U.S. containerized import activity remains uneven as January draws to a close, with demand shifting across origin regions rather than strengthening overall. China-origin volumes continued to soften while Southeast Asia captured a larger share of outbound activity, leaving capacity available but not always aligned with demand. Carriers added vessel supply ahead of Lunar New Year, improving utilization without materially tightening space. As factory shutdowns extend into February, importer focus remains on timing, service execution, and localized disruption rather than access to capacity.

TRANS-PACIFIC OCEAN CAPACITY AND DEMAND SIGNALS

Following the late-January demand reset, trans-Pacific vessel supply continues to exceed demand as Lunar New Year approaches. Pre-holiday volumes continue to underperform seasonal expectations as shippers pulled production forward into December and manufacturers across China maintained available capacity. Carriers added vessel supply ahead of the holiday, improving utilization without creating sustained space pressure. East Coast routings remain broadly available, while variability on select West Coast services reflects carrier scheduling decisions rather than demand-driven tightening.

SOUTHEAST ASIA ORIGIN SHIFTS AND SERVICE ADJUSTMENTS

Carriers continue to advance network changes that elevate Southeast Asia within trans-Pacific service design. New and adjusted loops add direct calls from Vietnam and Thailand into both U.S. West Coast and East Coast gateways, expanding routing flexibility while redistributing vessel supply away from traditional South China load ports. These changes increase origin optionality but introduce a more dynamic allocation environment as services stabilize. The trend reflects continued sourcing and network rebalancing rather than short-term demand acceleration.

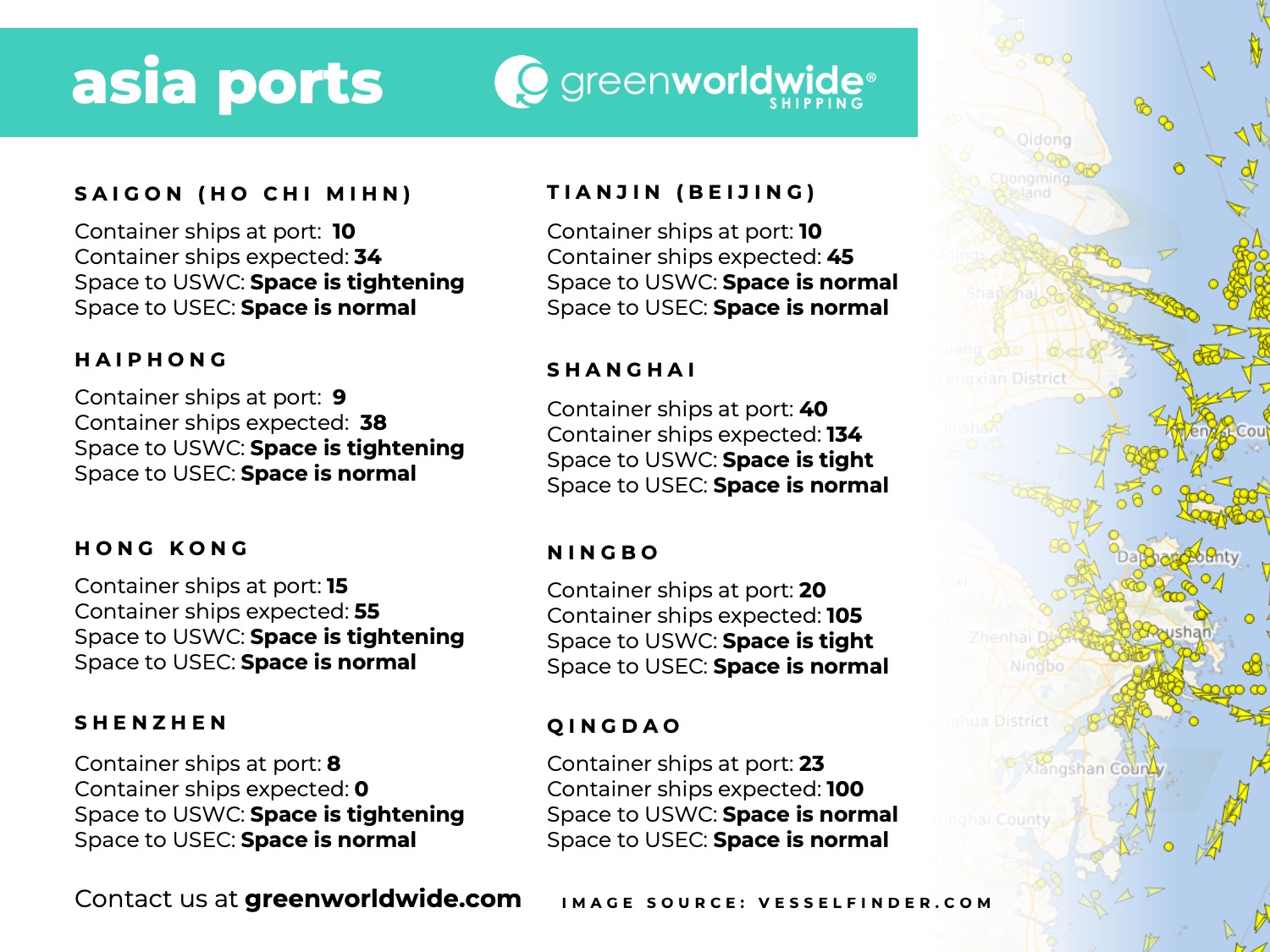

ASIA PORT CONDITIONS AND OPERATIONAL CHALLENGES

Port conditions across Asia remain uneven, with Southeast Asia generating the most persistent operational friction. Port Klang continues to experience extended vessel waits tied to yard congestion, while delays in Vietnam have expanded beyond Cat Lai into Cai Mep. Indonesia and the Philippines now present additional pressure points as berth congestion disrupts schedule reliability. These conditions do not constrain overall capacity but continue to affect transit planning and execution risk.

