The global freight market enters Week 24 under intensifying pressure from regulatory enforcement, terminal congestion, and inland chassis repositioning. Ripple effects are emerging across trans-Atlantic and trans-Pacific lanes.

CBP ENFORCEMENT BEGINS FOR EXPANDED SECTION 232 TARIFFS ON STEEL, ALUMINUM, AND COMPOSITES

As of June 4, 2025, U.S. Customs and Border Protection (CBP) is enforcing a 50 percent duty on imported steel and aluminum under the updated Section 232 proclamation. This increase applies to the declared value of the covered metal content, not the entire article, provided the entry is segmented and filed correctly. Importers are now required to separately declare metal and non-metal portions for composite goods. Failure to segment content appropriately may result in full duty assessments, penalties, or suspension of import privileges.

CBP clarified that derivative articles falling outside traditional Chapters 72, 73, and 76 may still be subject to the new tariff. Documentation such as melt-and-pour (steel) or smelt-and-cast (aluminum) certifications is mandatory for claiming exemptions. Importers utilizing Foreign Trade Zones or bonded warehouse programs must ensure privileged foreign status is granted prior to entry to preserve deferral eligibility.

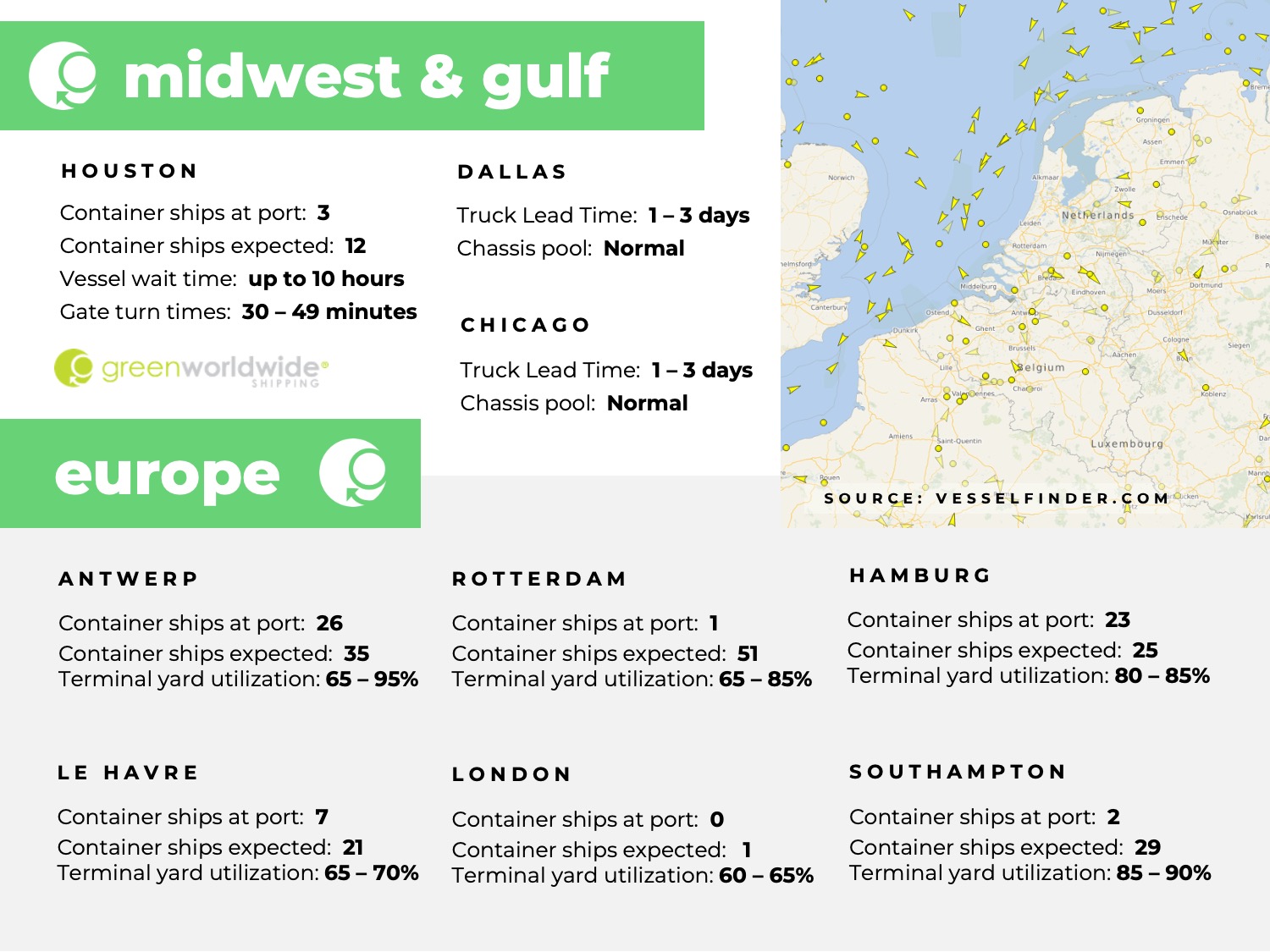

NORTHERN EUROPEAN PORT NETWORK STRUGGLES WITH ONGOING CONGESTION AND INFRASTRUCTURE STRAIN

Northern Europe’s logistics infrastructure is now under severe operational pressure, with cascading delays across maritime and inland networks. Yard utilization at the Port of Antwerp has reached 96 percent, with berth waiting times climbing 37 percent. Alliance reshuffling is compounding arrival schedules. Rotterdam, Antwerp, and Hamburg are all experiencing significant backlog, with some estimates indicating that half of the vessels in the region are awaiting berth.

Low water levels on the Rhine are limiting barge capacity. Ongoing rail strikes and network maintenance are impeding inland cargo flows. Analysts expect the disruption to persist into the summer peak season, with normalization unlikely before August. Carriers are rerouting services and skipping key port calls in an effort to mitigate congestion, though this may lead to increased dwell times and misaligned inland transfers.

