Week 28 finds U.S. importers navigating new compliance deadlines, an extended pause on reciprocal tariffs, and tightening Transpacific capacity as blank sailings reduce vessel space.

U.S. TRADE POLICY & COMPLIANCE UPDATES

A July 7, 2025, executive order keeps the 10% duty for Annex 1 partners in place until 12:01 AM EDT on August 1, while sector-specific automotive and metals duties continue unaffected. The administration has cautioned multiple trading partners that higher tariffs could follow if negotiations stall, and signaled an additional 10 percent levy on countries aligning with BRICS positions.

The One Big Beautiful Bill Act, signed July 4, sets two key de minimis checkpoints:

- August 3, 2025: Civil penalties of up to $5,000 for a first violation and $10,000 for each subsequent violation apply to non-compliant de minimis entries.

- July 1, 2027: Repeal of the commercial-shipment exception confines eligibility strictly to 19 U.S.C. § 1321(a)(2) thresholds, removing volume-based relief.

Importers should audit low-value entry programs, update broker instructions, and earmark budgets for potential penalty exposure.

ASIA-PACIFIC DEMAND & CAPACITY ADJUSTMENTS

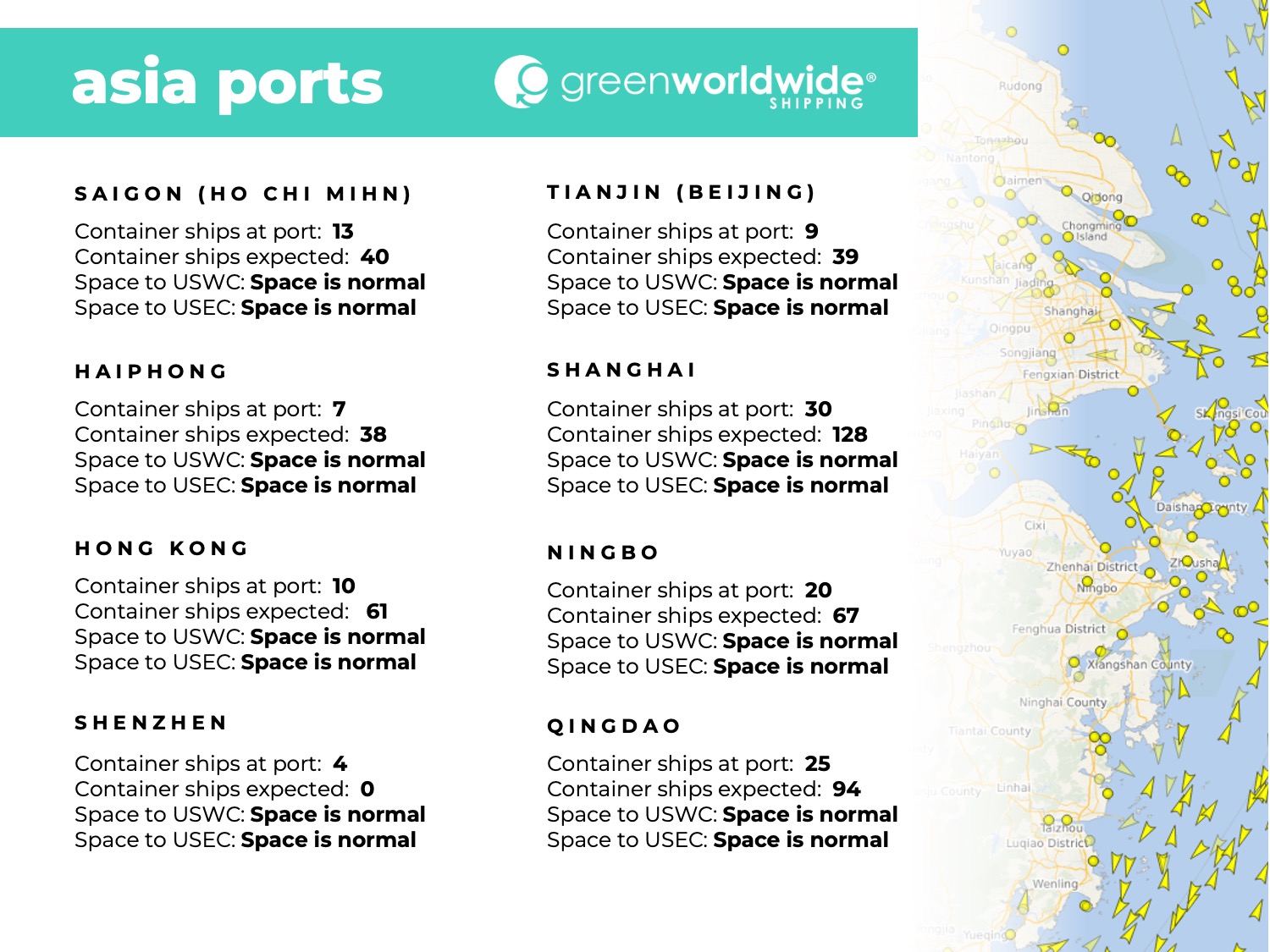

Dampened booking activity across China and neighboring regions is leading shippers to reassess departure dates, maintain flexible service contracts, and draw down inventory buffers built during the spring front-load cycle. Blank sailing schedules for July will withdraw roughly 7% of planned transpacific departures, with the heaviest reductions on Gulf and West Coast services. Carriers note lower bookings and excess inventories as primary drivers. Proactive space management will be critical as capacity tightens mid-month.