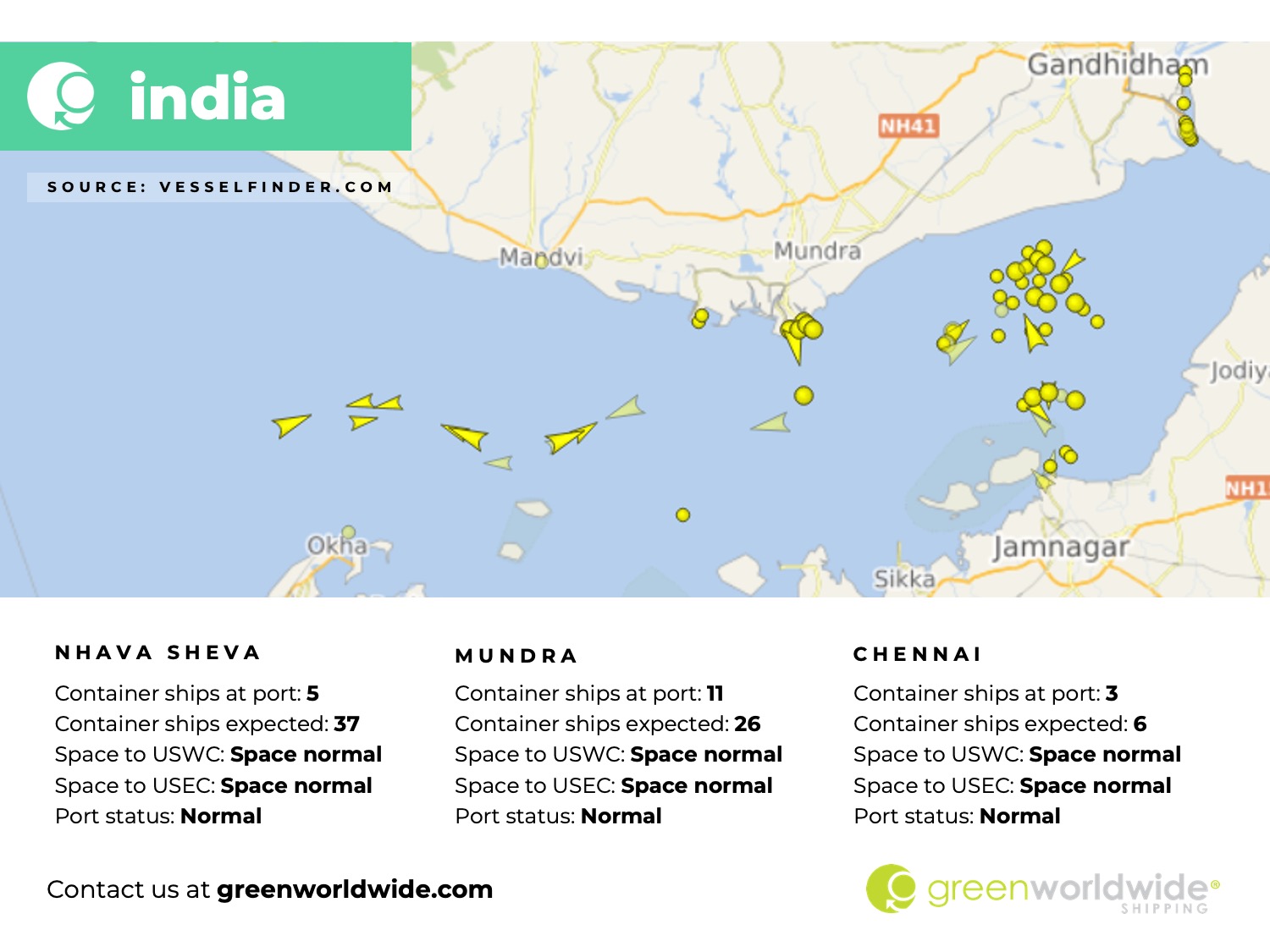

INDIA-USA OCEAN MARKET CONDITIONS

Space availability from India to both U.S. coasts remains open across the near-term planning window. Vessel supply continues to exceed demand, supporting consistent access to lift despite carrier signaling around upcoming market actions. Current conditions point to stability rather than tightening, with routing selection and transit variability remaining the primary planning considerations.

ASIA-U.S. AIR CARGO DEVELOPMENTS

Asia-U.S. air cargo demand strengthened entering Week 4 as shippers advanced shipments ahead of Lunar New Year factory closures. East China lanes continue to draw support from high-technology and automotive flows, while Southeast Asia volumes returned to more typical levels following earlier disruption. Hong Kong continues to fall short of typical pre-holiday patterns as factories begin closures earlier and outbound activity remains heavily weighted toward e-commerce. Overall demand continues to reflect short-cycle replenishment rather than sustained peak-season behavior.

U.S. TRADE POLICY AND SECTION 232 ACTIVITY

Trade policy activity remained elevated during Week 3 into Week 4, with multiple semiconductor-related actions shaping near- and longer-term planning considerations. New Section 232 measures on advanced computing chips entered into force, processed critical minerals moved onto an active negotiation track, and a new U.S.-Taiwan framework linked future Section 232 treatment to U.S. manufacturing capacity milestones. Taken together, actions from the White House, the U.S. Department of Commerce, and the U.S. Trade Representative continue to reinforce a policy environment that ties trade treatment more directly to investment timelines, capacity development, and end-use accountability.

Stay up-to-date on freight news with Green’s Weekly Freight Market Update by following us on LinkedIn. For continuous updates, make sure to check out our website at greenworldwide.com.