CHASSIS PROVIDERS BRACE FOR SURGE IN U.S. IMPORT VOLUMES

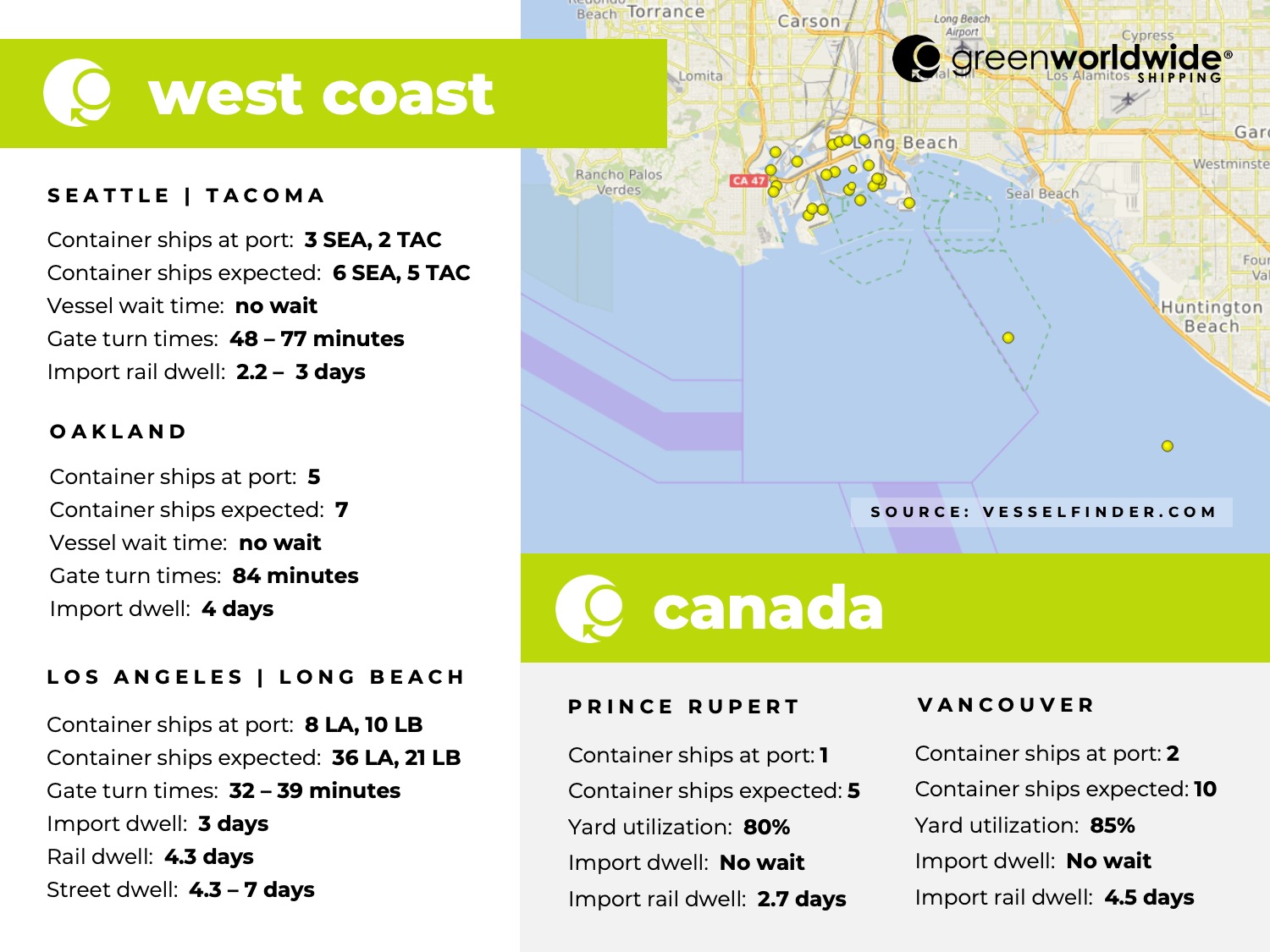

In anticipation of rising import volumes during the 90-day pause in China-origin tariffs, U.S. chassis providers have begun unstacking tens of thousands of idle units and repositioning equipment to inland hubs such as Chicago, Dallas, and Memphis. These preparations are designed to prevent a recurrence of the shortages seen during the pandemic by proactively addressing capacity and repair timelines.

Chassis pulled from long-term storage are undergoing full inspections and structural assessments before being certified for road use. Network operators are also leveraging cargo forecast data and the U.S. Department of Transportation’s FLOW initiative to position chassis in secondary inland markets likely to experience surges, including Columbus, Cincinnati, and St. Louis. With terminal operating models evolving and more trucking fleets deploying private chassis, pressure on shared pools may remain manageable if current deployment and repair schedules stay on track.

