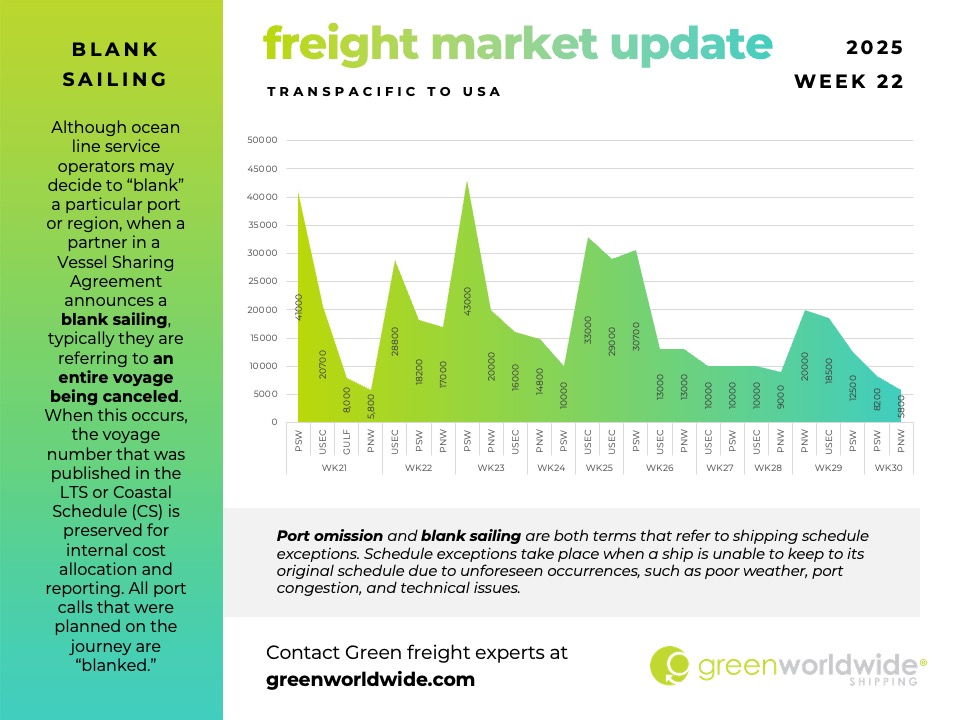

OCEAN SERVICE AND DEMAND

Ocean carriers are in the process of restoring the Far East–U.S. West Coast loops that were withdrawn in April and early May. The decision follows a sharp recovery in Chinese export bookings that began immediately after the United States and China agreed to a 90-day reduction in reciprocal tariffs. The temporary policy shift has encouraged importers to accelerate orders, rapidly rebuilding volumes on the trade.

CAPACITY CONSTRAINTS

Despite the return of suspended services, effective vessel capacity remains limited. Ships that had been redeployed to other routes are returning slowly, while berth congestion at major Chinese gateways (Shanghai, Ningbo, Qingdao) and at trans-shipment hubs such as Singapore and Busan is absorbing schedule buffers and delaying turn-times. Shippers have reported shortages of empty containers in several Chinese load ports, further restricting available slots.

EXTRA-LOADER SAILINGS WITH LIMITED MARKET IMPACT

Carriers have announced a series of ad-hoc “extra-loader” voyages and are upsizing certain vessels; however, many of these sailings are reserved to clear rolled cargo accumulated during the April–May downturn. As a result, the additional tonnage is not translating into meaningful open capacity for the broader shipper community in the near term.

ADVANCE BOOKING GUIDANCE

Given the gap between demand and available slots, carriers are urging shippers to secure space well ahead of cargo-ready dates—typically a minimum of four weeks for spot shipments and longer for fixed-allocation contracts—to reduce the risk of rollings.

LIMITED RELIEF EXPECTED IN JUNE

Incremental relief is projected for weeks 23–24 (early to mid-June) as several previously blanked weekly loops resume and additional feeder-size vessels enter the lane. While this should modestly increase weekly slot availability, industry analysts expect demand to continue outpacing supply through the end of the tariff-reduction window.

TARIFF-DRIVEN FRONT-LOADING AND BACKLOG

The 90-day tariff reprieve—reducing U.S. duties on certain Chinese goods from levels of up to 145 percent to a provisional 30 percent while maintaining a 10 percent baseline—has prompted large-scale front-loading by U.S. importers. The resulting surge has created substantial cargo backlogs that carriers are still clearing, reinforcing the present tightness in capacity despite the restoration of services.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.