U.S. PORT & INLAND OPERATIONS REPOSITION FOR LATE-JULY VOLUMES

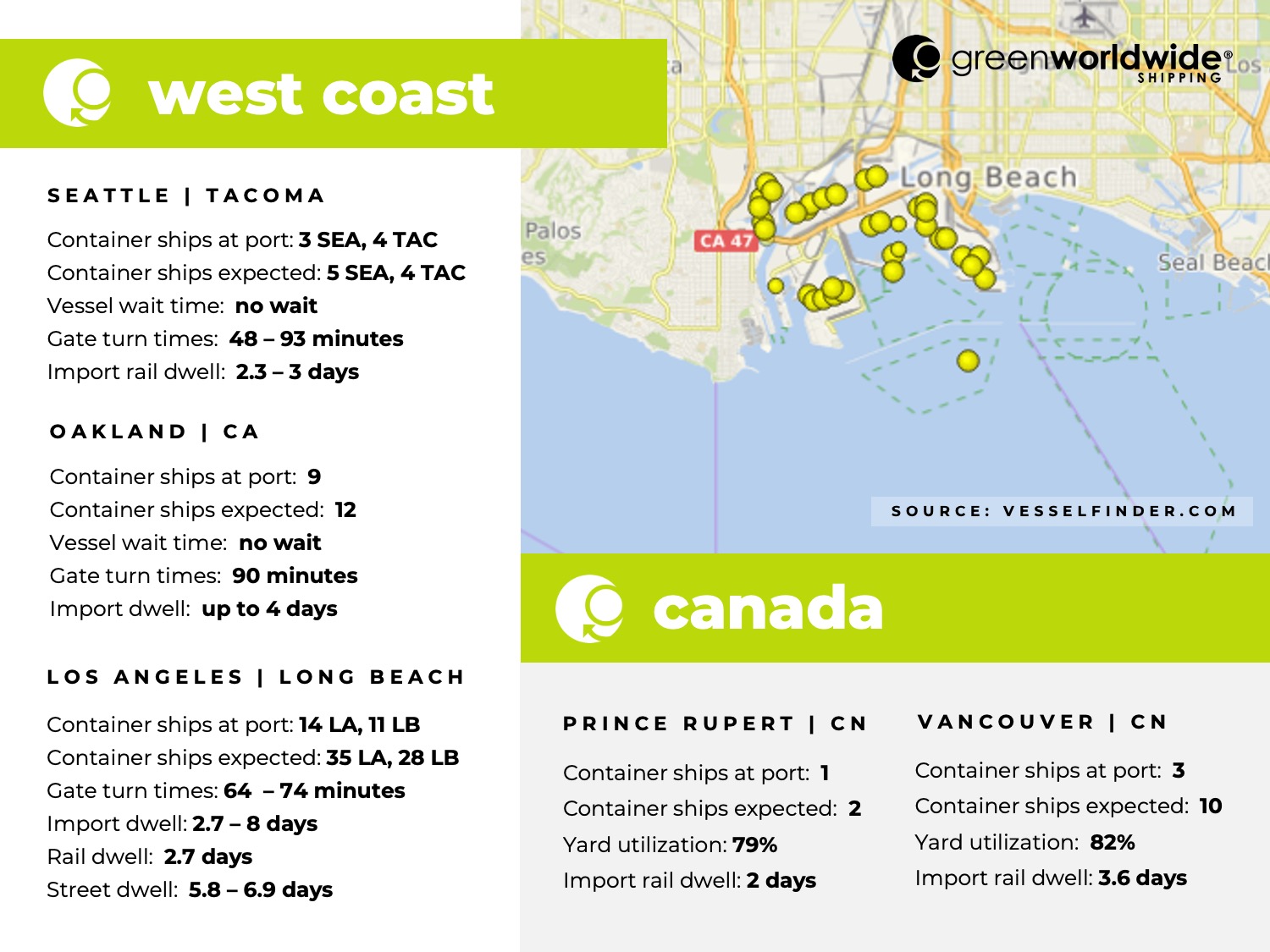

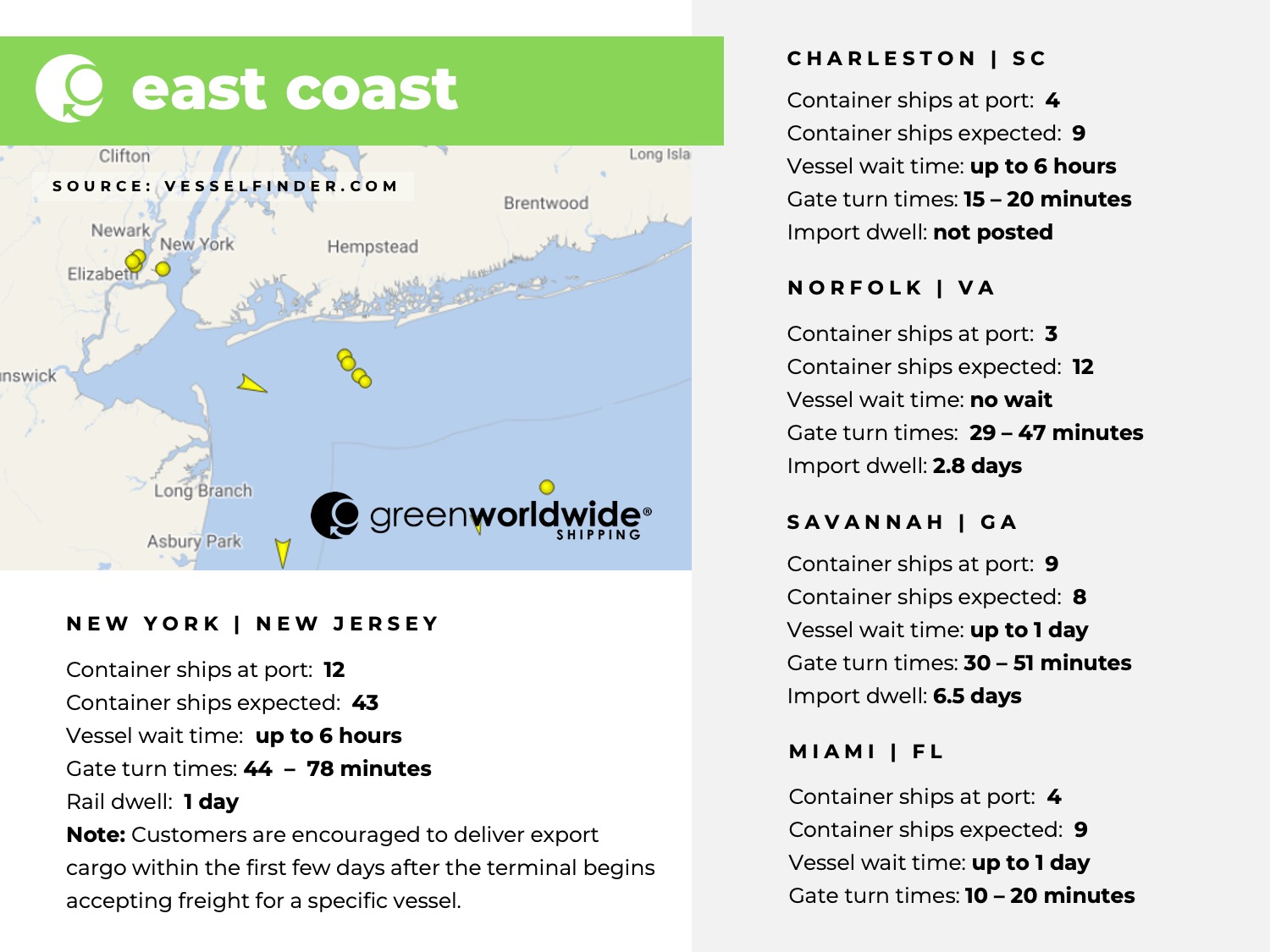

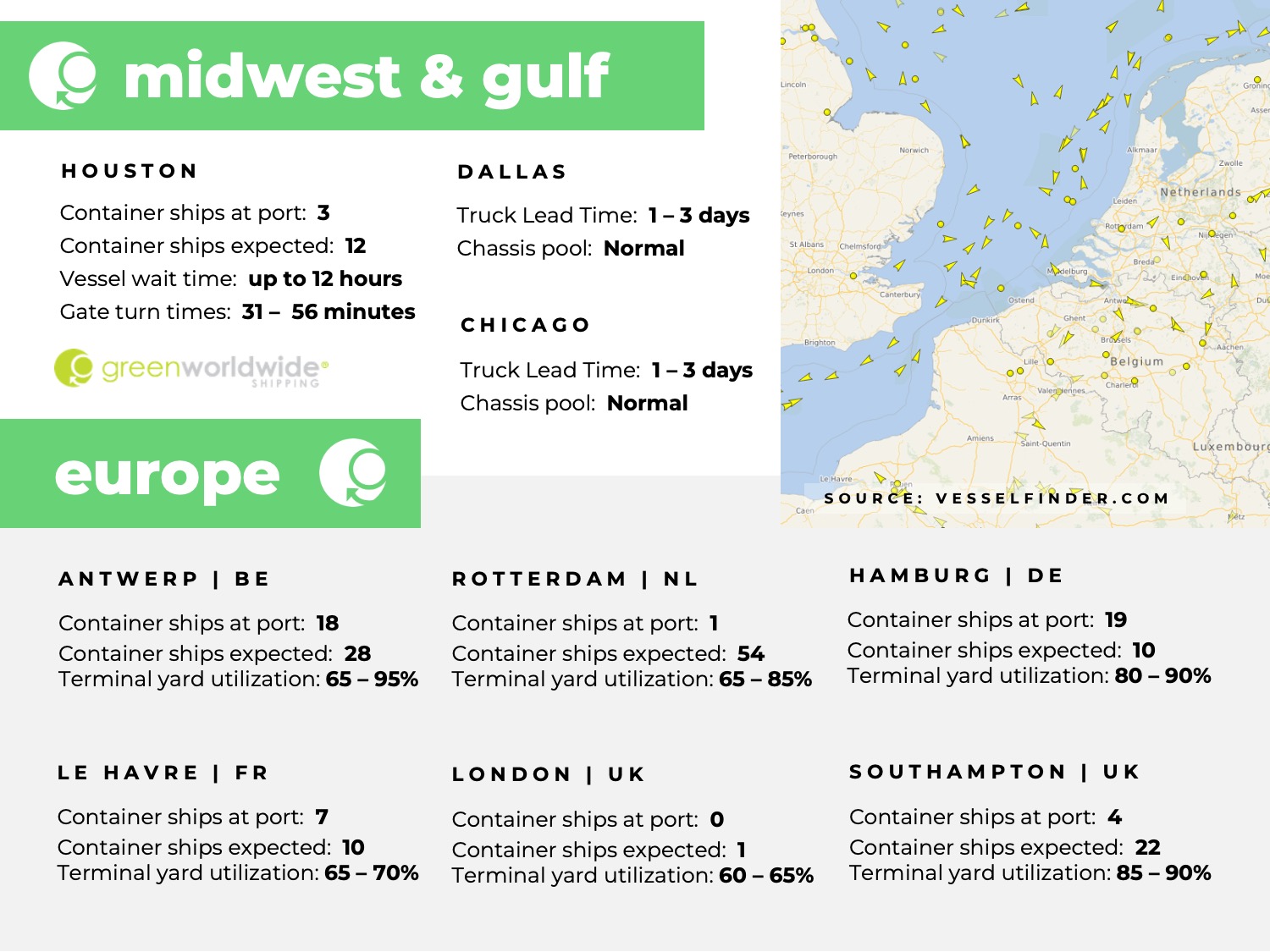

West Coast terminals continue realigning container stacks and chassis pools in anticipation of potential late-July surges when tariff guidance is finalized. East Coast ports report steady truck turn times, aided by ongoing equipment balancing. Inland rail hubs remain fluid, though several note rising empty-equipment reposition requests as exporters adjust shipment timing.

Northern European Ports as well as the Port of Manzanilla and neighboring ports in Mexico remain heavily congested with longer than usual truck turn and container transfer times. Shippers may see freight delays and should anticipate blank sailings and port omissions while ports work through container backlogs.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.