Week 25 finds the freight industry navigating European maintenance delays and capacity shifts across Pacific trade lanes amid ongoing regulatory changes. Importers are recalibrating cargo timing and exploring alternate sourcing to stay ahead of the latest trade policy developments.

EUROPEAN PORT OPERATIONS PERSIST AMONG ONGOING INFRASTRUCTURE CHALLENGES AND WEATHER DISRUPTIONS

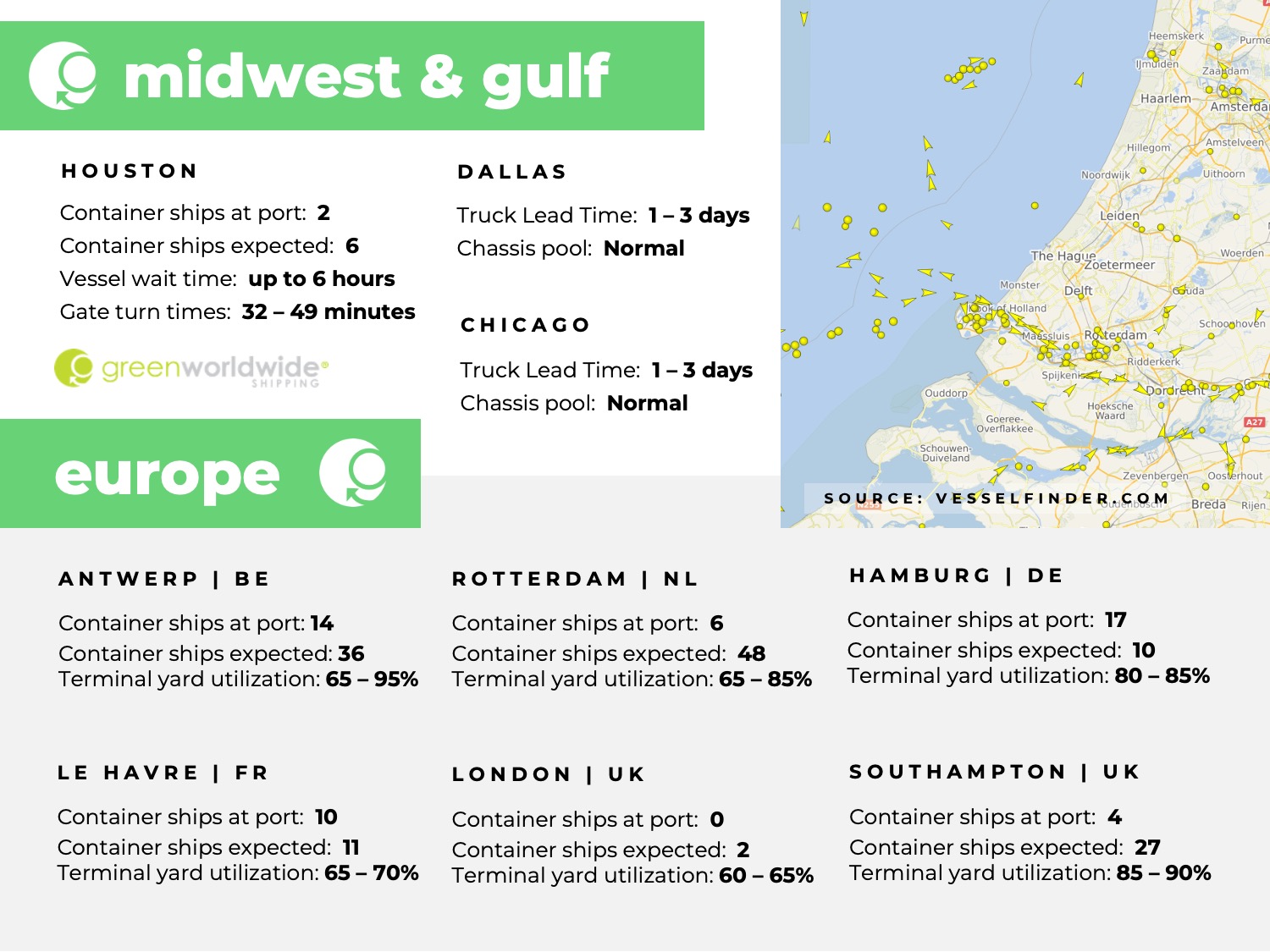

Northern Europe’s logistics network remains under significant strain as rail maintenance and extreme weather converge on key corridors. Rail works across Germany and Central Europe are causing delays for import and export trains, while low water levels on the Rhine River continue to restrict barge capacity.

In southern Europe, heavy rainfall in south-eastern Spain has disrupted road transport, triggered safety restrictions, and detours constraining inland haulage capacity. Meanwhile, construction of the A 26 West corridor will suspend rail connections to Hamburg’s primary container terminals from July 4, 2025 through July 8, 2025 (with preparatory and follow-up works extending the impact window). Shippers should plan to reroute rail-dependent cargo via alternative North Sea gateways such as Wilhelmshaven or Bremerhaven.