CROSS-NETWORK STRAINS INTENSIFY AS CAPACITY TIGHTENS ACROSS EAST-WEST TRADE LANES

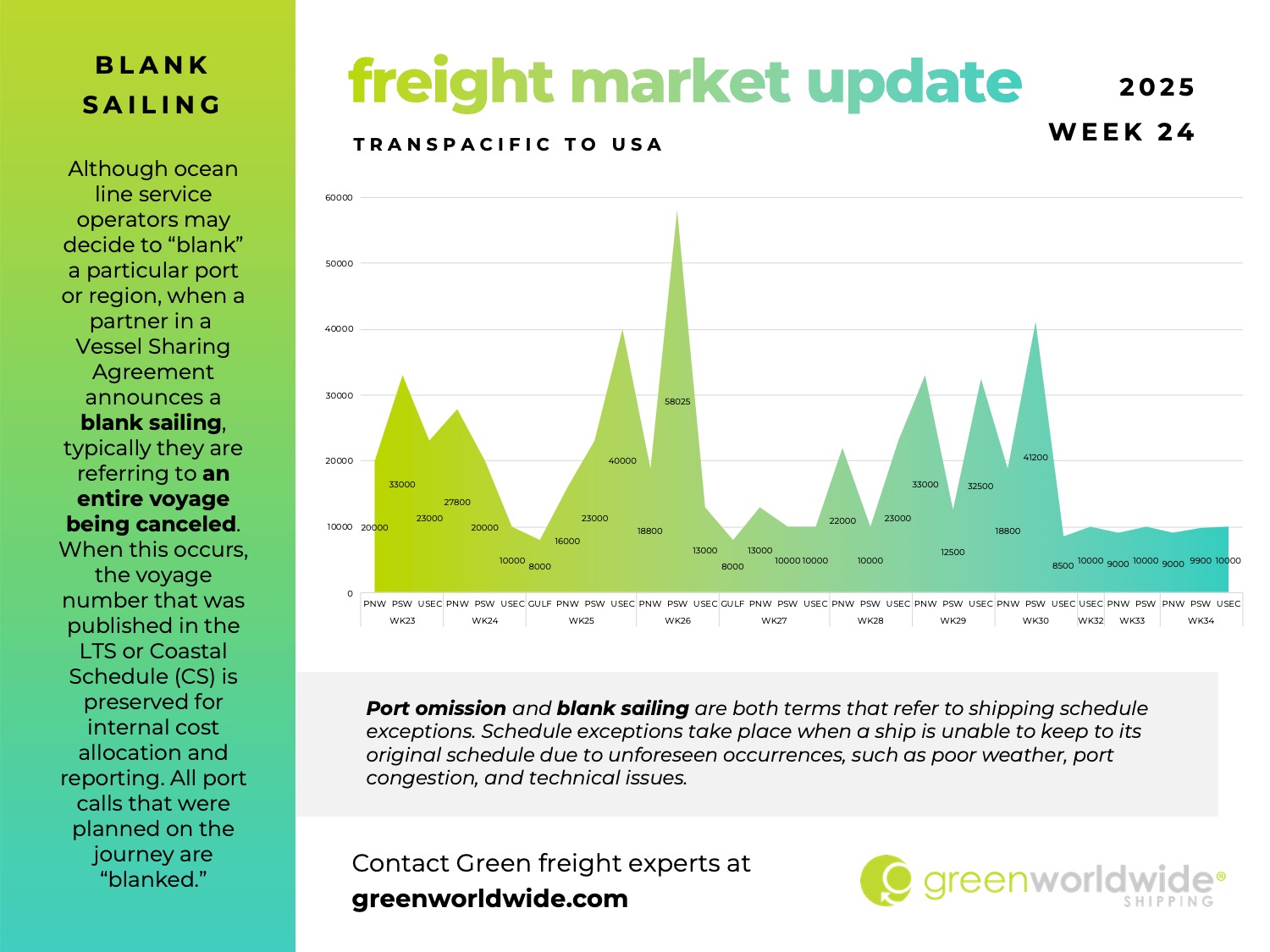

Mounting congestion across Asia to Europe corridors continues to ripple through the global network. U.S.-bound capacity is absorbing additional pressure. Extended berth delays at Shanghai and Singapore are now overlapping with Europe’s port congestion, forcing carriers to redistribute vessels, reduce buffer slack, and rebalance port calls to maintain schedule integrity.

As carriers recalibrate service rotations, trans-Pacific demand remains high. Previously suspended loops are being reactivated. However, space constraints persist, particularly on Far East to U.S. West Coast lanes. Berth congestion in Asia and backlogs from May’s tariff-driven export surge are still impacting slot availability.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.