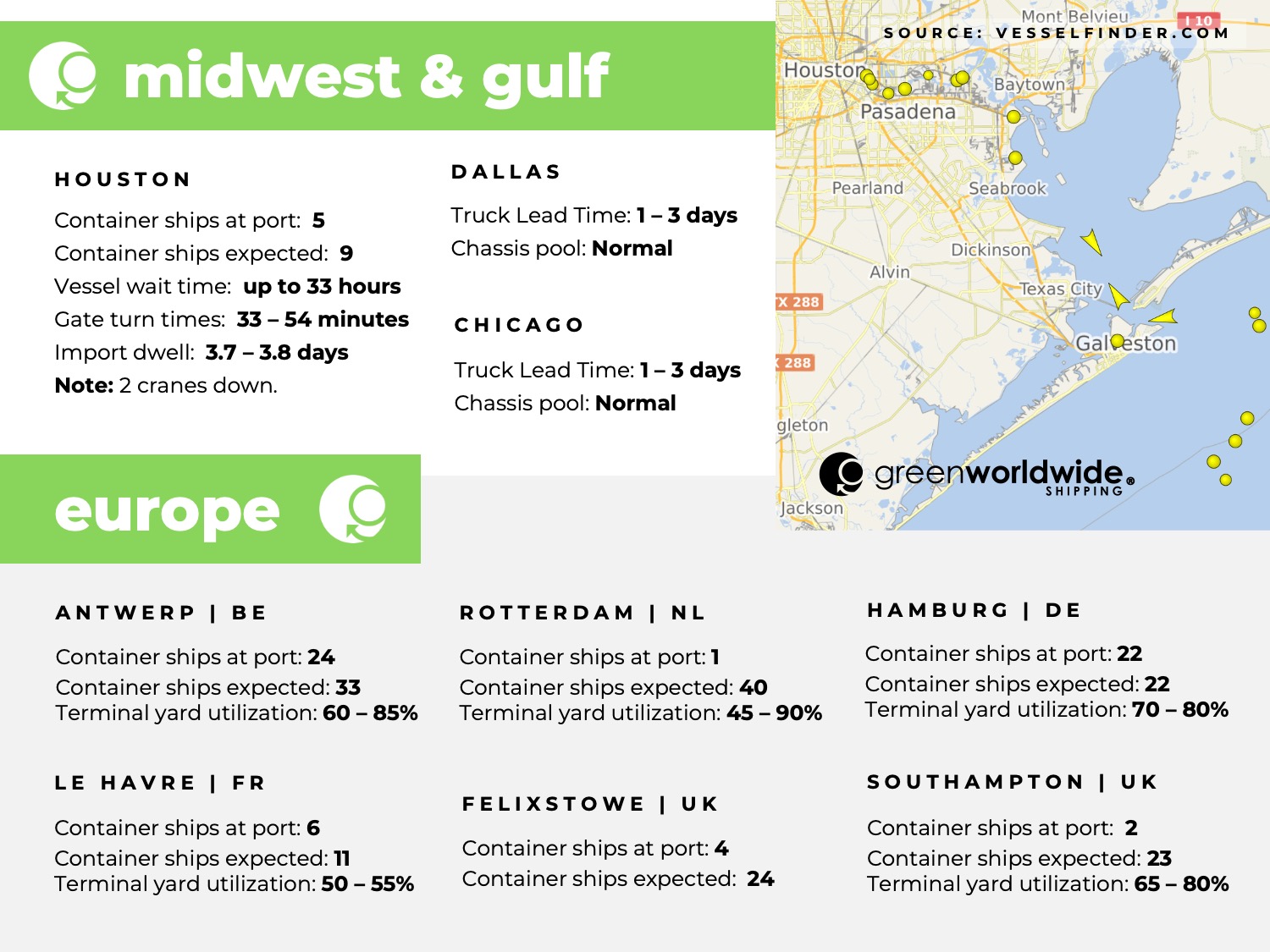

EUROPE WEATHER-RELATED OPERATIONAL IMPACTS

Severe winter weather across Northern Europe is disrupting port, inland, and air operations as snow, ice, and freezing temperatures affect terminal productivity and transportation networks. Flight cancellations across multiple countries are compounding delays, while hazardous road conditions are slowing truck movements. Rail services are experiencing interruptions due to frozen infrastructure, contributing to extended dwell times and increased yard congestion. Operational impacts are most pronounced at major hub ports including Rotterdam and Hamburg, with additional inland disruptions affecting corridors connecting Antwerp, Venlo, and Duisburg. While some rail services are gradually resuming, residual backlogs are expected to persist as weather conditions remain volatile.

AIR CARGO MARKET CONDITIONS

China to U.S. air cargo operations have entered a recovery phase following the New Year holiday, with volumes rebounding rapidly as manufacturing activity resumes. The late timing of the 2026 Lunar New Year is extending January’s trading window, supporting steadier throughput at major Chinese hubs. Freighter capacity remains relatively stable, with incremental growth expected to come primarily from improved utilization of passenger aircraft belly space. U.S. gateway operations, including Los Angeles and New York, have returned to standard clearance timelines, easing holiday related backlogs. Across Asia, the Hong Kong market remains comparatively soft as factories restart, while Southeast Asia lanes are returning to typical seasonal operating conditions.

U.S. INLAND RAIL OPERATIONS UPDATE

Inland operations at the Louisville rail ramp are experiencing congestion following a shift from wheeled to grounded operations implemented in early December. The change has contributed to extended truck turn times and slower container processing for both import and export moves. While operations continue, the ramp remains under pressure as volumes work through the adjusted handling model.

U.S. TRADE POLICY AND CUSTOMS COMPLIANCE UPDATE

Recent policy actions provide added clarity for 2026 planning. A late December proclamation confirms that Section 232 duty rates on select wood products will remain unchanged throughout 2026, deferring previously scheduled increases into 2027 while trade negotiations continue. Separately, U.S. Customs and Border Protection will transition to mandatory electronic refund issuance via ACH effective February 6, 2026. Importers and authorized parties must complete ACH refund authorization within the ACE Portal to receive refunds electronically, with paper refunds permitted only in limited waiver approved circumstances.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.