TRANS-PACIFIC CAPACITY ADJUSTMENTS, EVOLVING TRADE POLICY, AND SUPPLY-CHAIN DIVERSIFICATION

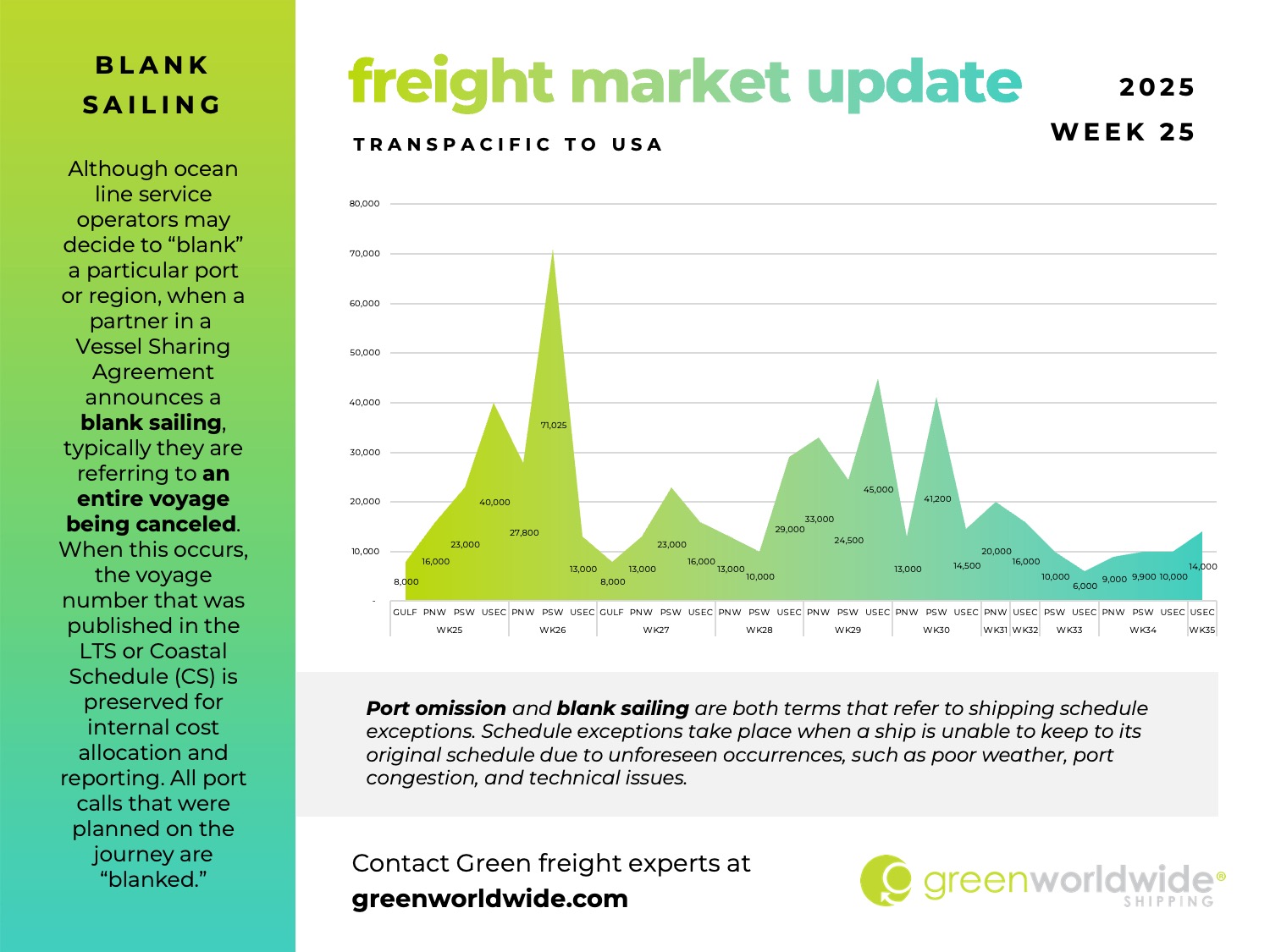

In June, carriers added extra sailings on the U.S. West Coast to handle a surge in bookings, creating temporary overcapacity. Now that those additional voyages are withdrawn, slot availability on West Coast services is improving. No extra sailings are planned for July since forward bookings have returned to levels manageable by standard service rotations. East Coast routes have maintained steady utilization throughout the summer. As a result, capacity between the two coasts should balance in the coming weeks. West Coast services may tighten if volumes spike again, but current forecasts indicate sufficient capacity through the summer peak.

Importers sourcing from China continue frontloading shipments to hedge against potential tariff reinstatements in August. This surge should taper by late Q3 if pending trade agreements lower tariff levels and shippers expand sourcing into Southeast Asia to maintain flexibility amid policy uncertainty. Retailers are expected to resume imports after recent relief measures while evaluating alternative sourcing strategies.

EXECUTIVE ORDER: U.S.–U.K. ECONOMIC PROSPERITY DEAL

On June 16, the White House finalized an executive order implementing the U.S.-U.K. Economic Prosperity Deal under IEEPA, the National Emergencies Act, and Section 232 of the Trade Expansion Act to expand market access for U.S. exporters while reinforcing security objectives. A White House fact sheet highlights automotive tariff-rate quotas permitting up to 100,000 U.K.-built vehicles per year at a combined 10 percent duty, removal of WTO civil-aircraft tariffs upon HTSUS amendment, directives to establish future steel and aluminum quotas at MFN rates, and planned negotiations on preferential pharmaceutical treatment following a Section 232 supply-chain security review.

SECTION 232 TARIFF EXPANSION

Effective June 23, CBP will enforce a 50 percent tariff on steel content in a broader range of household appliances and metal subcomponents, including combined refrigerator-freezers, chest and upright freezers, dishwashers, washing machines, dryers, food-waste disposals, cooking appliances, and welded wire racks. Importers using Foreign Trade Zones must admit qualifying goods under privileged foreign status by 12:01 a.m. EDT on June 23 with melt-and-pour documentation to retain previous duty treatment.

Updated CBP guidance requires separate declaration of metal and non-metal portions in composite entries or the full duty will apply to the article. These expanded classifications fall outside Chapters 72 and 73 and reflect the continued implementation of Proclamations 10896 and 10947, with FTZ and bonded warehouse programs still offering deferral options for timely entries.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.