The global freight environment continues to balance trade progress with ongoing capacity management. U.S. policy developments in Asia are reinforcing supply stability, while carriers in key markets are adjusting deployments to match persistent fourth-quarter demand.

UNITED STATES AND CHINA REACH TRADE AGREEMENT

The United States has announced coordinated actions that modify its reciprocal tariff framework with China and adjust duties tied to the synthetic opioid supply chain. Under the Kuala Lumpur Joint Arrangement, the United States will maintain a 10 percent additional duty on covered Chinese imports and extend the suspension of higher reciprocal tariffs through November 10, 2026, as implemented through Executive Order 14358. In a separate but aligned action under the synthetic opioid supply chain framework, Executive Order 14359 reduces the additional duty from 20 percent to 10 percent on products classified under heading 9903.01.24, effective November 10, 2025. Federal agencies will monitor implementation across both programs, including China’s commitments on rare earth export controls, expanded agricultural imports, market access in advanced manufacturing, and enforcement of fentanyl precursor restrictions.

INDO PACIFIC TECHNOLOGY AND CRITICAL MINERALS FRAMEWORKS EXPAND

The United States advanced a broader Indo-Pacific strategy through new economic and technology frameworks with the Republic of Korea and Japan. In Seoul, the U.S.–Korea Technology Prosperity Deal established a structure for joint research in artificial intelligence, quantum science, biotechnology, telecommunications, and space while reinforcing research security and intellectual property protections. The visit produced large-scale industrial commitments, including aircraft, engine, and defense programs, as well as energy, grid, and shipyard investments that support manufacturing and maritime capacity in the United States. In Tokyo, the United States and Japan signed a Critical Minerals Framework and a parallel Technology Prosperity Deal focused on responsible extraction, processing, stockpiling, and coordinated standards for advanced technologies. Japanese investment plans in U.S. energy infrastructure, data centers, fertilizer production, port upgrades, and battery manufacturing are intended to reinforce supply resilience and long-term industrial growth.

TRANSPACIFIC CAPACITY FROM ASIA REMAINS MIXED

Market commentary indicates a persistently volatile operating environment for Transpacific trades, with frequent adjustments in demand, capacity, and network deployment. From the Far East to North America, carriers continue to manage blank sailings and schedule changes while shippers navigate limited visibility on longer-term allocations. Space from Saigon to the U.S. West Coast is tightening, while Saigon to the U.S. East Coast remains generally normal. From Haiphong, Hong Kong, Shenzhen, Tianjin, Shanghai, and Qingdao, space is broadly normal to both coasts, although isolated operational constraints can emerge around holiday or promotional peaks. Ningbo to the U.S. West Coast is tightening with some carriers subject to roll, while Ningbo to the U.S. East Coast remains largely normal, reflecting a more balanced deployment pattern on all-water services.

