February continues to show uneven demand across Asia–U.S. trade lanes as the market moves through the Chinese New Year holiday window and carriers tighten their networks. Transpacific execution is being shaped by aggressive capacity withdrawals, elevated rollover exposure, and ongoing congestion at select Asia origin ports. Air cargo demand is also entering the CNY holiday period, with capacity decisions and fleet dynamics playing an outsized role in service reliability.

TRANS-PACIFIC OCEAN CAPACITY MANAGEMENT

Carriers began withdrawing capacity more aggressively starting in Week 07, with blank sailings expected to peak in Week 09. The forecast calls for 17 blanks on PSW, 7 on PNW, and 9 on USEC, equating to effective capacity reductions of 60%, 58%, and 50% respectively. As a result, available space is tightening quickly on many strings, and shippers should expect more constrained weekly sailing options through this period.

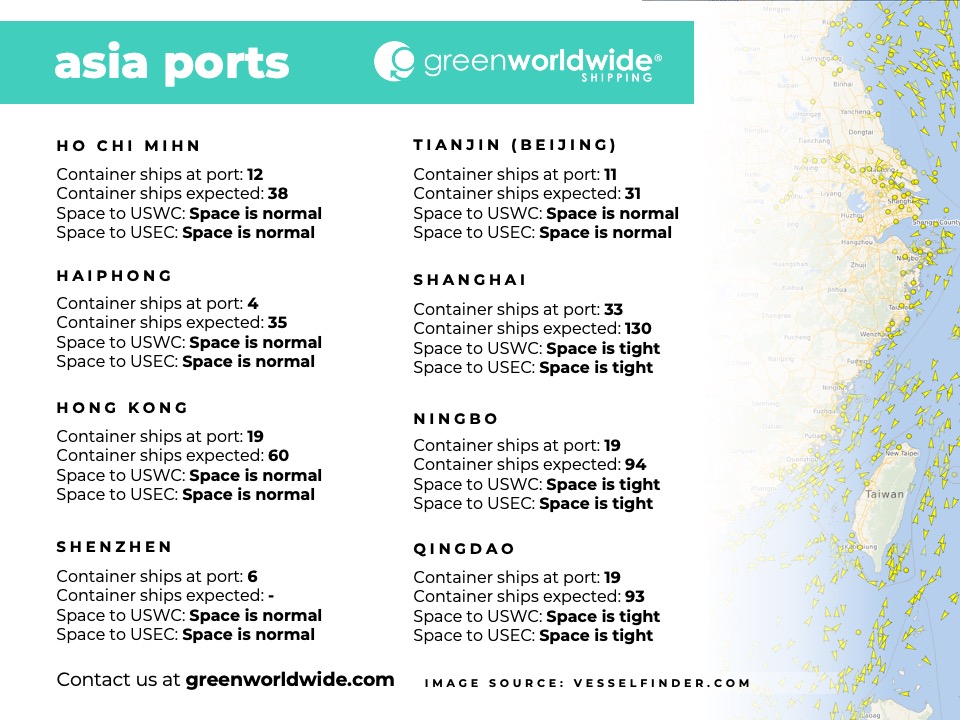

SPACE AVAILABILITY AND ASIA-ORIGIN PORT OPERATIONS

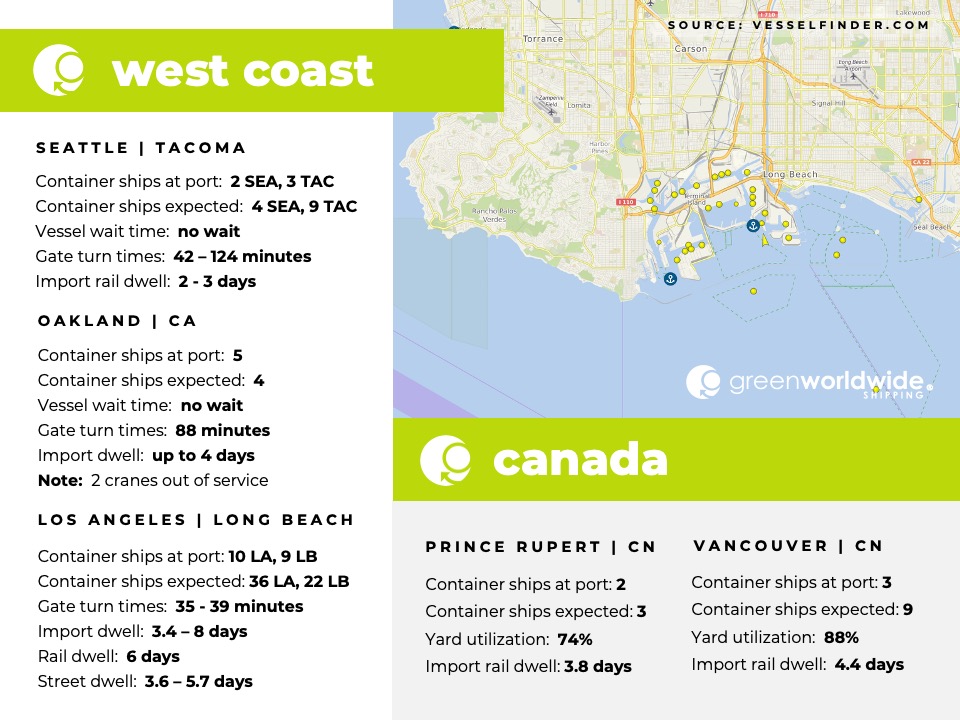

Rolling issues are described as severe due to the scale of capacity cuts, with space released around the Chinese New Year subject to roll or even double-roll. The expectation is for gradual improvement in the coming weeks as factories in China complete February orders and begin holiday shutdowns. On the origin side, multiple terminals are reporting 2–4 day berth waiting across major China gateways, and yard utilization is elevated in parts of Southeast Asia, adding friction to overall execution and feeder reliability.

AIR CARGO MARKETS REMAIN SUBDUED

The U.S.–China air market entered the CNY holiday period in Week 07 beginning February 09, with demand expected to remain soft through the holiday window. While air capacity is expected to grow faster than demand in 2026 in several regions, the U.S.–China network is still navigating constraint points tied to fleet and schedule shifts, including MD-11 availability impacts affecting UPS and FedEx and wide cancellations on China–Japan routings. In broader Asia–U.S. markets, Hong Kong remains soft ahead of the holiday, while Southeast Asia demand is described as more stable, supported by high-tech, e-commerce, fashion, and electronics flows, with Singapore showing year-over-year tonnage growth supported by pre-shipments and new freighter services.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.