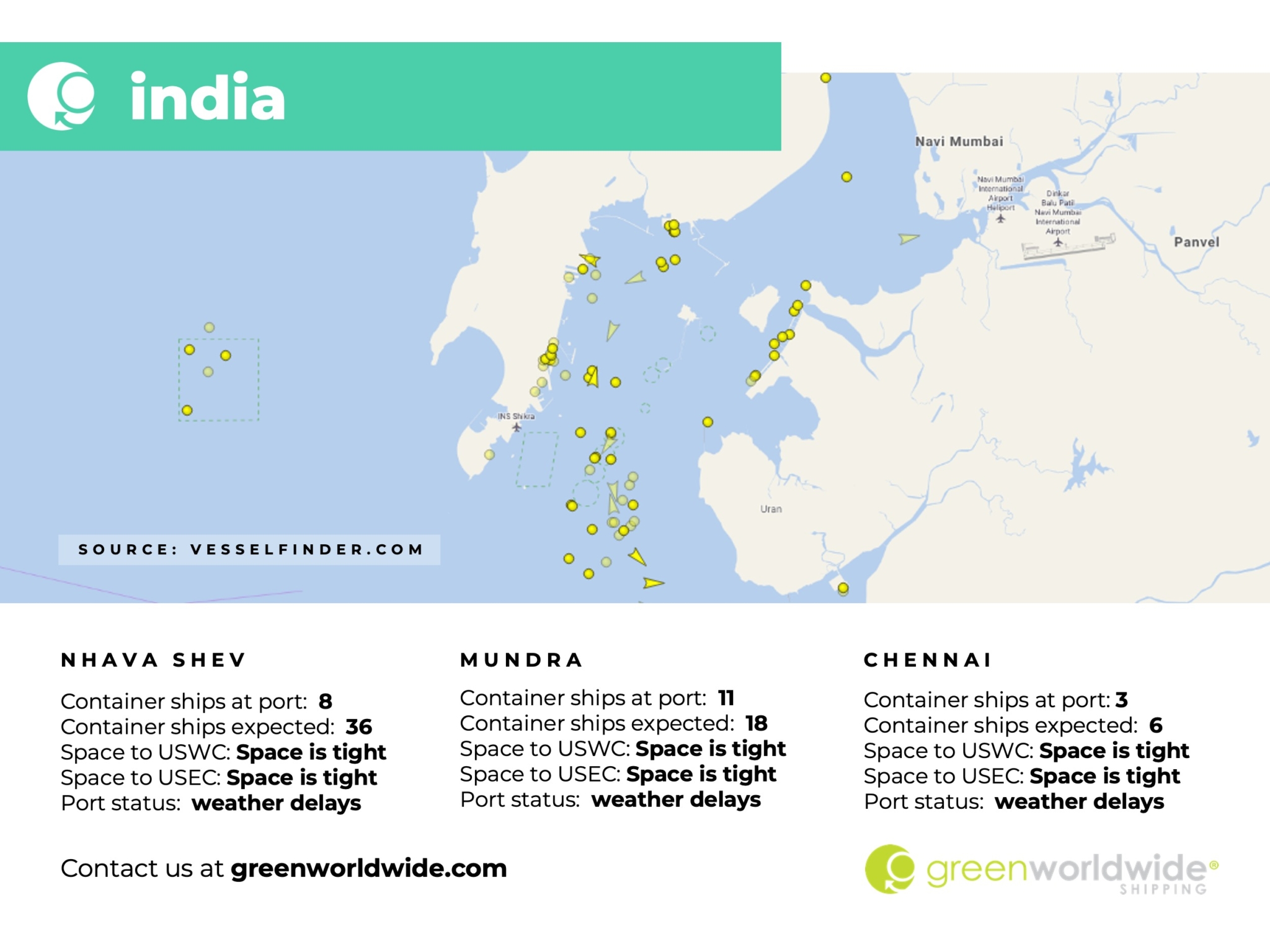

INDIA–NORTH AMERICA OCEAN CAPACITY TIGHT FROM SELECT ORIGINS

For weeks 46 through 51, space from India to the U.S. West Coast remains tight but manageable, supported by steady export demand and ongoing blank sailings by several major carriers. To the U.S. East Coast, conditions are more challenging from Chennai, Tuticorin, and Cochin because of strong booking pressure and extended transit times via Colombo and Singapore, where advance bookings of at least two to three weeks are recommended. Equipment is generally available for 20-foot containers, but 40-foot high-cube equipment is intermittently tight at Chennai and Tuticorin, and more limited at Cochin, with carriers repositioning empties from regional hubs to maintain coverage. Moderate terminal congestion at Chennai and Tuticorin, along with occasional vessel omissions at Colombo and Singapore, is contributing to transshipment delays, while seasonal northeast monsoon weather continues to affect gate operations and berthing windows. Nhava Sheva and Krishnapatnam or Vizag remain more balanced, with carriers using repositioning programs to keep inventories stable.

SOUTHEAST ASIA AIR CARGO VOLUME STRONG INTO YEAR-END

Air cargo demand from Southeast Asia to the United States remains strong as the fourth-quarter peak continues. High volumes of e-commerce shipments from platforms e-commerce are driving sustained lift requirements from Hong Kong to the United States and South America, with airlines adjusting schedules and capacity allocations accordingly. Space into the U.S. market is in demand, particularly on lanes from Vietnam and Thailand, where project cargo, solar-cell shipments, and e-commerce exports are combining to create a super-peak environment in the fourth quarter. Overall, Southeast Asia airfreight capacity remains tight, and demand is significantly higher than in October. Direct and deferred services to the U.S. West Coast, U.S. East Coast, and major European gateways are operating at high load factors, and shippers continue to rely on advance planning to secure uplift.

CBP FIRST SALE REVIEWS INTENSIFY FOR MULTI-TIER IMPORTS

U.S. Customs and Border Protection (CBP) is increasing scrutiny of the first sale for export valuation, particularly in multi-tier import structures that involve agents, trading companies, or related parties. Examiners are looking beyond invoice comparisons to confirm that each sale in the chain is a bona fide transaction, with clear evidence of who holds title, who assumes commercial risk, and how prices are established. Document requests have become more granular, frequently covering purchase orders, contracts, Incoterms confirmations, cost builds, manufacturing data, payment records, and accounting analyses that link margins to shipment-level values. Valuation and country of origin remain focal points, especially for products subject to antidumping, countervailing, Section 301, or Section 232 measures, where additional verification requests and audits are increasingly common. Importers relying on the first sale are encouraged to maintain robust documentation, internal audit programs, and clearly defined supplier communication protocols to demonstrate reasonable care during any CBP review.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.